Determining If Pepsi Is A Good Dividend Stock?

It’s time for a Pepsi dividend review and stock analysis.

Putting my drink preferences aside, PepsiCo is a favored stock of dividend investors. Most noteworthy, there is always a lot of interest in buying Pepsi shares in this group.

So, let’s work through a Pepsi dividend stock analysis.

Disclosure: At no cost to you, I may get commissions for purchases made through links in this post.

Pepsi Dividend Stock Analysis

Are you ready to buy some PepsiCo stock? Then, we must answer some important questions first.

Such as…

Is Pepsi a good dividend stock? Is Pepsico stock a good investment?

Which is a better stock, Pepsi or Coke? Is Pepsi stock currently a good buy?

To help manage your finances and investments, I will answer these questions and more. So, let’s dive into the Pepsi dividend stock review right now!

And begin with several of these questions. They will serve as key takeaways.

Is Pepsi A Good Dividend Stock?

In my opinion, yes. Pepsi is a good dividend stock.

First, Pepsi has a rich history of rewarding shareholders with dividends. Furthermore, Pepsi stock has an attractive dividend yield and solid dividend growth potential.

Finally, Pepsi’s dividend is supported by a stable business loaded with iconic brands. This is a powerful combination any dividend investor can take a liking to.

Is Pepsi Stock A Good Investment?

Good investments depend on one’s investment objectives. If your investment objectives emphasize:

- Current income from dividends

- Increasing dividend income from annual dividend increases

- Long-term share price appreciation

Then yes, Pepsi stock is a good investment.

Is Pepsi Stock A Buy Now?

I happen to like Pepsi stock at a lower price point.

However, the stock is a long-term holding in my dividend stock portfolio. And I have no interest in selling my shares.

Next, let’s dive into the details. Starting with background on the company.

Pepsi – Company Background

PepsiCo is one of the world’s leading beverage and snack food companies. It was established through the merger of Pepsi-Cola and Frito-Lay.

Pepsi-Cola was created in the late 1890s. Frito-Lay, Inc. was formed by the 1961 merger of the Frito Company with H. W. Lay Company.

Source: Pepsico – About.

PepsiCo has a diverse global portfolio of brands. They reside in the savory snacks and beverages categories.

Some of their well-known brands include:

- Pepsi Cola

- Gatorade sports drink

- Tropicana juices

- Aquafina water

- Lay’s chips

- Doritos chips

- Fritos chips

Source: Pepsico Product Information

Pepsico Business Strategy

I thumbed through some recent investor materials. Looking through them, I tried to understand the company’s business priorities.

Here is what I have come up with:

Grow Product Revenue & Market Penetration To:

- Leverage their global position in savory snacks

- Expand their position in global beverages

- Fortify growth in developed markets

- Accelerate growth by investing in foreign markets

Make Smart Investments In:

- Manufacturing capacity

- Digitalization & technology

- Delivery route optimization

- Supply chain agility

- Sustainability, talent, and culture

- Advertising & Marketing

Manage Costs To Achieve:

- Work redesign for simplification & waste reduction

- Automation

- Increasing returns on investments

- Increasing asset utilization

Financial Improvement Goals:

- Low single-digit percent organic revenue growth

- Expansion of operating margins

- Mid to high single-digit percent earnings per share growth

- Increasing returns on invested capital

PepsiCo Stock Symbol

PepsiCo stock trades on the Nasdaq stock exchange. It operates using the stock symbol PEP (NASDAQ: PEP).

Furthermore, I trade all of my stocks commission-free. And use the fast, powerful Webull app to do. Also, it has some excellent stock research features.

You can sign up for a Webull account here.

Finally, with that brief review of Pepsi’s business taken care of. Let’s move on to the Pepsi dividend.

We will cover all the important facts investors should know about dividends for this company.

Does Pepsi Pay A Dividend?

Yes. Pepsi pays a dividend. And has paid a dividend for many years.

So, let’s next dig into the facts and figures about Pepsi’s dividend. It’s the only way to justify my answer to the all-important question. Is Pepsi a good dividend stock investment?

