Increased Benefits Of Passive Investing With The Passiv Web App

Today’s article is a Passiv review.

What is Passiv? Passiv is software that helps you implement a passive investing strategy in your brokerage account(s).

Passiv Review Outline

There are many important concepts in the prior sentence. So let’s explore by breaking it down into smaller parts.

- What is passive investing?

- Passiv review part A: features and functions

- An example to illustrate the use of Passiv

- Passiv review part B: brokers, security, and cost

- How to get started with Passiv: getpassiv

This is a sponsored article. All research and views are my own. Please see our policy statement.

1. Passiv Review: What Is Passive Investing?

Investing can be costly and challenging. That’s why many people use a passive investment strategy. So, what is passive investing?

First of all, a passive investment strategy typically means investments are bought and held for the long-term. Furthermore, trading and investment costs are minimized. Finally, using index funds is the most common form of passive investing.

Typically, the passive investor will buy several index funds. And set a target allocation for each one. This popular approach is one of the benefits of passive investing. It keeps investment costs low by eliminating professional management.

Unfortunately, that’s where the passive part of this strategy ends. To do passive investing right and maximize your investment returns, it takes knowledge and ongoing work by the passive investor.

For example, every time new investments are made, they should be done to achieve the target allocation. And at least once per year, the funds should be brought to their target allocations if new purchases have not done so.

Why do the funds stray from their allocations? Mainly due to fluctuations in the financial markets.

Making matters more complex, as we age, our target asset allocations should change. Why? Most of us have a reduced tolerance for higher risk assets as we approach retirement.

And that usually means a lower allocation to stocks. Changing your target allocations requires more calculations. And, additional trading to bring passive investors assets to the new targets.

One of the dangers of passive investing is that the average person doesn’t monitor their accounts, perform calculations, and make the required trades.

Left undone, an investor’s risk-adjusted investment returns can suffer. Most noteworthy, this is the hard work required to make a passive investing strategy successful.

That’s where Passiv comes into play. Their tools can help make investing an enjoyable experience. So, let’s dive in.

2. Passiv Review Part A

The company’s software takes the work out of executing a passive investing strategy. But before we get into the details of the software, let’s step back for a moment.

Who Is Behind Passiv And Why Was It Started?

Passiv was started by DIY investors Brendan Lee Young and Brendan Wood who are passive investors. They created Passiv out the frustration of having to use spreadsheets each month to figure out what trades to place in their brokerage accounts based on their monthly cash contributions.

So, they decided to build a tool that freed them from their spreadsheets and tedious tasks involved in their investment strategy. When it was ready, they launched the Passiv software in 2017 from their base in Fredericton, New Brunswick, Canada.

Resource: Read More About Passiv

What Does The Passiv Software Do?

Passiv helps you to manage your investments. And keep your ETF investment portfolio balanced. In contrast, other parts of your investments may require active management.

With Passiv, you can turn your brokerage account(s) into your own “personalized robo advisor service”.

The software automatically calculates the trades needed to keep a portfolio close to its target allocation. Furthermore, with the Elite one-click trade feature, your trades can be made with one simple click.

Also, Passiv can keep your trading to a minimum through the buy-only rebalancing option. This is how I rebalance my investments. That is, by making purchases with new money whenever I can.

I like to buy and hold forever, so selling is rarely an option. But, that means every time I have the cash to invest, it has to be allocated to the funds that have drifted below my target allocation.

By default, the software will determine the fund or funds to purchase by calculating which of your target assets is the most underweight using the cash that’s available in your account. However, you can alter the calculated trades to sell overweight assets, invest using other currencies, and use dollar-cost averaging.

What does all of this mean for you? No calculations, no spreadsheets, no need to log in to your account, and no need to manually set up and execute multiple trades.

That’s how you getpassiv with your investments.

Other Features Of The Passiv Software

Get notifications when dividends are received or your portfolio drifts. This way you always know when cash enters your account from dividends or your portfolio is no longer aligned with the target allocation(s) you’ve set.

Do you want to own some individual stocks outside of your passive index portfolio? The web app has that covered. You can keep your stock picks separate.

