This Dividend Discount Model Tells Us The Value Of 5 Dividend Stocks

My go-to dividend discount model is known as the Gordon Growth Model.

I use the Gordon Growth Model in all of my dividend stock reviews. Why? As one way to estimate what a company’s stock is worth.

So, it’s time to fully explain this handy dividend discount model (DDM). And, exactly how to use it.

With examples of stocks from my model dividend-paying portfolio. So, we can look at 5 top dividend stocks to see if they are buys right now!

First, a few key takeaways from this article.

Guide To The Gordon Growth Model: Key Takeaways

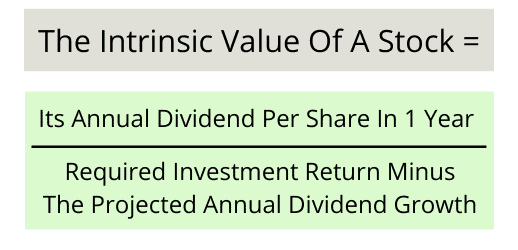

1. The Gordon Growth Model is used to calculate the intrinsic value of a dividend stock.

2. It is calculated as a stock’s expected annual dividend in 1 year. Divided by the difference between an investor’s desired rate of return and the stock’s expected dividend growth rate.

3. Therefore 3 inputs are required for the model to work. They are the annual dividend rate per share, projected annual dividend growth rate, and the investors required rate of return.

4. The Gordon Growth model has several advantages and disadvantages. The biggest advantage is its simplicity and ease of use. On the other hand, it’s only useful for stocks that pay a consistent and rising stream of dividends. Also, its results can be highly sensitive to changes in the 3 inputs.

With those highlights taken care of. Let’s dig in and fully define and explain the Gordon Growth Model. Then go through 5 real-life examples and frequently asked questions before we conclude.

Disclosure: At no cost to you, I may get commissions for purchases made through links in this post.

What Is The Gordon Growth Model?

First of all, the Gordon Growth Model is a tool to calculate the intrinsic value of a stock. And more specifically, the value of a dividend growth stock.

Furthermore, you will hear this tool referred to as a “constant perpetual growth model”. Or at times, just “the constant growth model”.

Finally, stock valuation is part of learning how to invest in dividend stocks.

What Does Gordon’s Model Tell You?

First of all, Gordon’s model tells you what value to pay today. For a stock that will provide a rising dividend stream in the future.

Furthermore, this dividend discount model is based on a company’s future series of dividends. That grows at a constant rate.

Finally, checking the value of a dividend stock is a good practice to get into. Especially if you are aggressively building out a dividend portfolio for monthly income.

What Is The Gordon Growth Model Formula?

As a formula, the Gordon Growth Model is quite simple. First I will describe it with words.

It is simply a company’s expected annual dividend payment 1 year from now. Divided by the difference between 2 numbers. The first number is your desired annual return on investment. Then second, subtract how much you think the dividend will grow each year in the future.

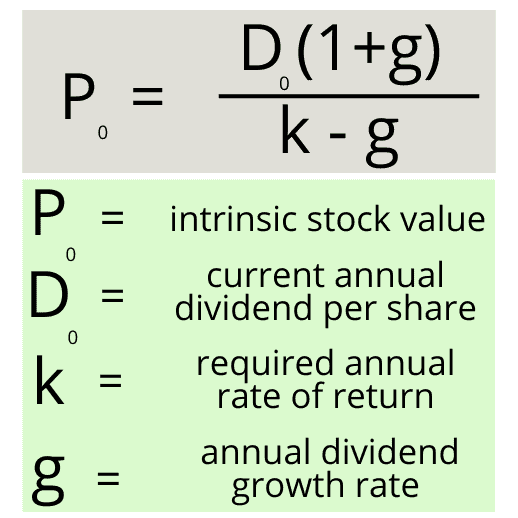

Now, taking those words here is the Gordon Growth Model formula.

Finally, if you are into math, here is the equation.

With that summary in mind, let’s dig into the details. To fully explain this dividend discount model, known as the Gordon Model.

And, how best to use it. As a general dividend valuation model to price your dividend stocks.

Plus, I will identify 5 of the best dividend stocks that are good values right now. That is based on the Gordon Model.

To kick-off, let’s cover some basics and background information.

What Is A Dividend Discount Model?