Pepsi Dividend Per Share

First, as with any dividend stock, Pepsi has an annual forward dividend per share.

Furthermore, the forward dividend is calculated by taking the last dividend approved by company management. Then, multiplying it by the number of times a dividend is paid per year.

Finally, that calculation gives us Pepsi’s dividend yield…

Pepsi Dividend Yield

I start my search and selection process for dividend stocks looking for dividend yields that fall in the 3-5% range. Although, I do make exceptions to this rule.

Since the longer I hold a dividend stock. The more likely, its current dividend yield will move outside my target area.

Pepsi’s yield typically falls at the low end of the range. Oftentimes below it. However, rarely have I seen the stock’s yield exceed 5%.

Let’s continue the Pepsi dividend review.

How Often Does Pepsi Pay Dividends?

Pepsi currently pays dividends 4 times per year. And they do so every year.

In Which Months Does Pepsi Pay Its Dividend?

A company’s dividend payment pattern is important to many investors. Why? Because some people build a dividend portfolio to get paid dividends every month.

With that in mind, Pepsi’s dividends are paid during January, March, June, and September.

In January the dividend is paid during the first week of the month. In contrast, during March, June, and September, it is paid during the last week of the month.

Here’s more on dividend dates…

Pepsi’s Ex-Dividend Date

As an investor in Pepsi, you must complete your purchase before the ex-dividend date to receive the next stock dividend payout.

Pepsi’s ex-dividend date falls about 4 weeks before its dividend is paid.

Pepsi’s ex-dividend date is slightly different each quarter. As is the payable date.

So, it’s best to check Pepsi’s ex-dividend date and the timing of dividend payment dates each quarter. Especially if the exact timing of cash from dividends is important to you.

Otherwise, buy and hold the stock. Then you will receive every dividend the company approves and pays.

Pepsi Dividend History

According to a recent news release, PepsiCo has paid consecutive quarterly cash dividends since 1965.

Furthermore, since 1973, the company has increased its dividend every year.

Will Pepsi Become a Dividend King?

Assuming Pepsi can continue increasing its dividend, the company will soon become a newly crowned Dividend King. But remains a Dividend Aristocrat as of the time of this article.

In contrast, Coca-Cola has already joined the current group of Dividend Kings. Having increased dividends annually since 1963.

Dividend Kings are those incredible and rare companies who have increased their dividends for at least 50 consecutive years!

Are you looking to invest money in these types of companies? You already know that Coca-Cola is Dividend King.

And I have reviewed several others right here at Dividends Diversify. They reside in my model dividend income portfolio.

Here is a table with links to a few of these Dividend Kings for easy reference.

Pepsi Dividend Growth Rate

The company has demonstrated an excellent and consistent recent dividend growth track record. It is much better than Coke’s dividend growth trend.

Pepsi Dividend Policy

Every company has a dividend policy. Some choose to communicate that policy to the public. Other companies do not.

A formal dividend policy communication is very helpful in setting future expectations for a company’s dividend. And I appreciate it when management communicates this specific type of dividend information.

In Pepsi’s case, I am unaware of formal communications from management about the dividend policy. However, I do not consider this a “red flag”. It just indicates how Pepsi chooses to go about its business.

Finally, I can tell from Pepsi’s dividend history. That increasing cash dividend payments made to shareholders will be a big part of their future.

On the other hand, a company can change its policy for paying dividends whenever it wishes. This is a good dividend lesson to know and understand.

Pepsi Revenue Trend & Its Influence On Future Dividend Increases

Like many large, mature packaged food and beverage companies, revenue growth can be challenging.

At least until more recently. As food and beverage consumption has shifted back into our homes. Benefiting Pepsi’s product lines.

Over the past decade, changing consumer preferences have been an issue for companies like Pepsi. Why?

First of all, carbonated beverages have fallen out of favor. Furthermore, people also want fresher, healthier food. Finally, life is fast-paced, and many folks want to snack multiple times a day on the run.

Thus, the Pepsi snack business has performed better than its beverage unit peer. Unfortunately for PepsiCo, most snacks do not fall into the fresh and healthy category.