Passiv’s cash management rules gives you even more control over your money and lets you easily follow dollar-cost averaging.

Maybe you have multiple accounts and invest in different currencies? Passiv has the capacity to:

- Combine multiple accounts into one portfolio

- Handle multiple brokerage logins

- Provide advanced currency handling

Resource: Learn more about how to use Passiv

What The Passiv Software Does Not Do

From my perspective, Passiv leaves the fun part of executing a passive investing strategy to you, the passive investor.

In that regard, Passiv does not choose the index funds for you to invest in. Nor does it decide or recommend a target allocation for those funds.

These tasks fall into the area of providing investment advice specific to your situation and risk tolerance. In other words, neither the company nor the software provides investment advice.

3. Passiv Review: Passive Investment Portfolio Example

To illustrate, let’s use an example from a popular article here at Dividends Diversify.

The article is titled: How to build a Vanguard three-fund portfolio

Passive Investment Portfolio Example: Step 1 – You Choose Your Funds

The article suggests investing in the following 3 funds. All are ETFs from Vanguard:

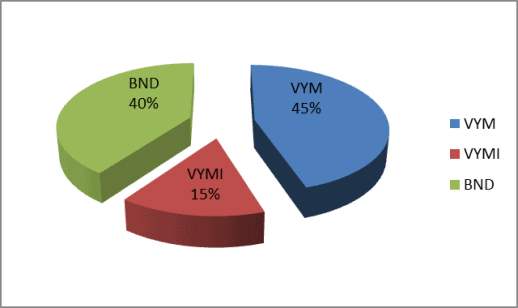

- High Dividend Yield ETF (VYM)

- Total Bond Market ETF (BND)

- International High Dividend Yield ETF (VYMI)

The first step in executing a passive investment strategy is now done. We have chosen the funds we want to invest in.

Passive Investment Portfolio Example: Step 2 – You Decide On Your Asset Allocation

Now that we have our 2 stock ETFs and 1 bond ETF selected we need to decide how much money to put in each one. One way to choose your allocation of money to the three funds is by your age.

The rule of thumb is to take your age as a percentage. And invest that amount in bonds. Then take the remaining percentage and invest it in stocks. Then, split the stock percentage by 75% US and 25% International.

This is a target asset allocation for example purposes. Yours may be different.

For example, a 40-year-old US resident would allocate money to the Vanguard three-fund dividend portfolio like this:

Passive Investment Portfolio Example: Step 3 – The Passiv Software Does The Rest

From here the Passiv web app takes over. You make new cash deposits in your account, passive income from dividends are received, and the market fluctuates. So, your cash needs to be invested and your actual asset allocation has drifted from the target.

The software automatically calculates the trades needed to put your new cash to work and keep the portfolio close to its target allocation. And with the Elite one-click trade feature those trades can be made with one simple click.

So rebalancing your portfolio is easy. It is an ongoing process. Every time you have new funds to invest, Passiv will use those funds to bring your account closer to target.

Allocating new purchases effectively will usually keep your investments at or near their target allocations. If not, consider turning off the buy-only trade option. Then let the software make the calculations and trades to sell overweight positions and buy underweight ones.

This periodic rebalance can be once or twice per year as needed. But, it may not be necessary since Passiv is directing every new purchase to the most underweight fund(s) during the year.

Rebalancing regularly can improve investment returns. Why? Because it encourages purchases of the funds that have underperformed.

So, you buy more those assets when their prices are lower. And perhaps, sell funds that have outperformed.

It’s a classic example of buying low and selling high. Last I heard, that’s how you make money investing. Some things never change!

4. Passiv Review Part B

Now, we know what the software does. And we have used an example to illustrate how it works. So, let’s address a few other important questions.

What Brokerage Platforms Partner With Passiv?

As of this writing, Passiv partners with:

- TD Ameritrade

- Interactive Brokers

- Alpaca

- Questrade

If you don’t see your broker here, don’t worry. They are working to bring more US brokerage platforms into their program very soon.