The Gordon Growth model is one version of what is more broadly known as dividend discount models. Or, just dividend models, for short.

In a general sense, a dividend discount model values a share of stock as the sum of all expected future dividend payments. A company stock with dividends is adjusted back to a value today using a measure of risk and the time value of money.

Who Popularized The Dividend Discount Model?

As one of the proponents of early theories about using dividends to value stocks, the Gordon Model was developed by Myron Gordon.

According to Wikipedia, Mr. Gordon was an American economist. He was Professor Emeritus of Finance at the Rotman School of Management, University of Toronto.

In 1956, Mr. Gordon along with Eli Shapiro published a method for valuing the stock of a business. It is now known as the Gordon Growth Model.

We will get to the pros and cons of the Gordon model in a moment. But it makes sense to present here that the model had its detractors.

An opposing model was developed. It was called the Modigliani Miller (MM) dividend irrelevance theory.

The MM dividend irrelevance theory was based on the belief that dividends had no impact on a companies value. Or, its stock price.

On the other hand, companies that follow a policy of dividend irrelevance. Require shareholders to sell company stock to generate cash from their investment.

Determining The Intrinsic Value Of A Stock

In simple terms, a business is worth the present value of its future cash flows. Otherwise known as free cash flow.

Valuing A Business Using Free Cash Flow

Free cash flow is the cash left over each year. After making the necessary capital investments to sustain the business.

The problem with free cash flow? As an outside investor, free cash flow is difficult to forecast.

Valuing A Business Using Accounting Earnings

On the other hand, the accounting profession tells us that accounting earnings are a good proxy for free cash flow. They say accounting earnings from regulated financial reporting smooth out the variability of cash coming and going. Plus, many companies provide forecasts for future earnings.

This sounds good on the surface. After all, I’m a CPA. But wait a minute, I’m not so sure.

Accounting earnings tend to be littered with one time charges and clouded by complex accounting rules. Also, not every company provides earnings guidance into the future. Or, if they do, they only estimate one year out for the public.

Valuing a Business Using A Dividend Discount Model

So using the prior two metrics, cash or earnings, for valuing a business is difficult. What is the solution?

Enter the simplicity and predictability of using a company with dividends to calculate the intrinsic value of a stock. At least in certain cases.

Dividend Valuation Models

Dividend valuation models are useful because of dividend policy. Every company has a dividend policy.

Whether they choose to communicate that policy to the public, or not. Many companies, especially in the U.S. use what is known as a constant dollar dividend policy.

What Is Constant Dollar Dividend Policy?

With a constant dollar dividend policy, the company decides a fixed amount of dividends per share for its stockholders.

Usually, there is no change in the dividend. This is true even if the company incurs a loss. Or, generates a higher than expected profit.

Then, its dividends are paid on a consistent and periodic basis during the year. Sometimes this method is also referred to as a stable dividend policy.

As the name suggests, the dividend stays a constant dollar amount per share. At least until the company decides to increase it. Normally, a company will increase its dividend on a pre-determined schedule each year.

U.S. based dividend-paying companies typically use a constant dollar dividend policy. And many of these companies increase their dividend each year just like I explained.

This provides an investor with a high degree of certainty about the amount of cash they can expect to receive. In the form of dividends.

So, the information a company’s constant dollar dividend policy provides is very useful. It forms the basis of the Gordon Growth Model calculator.

Next, let’s break down the pieces of the Gordon formula. This way you will know exactly what is needed to make your calculations.

For the dividend stocks, you own. Or, are interested in buying.

Gordon’s Dividend Discount Model Assumptions

I have already shown you the Gordon Growth Model formula. To review, here are the three inputs we need to make the calculation.

- Current annual dividend per share

- The projected annual growth rate for the dividend per share

- Your desired annual return on investment

Next, let’s discuss each one of these assumptions. And, where or how to get them.

Assumption 1: Current Annual Dividend Per Share

This is the easiest of the 3 assumptions to find. It is merely a company’s current annual dividend per share.

It can be found on most financial websites. Or, go directly to the company’s investor relations website. There, they will usually show their history of dividend payments on a per-share basis.

Most companies that use a constant dollar dividend policy pay their dividend quarterly. So, you must take the last quarter’s dividend per share and multiply by 4.