Management is targeting annual organic revenue growth in the future. And acquisitions can add to that number.

But I will be watching to see how they do. After all, costs can only be cut so far.

Pepsi’s earnings growth and stock dividend growth will continue to require higher revenues. And unlike other essential service businesses for dividends, consumers have many choices regarding what they eat and drink.

So let’s talk about Pepsi’s dividend in relation to earnings next.

Pepsi Dividend Payout Ratio Based On Earnings

Pepsi’s accounting earnings are difficult to interpret. For many years, they have been full of unusual charges.

For example,

- Noncash write-offs for failed investments in Venezuela

- Accounting adjustments due to changing tax laws

- The impact of Pepsi’s international reorganization

When you exclude one-time events, core business earnings have been on a generally positive upward trend. This is mainly due to margin expansion from pricing and cost reductions. Also, revenue growth when they produce it.

The company aggressively pursues cost efficiencies. Partly coming from closing manufacturing facilities, identifying good investments with paybacks from automation, and reducing jobs. Efficiency efforts are continuing as their business strategy indicates.

The dividend payout runs high based on earnings but is consistent with other consumer goods concerns that pay large dividends. However, dividends are paid from cash, not accounting earnings.

So, let’s cross-check Pepsi’s dividend payout ratio against cash flow.

Pepsi Dividend Payout Ratio Based On Cash Flow

No matter when or how you look at it, a sizeable portion of Pepsi’s available cash flow is paid out as dividends for shareholders. However, over the long run, cash flow covers the dividend with room to spare.

So, let’s discuss Pepsi’s dividend payout ratios in more detail next.

Thoughts About The Pepsi Dividend Payout Ratios

At times, dividend payments have grown more rapidly than earnings and cash flow.

A lower dividend payout ratio is a positive metric. It shows the company has ample room to raise dividends in the coming years. Or withstand an earnings drop without reducing it.

Pepsi’s dividend looks adequately covered by earnings and cash for the time being. And because of the stability of Pepsi’s business, the ratios are of little concern to me. But the dividend payout ratios tend to run on the high side.

I do not want to see Pepsi go the way of Coke. Where dividend payout ratios have exceeded 90% at times virtually guaranteeing low stock dividend growth for the foreseeable future.

The discussion thus far about Pepsi’s dividend leads me to my dividend growth forecast.

Pepsi Dividend Growth Forecast

Because of the high dividend payout ratios, I believe dividend growth will be constrained.

It will be limited to a mid-to-high single-digit percentage range in the coming years. In line with earnings growth. Or slightly lower than earnings growth to reduce the dividend payout ratios.

So, for my planning purposes, I assume the Pepsi dividend will grow by 5-7% annually in the coming years.

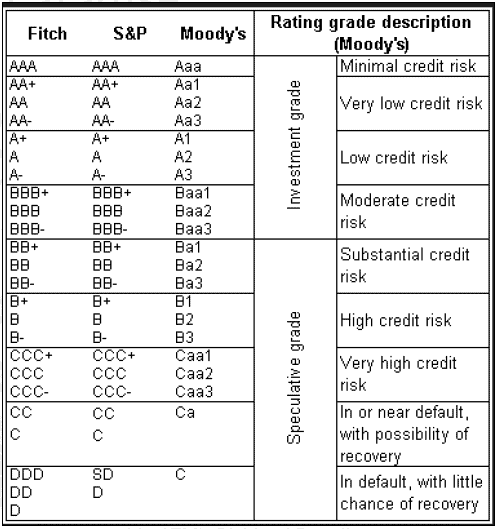

Pepsi Balance Sheet & Credit Rating

Pepsi carries a large amount of debt. Their debt-to-equity ratio checks in at a relatively high level.

However, Pepsi has strong credit ratings from Moody’s and S&P.

Source: FINRA

Credit Evaluation Grid

As shown in the table above, Pepsi is rated investment grade.

Yes, Pepsi’s debt levels are slightly troublesome to me as an investor. But, offsetting my concerns about debt is a high credit evaluation.

Furthermore, this company’s consistent free cash flow generation is a good sign. And finally, there is ample cash sitting on the balance sheet for liquidity purposes.