Their team is currently prioritizing brokerages with open application programming interfaces (APIs). I’ve been told that they are working on Ally Invest and Tradier at the moment.

Is The Passiv Software Secure?

The short answer is yes. Passiv uses open APIs made available by brokerages to connect your account to their software. This means that they do not see or have access to your login credentials.

I’m an investor, not a technology expert. So, I would encourage you to read more about their security measures on the company’s website.

Resource: Read more about Passiv Security

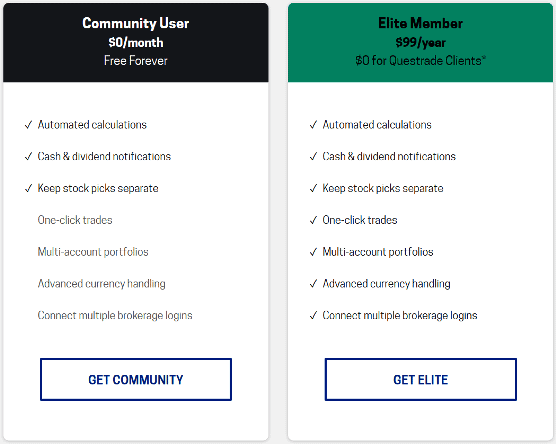

What Does It Cost To Use The Passiv Software?

Passiv uses a freemium business model. This means offering customers both complementary and extra-cost services.

Here are their pricing plans. And the services that come with them.

I like the fixed fee aspect of the Elite member plan. You pay one fixed fee even as your assets grow.

This is a difference between an active and passive investment strategy. Active investment fees are usually based on a percentage of assets. As the value of your account grows, you pay more for active management and robo advisors.

Your investment cost savings depend on the cost of the alternative you might choose. But doing some quick math, I’d say the Elite option will cost less than active or robo management once your assets exceed $7,500 to $10,000.

But, let’s look at the costs from an additional angle. I will assume that it takes about 1-2 hours per month to log in to your account, perform the necessary calculations, set up, and execute the trades.

To make it simple, let’s go with 20 hours per year. At $99 per year, the Elite plan will cost less $5 per hour of your time.

Is your time more valuable than $5 per hour? I’m pretty sure your income earning potential is higher than that if you are reading this article.

Furthermore, are you managing multiple accounts? And more than 3 funds like our Vanguard 3-fund passive investment portfolio example?

Then your time commitment to passive investing will probably be much more than 20 hours per year.

A Special Offer From Passiv

For a limited time, Passiv is offering a discount to Dividends Diversify readers. Get $40 off your first year of Elite membership!

Simply create a Passiv account. Click this link to apply the $40 off coupon. Then upgrade your new account to Elite.

5. How To Get Started With Passiv?

You can getpassiv in a few easy steps:

- Register for an account on the company’s website.

- Link your brokerage account(s) to Passiv

- Choose your funds and set a target asset allocation

- Set up automatically recurring contributions to your broker

- Sit back and let Passiv do the work

Sign Up: Register for a free Community or Elite Passiv account

One point on step #4. Regularly adding money to your brokerage account for investing, is a great idea. It’s also known as “paying yourself first”.

Many average folks just like you and I have built small fortunes by:

- Saving money and paying themselves first

- Implementing a passive investing strategy

- Monitoring and managing that passive strategy regularly

The great thing is that Passiv takes the monitoring, managing, and trading work off your hands.

Passiv Review: Concluding Thoughts

For the passive investor, Passiv is an excellent tool to consider.

First of all, Passiv will save you time. Furthermore, it will assist in executing a passive investment strategy properly and consistently. Finally, all of it can be had at a very reasonable price.

Sign Up: Register for a free Community or Elite Passiv account

And don’t forget to take advantage of this limited time offer. Simply create a Passiv account. Click this link to apply the $40 off coupon. Then upgrade your new account to Elite.

Author Bio: Tom Scott founded the consulting and coaching firm Dividends Diversify, LLC. He leverages his expertise and decades of experience in goal setting, relocation assistance, and investing for long-term wealth to help clients reach their full potential.

I own the VYM and VYMI ETFs mentioned in this article.