Let’s say you go to XYZ Company’s investor relations website. You see XYZ’s last quarterly dividend payment was $1 per share. Multiply it by 4 and you have your first assumption for the Gordon Growth Model calculation.

Current Annual Dividend Per Share = $4.00

Assumption 2: Estimated Annual Dividend Growth Rate

Our second assumption is the most difficult one to come by. It is the estimated annual dividend appreciation rate.

Sometimes a company will help us out. As part of their publicly communicated dividend policy, they may indicate how much then intend to grow the dividend each year.

It is a piece of helpful dividend information. But most of the time, we are on our own. And have to make an estimate.

I make an estimate of future dividend growth for every one of my dividend stocks. As a dividend growth stock investor, this is a very useful number to have. Let me explain why.

First of all, and most obvious for our conversation today, it allows me to use the Gordon Growth Model to calculate the intrinsic value of my stocks.

Furthermore, it helps me plan my future dividend income. This is especially important when you use your dividends to pay for the cost of living.

Finally, my dividend growth model forecast sets an expectation from which I can compare a company’s actual dividend increases. If future dividend increases are vastly different than my estimated dividend growth rate. Then it’s time to investigate and figure out what is going on.

How To Make A Dividend Growth Forecast

At the end of the day, a dividend growth model forecast is just an estimate. It will rarely be perfect.

Furthermore, making a dividend growth forecast for a company is not a 1 shot deal. It should be re-evaluated periodically. And, adjusted if necessary.

But here is what I use to make my best judgment about a company’s future dividend growth. These are all important points to know anyway. When your goal is to select and invest in the best dividend stocks.

- The historical dividend growth rate

- Dividend payout ratio based on earnings

- Dividend payout ratio based on free cash flow

- Stated dividend policy when management provides one

- The overall health of the business and its fundamentals

- Management’s strategy for growing revenues and profits

This may seem like a lot of information to gather and assess. To forecast a company’s future dividends. And it is.

So, if you are pressed for time, look at the historical dividend growth rate over the past 5 years. Unless you have reason to believe it will change. It’s a pretty good and quick number to use.

Okay. So you’ve done your homework. Let’s say you think XYZ’s dividend per share will be increased 6% annually each year in the future.

Assumption 3: Your Desired Annual Return On Investment

This assumption is pretty easy to come by. It’s entirely up to you.

Ask yourself this question. How much annual return on investment do you want by investing in this dividend stock?

Do you want 8%, 9%, more, or less? You decide. It’s your call.

But, I want to help you out. To do so, here are several points to think about when determining your required return on investment.

First of all, long-term historical returns from the U.S. stock market have averaged about 10% per year. So, 10% is a pretty good place to start.

Furthermore, investing comes down to risk versus reward. The more risk of loss you perceive when buying a stock, then the more you should demand in potential return. Perhaps more than a 10% required return is appropriate for some stocks.

On the other hand, for consistent and relatively safe dividend stocks. Say, a well-managed electric utility with a strong financial position and robust cash flows. Maybe an 8% annual return on investment is acceptable.

After all, we are evaluating relatively conservative blue-chip stocks. Those with an established history of paying a rising stream of dividends. We are not talking about Tesla, for example.

Remember, the Gordon Growth Model doesn’t work for companies that do not pay dividends. And, it works best for a company that is predictable about paying a higher dividend each year.

For example, let’s say you want a 10% return on investment from XYZ Company. Speaking of examples, let’s pull this all together into a Gordon Growth Model example calculation for XYZ.

Gordon Growth Model: Hypothetical Example for XYZ Company

Here are our dividend discount model assumptions for XYZ Company that we just developed.

- Current annual dividend per share: $4.00

- The projected annual growth rate for the dividend per share: 6%

- Your desired annual return on investment: 10%

Now, let’s perform the calculation.

$4.00 times 1.06. This gives $4.24. This represents the expected annual dividend rate in 1 year. That’s the numerator of our calculation.

Next, take 10% and subtract 6% from it. That gives us 4% or .04.

Finally, take $4.24 and divide it by .04. And our answer is? XYZ Company stock is worth $106 per share.

But what do you do with that number? It is simple. Just look up the actual price of XYZ Company before buying the stock online.

If the actual price is lower, then the stock is a good value. If it’s higher, the Gordon Growth Model suggests the stock is overvalued.