The higher dividend payout ratios combined with the debt levels will keep a lid on future dividend growth. So, I stand by my Pepsi dividend growth forecast.

Pepsi Dividend Safety

I judge dividend safety by considering many of the factors we have discussed. Specifically,

- Business fundamentals

- Earnings and cash flow trends

- Dividend history

- Dividend payout ratios

- Debt levels and credit ratings

Based on these factors, I judge Pepsi’s dividend to be safe from a reduction in the foreseeable future.

Next, it’s time to wrap up this Pepsi dividend stock analysis by looking at the stock valuation.

Pepsi Stock Valuation

Let’s gage Pepsi’s stock value in several ways:

- Dividend discount model

- Dividend yield

Pepsi Dividend Discount Model

The single-stage dividend discount model (also known as the Gordon Growth Model) considers several factors I have discussed thus far.

- The current annual dividend payment

- Projected dividend growth

- My desired annual return on investment

Using these assumptions, the Gordon Growth Model calculator suggests the stock is overvalued as of the publication date of this article.

Pepsi Dividend Yield As An Indicator Of Value

Finally, as I previously mentioned, I like dividend yields in the 3-5% range. So, I wouldn’t buy more Pepsi stock unless the yield is at least 3%.

Especially given my concerns about future dividend growth.

Pepsi Stock Valuation Summary

As I review various measures of value, I conclude that Pepsi stock is fully valued at this time. Okay, perhaps a bit overvalued. But neither a clear-cut buy nor sell, in my opinion.

Looking at it from my long-term dividend investor perspective. This is a buy-and-hold forever stock.

So, for my purposes, I think Pepsi stock is a reasonable value on any price pullbacks. Providing a decent entry point price when using a dollar-cost averaging strategy into the shares.

And, absent a change in business fundamentals, Pepsi would be a good stock buy whenever the overall stock market corrects. Bringing stocks like Pepsi down with it.

Finally, please realize that these valuation observations are at the time of this article update. Most importantly, stock values can change quickly.

To get a current and up-to-date call on valuation. I use the Simply Investing Report & Analysis Platform.

Pepsi Dividend Review & Stock Analysis Wrap Up

Let’s wrap up by comparing Coke to Pepsi.

Which Is A Better Stock, Pepsi or Coke?

I think both Pepsi and Coke are good stocks that pay dividends.

But from a business perspective, this may not be a fair comparison. After all, a majority of Pepsi’s business is in the snack food segment. In contrast, Coke is a pure play in the beverage sector.

Nevertheless, the 2 companies often get lumped together and compared. Because of their long history battling it out in the cola market.

The table below compares Coke and Pepsi stock head to head based on the factors I consider important as a dividend growth stock investor.

Pepsi Stock Vs. Coke Stock

Where Pepsi Has An Advantage:

- Best Product Diversity

- Highest Dividend Growth

Where Coke Has An Advantage:

- A longer history of raising dividends

- Better communicates dividend policy

Tie between Pepsi and Coke:

- Highest Dividend Yield

- Attractive Stock Valuation

- Dividend payout ratios

It’s a close contest. I currently own both in my diversified collection of dividend stocks. And expect to hold both for the long term. So, I have little to no bias.

However, if forced to choose between the 2 stocks today, I select Pepsi for my dividend income and investment dollars.

Now, I must tell you. My choice for a refreshing cola on a hot summer day? I prefer an ice-cold Diet Coke!

But for a snack, I’ll take some Doritos with a hamburger off the grill.

More Reading About Dividends And Dividend Stocks

- A valuable resource for dividend investors

- Rapid dividend appreciation from a Vanguard ETF

- Book review: The Little Book Of Big Dividends

My Favorite Dividend Investing & Finance Resources

- Free online stock trading with Webull

- Dividend stock recommendations from Simply Investing

- Manage all your finances for free with Personal Capital

Author Bio: Tom Scott founded the consulting and coaching firm Dividends Diversify, LLC. He leverages his expertise and decades of experience in goal setting, relocation assistance, and investing for long-term wealth to help clients reach their full potential.