Next, let’s use 5 companies from my model dividend stock portfolio. And see if they have undervalued stocks to invest in. In other words, top dividend-paying stocks we may or may not want to buy right now.

Note that actual stock prices will be as of the time of this article. So, be sure to check the stock’s price as of when you are reading this article for a fair comparison.

Gordon’s Dividend Discount Model Example 1: Philip Morris (NYSE: PM)

Let’s first check-in with the international tobacco company Philip Morris (NYSE: PM). A dividend stock in the consumer goods sector. And run this company through the dividend growth model formula.

- Current annual dividend payment – $4.80 per share

- Projected dividend growth – 3.0%

- My desired annual return on investment – 9%

Using these assumptions, the dividend discount model calculates the value of Philip Morris stock at $82 per share. Philip Morris stock has been trading in the low-80s. So, it looks like we have a stock trading at about its fair value.

Gordon Growth Model Example 2: International Business Machines (NYSE: IBM)

How about a dividend-paying technology company next? I will run IBM through the Gordon Growth Model.

- Current dividend payment – $6.52 per share

- Projected dividend growth – 5%

- My desired annual return on investment – 10%

Using these assumptions, the dividend discount model calculates the fair value of IBM stock at $137 per share. With the stock trading in the low $120s, we have a potential investment opportunity here.

Gordon’s Dividend Discount Model Example 3: Raytheon Technologies (NYSE: RTX)

RTX is a dividend payer from the industrial sector. Here are the assumptions I plugged into the dividend discount model for Raytheon.

- Current annual dividend payment – $1.90 per share

- Projected annual dividend growth – 7%

- My desired annual return on investment – 10%

Based on these assumptions, the single-stage dividend discount model places a fair value on Raytheon stock at $68 per share. Trading around $70 per share, we have another stock that looks to be fully valued.

Gordon Growth Model Example 4: AbbVie (NYSE: ABBV)

Healthcare stocks are a good place for dividends. Let’s check in on one of my favorite pharmaceutical companies, AbbVie. I put these assumptions into the dividend growth model formula.

- Current annual dividend payment – $5.20 per share

- Projected dividend growth – 7%

- My desired annual return on investment – 10%

Using these assumptions, the dividend discount model calculates the fair value of AbbVie stock at a lofty $185 per share. Holy smokes! Gordon Growth tells us we have a screaming buy here. AbbVie has been trading around $100 per share.

Gordon’s Dividend Discount Model Example 5: PepsiCo (NASDAQ: PEP)

Time for another consumer goods stock. Let’s challenge snack food and beverage giant Pepsi with the dividend growth model formula.

That’s a little play on words. Remember the days of the “Pepsi Challenge” advertising campaign? That’s when Pepsi was going toe to toe slugging it out for market share with rival Coca-Cola.

They are still slugging it out today. But let’s get to Pepsi and the dividend model. Here it is:

- Current annual dividend payment – $4.09 per share

- Projected dividend growth – 7%

- My desired annual return on investment – 10%

With these assumptions, the dividend growth model formula tells us the fair value of Pepsi stock to be $146 per share. Once again, roughly fair value based on where the stock has been trading.

Read more: Pepsi dividend review and stock analysis

By now, you understand how the Gordon Growth Model Works. And how it applies in real life to companies and their stocks.

Upon a second glance at the examples. I noticed I didn’t include any utility stocks. You might like this investment option focused on utilities.

However, our conversation would not be complete without a discussion of some of the advantages and disadvantages of the Gordon Growth Model. Let’s move on to that next.

Advantages of The Gordon Growth Model

1. It is easy to use. Hopefully, today’s examples have shown you this dividend discount model is easy to use.

The calculations are pretty simple. It is just basic math that can be done with a standard calculator.

Not only can the model be used on stocks. But, it can also be used to value dividend ETFs.

2. The assumptions are reasonable to determine. Unlike free cash flow or accounting earnings, estimating the 3 inputs for the Gordon Growth model is pretty straight-forward.

Yes. You need an estimate for constant dividend growth. But that is not insurmountable as I explained.

3. It’s real. What do I mean by that? Well, the dividend growth formula is based on the time value of money, adjusted for risk.

These finance and economic concepts date back hundreds of years. I don’t anticipate them going away anytime soon.

4. Useful for scenario analysis. Once you get comfortable with the formula, play with a little bit. Run several different scenarios.

What if dividend growth is higher or lower? Then what is the intrinsic value of the stock?

Or, what if you are willing to accept a lower or higher return on investment? What happens to the intrinsic value of the stock then?

5. The formula can be re-engineered. Sometimes I like to use the Gordon Growth formula in reverse. What do I mean by that?

I take the current market value of the stock, my desired return on investment, and the current annual dividend payment. Then solve for the dividend growth rate.

Use the Gordon Model this way. And, the stock market tells you the expected dividend growth rate that is priced into the stock.

Disadvantages of The Gordon Growth Model

Like all stock valuation models, the Gordon Growth model has its limitations. It is not with its detractors.

1. The company pays dividends. First of all, similar to other dividend valuation models, the company must pay a dividend. And the dividend must be in the form of cash versus stock dividends or property dividends. Or the model cannot be used.

2. Constant dividend growth. This dividend model requires a constant dividend growth assumption. So, it’s not a great option for many non-U.S. based stocks whose dividends tend to vary directly with profits.

Rarely, if ever, does a company’s dividend grow at a constant rate indefinitely. There is one solution to this. That is the two-stage dividend discount model.

As the name suggests, this dividend model can handle two dividend growth rates. One rate in stage 1. And another rate in stage 2.

The calculations are a little more complex. But the underlying principles are the same.

3. The model is sensitive to slight changes in assumptions. The intrinsic stock value can swing widely with just small changes to the inputs. Pick your favorite dividend stock and play with the model. And you will see what I mean.

4. Stock prices aren’t always rational. The Gordon Growth Model is a very disciplined and rational means to value a stock. Unfortunately, the stock market is rarely rational.

This dividend discount model may tell you a stock is always a good value. In other words, a good buy.

But the stock market may never fully value the stock. Or value it in such a way that allows you to make money with share price appreciation. As with any investment that’s not guaranteed, there is never a sure thing.

So, always do your investment research. And, invest at your own risk. After all, it’s your money! So, manage it well.

Before I wrap up, let’s address a couple of frequently asked questions.

Is The Gordon Growth Model Accurate?

Yes. In my opinion, the Gordon Growth Model is accurate.

It is precisely accurate taking into account risk and the time value of money. It tells you exactly what a constant and growing dividend stream is worth in today’s dollars. And, adjusts for your risk tolerance.

But realize. The Gordon model is only as accurate as the assumptions that you provide it.

So you have found a dividend stock. Let me offer my opinion on how best to use the Gordon model.

How Do You Use The Gordon Growth Model?

By now you know exactly how to calculate the intrinsic value of a stock using the Gordon Growth Model. And it’s simply good investing to estimate a stock’s value before buying it.

But that’s not the point I’m trying to make with this question.

Because of its inherent limitations, the Gordon model is best used as just one method of valuation in doing stock research and analysis. I find it best to use a range of valuation models and tools.

Then I make a judgment about the stock’s value. After considering all of the results both individually and collectively.

Other valuation tools that are available just to name a few include:

- Stock price to earnings ratio

- Morningstar fair value estimates

- Analyst buy targets

- Dividend yield theory

- Dogs of the Dow theory

Wrap Up: Gordon Growth Model Fully Explained

We have covered the following points related to this popular dividend discount model. Known as the Gordon Growth Model. Specifically, we now know these points about Mr. Gordon’s model:

- What it’s used for

- How it’s calculated

- The required assumptions and inputs

- How it’s used to value stocks of real companies

- Advantages of using this dividend growth formula

- Limitations of dividend valuation models, like Gordon’s

Further Reading About Dividend Investing And Dividend Stocks

- A comprehensive guide to the Dividend Achievers

- Building a model dividend portfolio for monthly income

- 4 ways to go about increasing your dividend income

- Dividend investing made easy with my favorite ETF

- Getting started with dividends as told by a beginner

My Favorite Personal Finance And Dividend Investing Resources

- Trade stocks for free with the Webull app

- Get stock research from Morningstar

- And stock analysis from Motley Fool

- Or dividend stock recommendations from Simply Investing

- Manage your finances for free with Personal Capital

Author Bio: Tom Scott founded the consulting and coaching firm Dividends Diversify, LLC. He leverages his expertise and decades of experience in goal setting, relocation assistance, and investing for long-term wealth to help clients reach their full potential.