Dividend Compounding Your Way To Wealth

I’m excited to discuss how to build a dividend snowball.

Because this topic is in line with one of the main themes of this site. That is, making money from dividends.

First of all, a snowball effect is a process that starts from a small, insignificant state.

But it builds upon itself, becoming larger. Thus, creating a continuous and beneficial cycle.

Now, let’s take this definition and apply it. To create a dividend snowball.

Disclosure: At no cost to you, I may get commissions for purchases made through links in this post.

What Is A Dividend Snowball?

A dividend snowball is a continuous cycle of growing dividend income. It is created by investing in shares of dividend growth stocks.

The dividend income from those shares increases over time. Higher dividend earnings come from the addition of new funds, dividend reinvestment, and organic dividend growth.

Now that you know what a dividend investment snowball is. Let me outline how to create one. So you will know how to make money with dividends.

How To Create A Dividend Snowball: Your 5 Step Plan

- Choose dividend growth stocks for your investments

- Add new money to your investments regularly

- Reinvest all dividends received

- Be patient and give this investment snowball strategy time to work

- Continue until you reach your dividend crossover point

Next, let’s dig into the details of these 5 steps. Then you will know how to grow a dividend snowball by compounding wealth.

Dividend Snowball On Pinterest (Pin and Save for Later!)

And remember. Before you go. Check our full complement of dividend investing articles to level up your dividend wealth game!

1. A Dividend Snowball Starts With Dividend Growth Stock Investments

A dividend snowball is built from a portfolio of dividend growth stocks. These stocks have several characteristics including:

- Moderate dividend yield

- Solid dividend histories

Next, I will explore these two topics to aid your search for good dividend growth stocks.

Moderate Dividend Yield

The dividend yield is a company’s annual dividend rate divided by the stock price per share. I prefer dividend yields between 3% and 5%. Why is that?

Because a dividend yield of less than 3% may not provide enough dividends for an income snowball. On the other hand, a dividend yield greater than 5% may indicate too much investment risk.

But dividend yield is just 1 measure. There are other important things to know about dividend stocks. Such as dividend history…

A Solid Dividend History

There are 2 considerations when looking at a company’s stock dividend history.

First of all, how long has the company consistently paid dividends? Furthermore, we want good dividend growth too. So, we need to know how many years in a row the company has increased its dividend. And at what rate.

In either case, longer dividend histories and faster dividend growth rates are usually better. They indicate the sustainability of a company’s business model. Also, a company’s commitment to paying recurring dividends to shareholders. No matter the circumstances.

So, where might you find good dividend stocks with these traits? Let me explain…

Dividend Kings & Dividend Aristocrats

The types of companies I’m talking about are pretty easy to find. I suggest the list of Dividend Kings and Dividend Aristocrats as a good starting place.

Because Dividend Kings are stocks that have paid increasing dividends for at least 50 years in a row. While Dividend Aristocrats have achieved higher dividend payments for a minimum of 25 consecutive years.

They are the Dividend Kings and Dividend Aristocrats! By definition, they are dividend growth stocks.

And, great stocks for a dividend snowball. For example, Procter & Gamble is a Dividend King. And a great snowball stock, in my opinion.

Or, put Johnson & Johnson on your snowball stock watch list. Because the health care sector is a good place to look for steady dividends.

Want more for more tips on compounding stocks? Then check out the Simply Investing Report for high-quality dividend stock recommendations.

And one last point before we move to step #2. Be sure to keep your investment costs low.

I invest in dividend stocks for free. And use the fast and easy to use Webull app to do so.

2. Regularly Add New Cash To Your Dividend Snowball Investment Strategy

As the saying goes, “it takes money to make money“.

So, your biggest personal finance challenge may be making more money. Also, spending less than you make.

That simple equation creates excess cash to feed each stock in your dividend income portfolio. In other words, you have to create excess cash to invest in the dividend growth stocks of your choosing. Here’s how…

Make More Money For Your Dividend Snowball

Earn more money. You do so by:

- Investing in yourself

- Improving your skills

- Creating more value in your business, or for potential employers

Here’s a resource to improve your resume and find a better paying job.

Also, spend some time working a side hustle. That can bring in some extra cash too.

The list of side hustles is endless these days. But, I prefer to keep it simple.

So, when I have a little extra time, I take consumer surveys. And get paid cash for doing so.

It’s easy and it’s fun. Survey Junkie is the online consumer survey site that I prefer.

Save More Money For Your Dividend Snowball

I know. It’s no fun to scrimp and save money. But, spending less than you make is the second part of the earn more than you spend challenge.

Here are a few tips on saving money to feed your dividend investment snowball.

Analyze Your Spending

Consider how you can reduce your costs and save money. Think about your spending on these 4 big-ticket items and look to cut your costs in these areas wherever it makes sense.

- Housing

- Transportation

- Food and Beverage

- Leisure activities

Sharpen your pencil and go through your budget with a fine-tooth comb. When you are making money from your dividends snowball, you will be glad you did.

Good Tools For Saving Money

Not sure where to start? Here are a couple of suggestions that work for us.

We save on just about all our everyday online purchases through Rakuten. Also, Rakuten gives you $10 just for signing up and using their app.

Next, I pull all of my finances together using Personal Capital. It allows me to see all my spending and investments in 1 place. Best of all, Personal Capital is free to sign up and use.

Understanding your spending is important for another reason. Because you will use that knowledge in step 5 of the dividend snowball plan.

But let’s not get ahead of ourselves. We are now ready for step 3. That is dividend reinvestment.

3. Reinvest All Dividends Received Back Into Your Dividend Snowball

You have a couple of options for reinvesting dividends. Let’s discuss both. Then I will give you my recommendation for building a dividend snowball.

Automatic Dividend Reinvestment

First of all, you can automate dividend reinvesting. What this means is that you tell your brokerage firm to automatically reinvest the dividends paid by a company back into that company’s shares.

The advantage of automated dividend reinvesting is that once you set it up, you can forget it. And when you get cash from dividends is put back to work in your dividend stocks right away.

On the other hand, investment decisions are taken out of your control. You may automatically reinvest in shares of an overvalued stock. Or, a stock you own too much of already.

Lump-Sum Manual Dividend Reinvestment

The second option is to let your dividends accumulate in cash. And then when you are making your regularly scheduled dividend stock purchases. Add your dividends collected to the amount you are saving each month. Then, put that money into the dividend stocks of your choice.

Lump-sum reinvestment allows for making the best dividend stock investment decisions. When cash from dividends comes available.

On the other hand, you must have the discipline to do it regularly. Because if you do not, your dividend snowball will not grow as rapidly as possible.

My recommendation for creating a dividend snowball? Use automatic reinvestment.

That’s how I built my dividend income snowball. So, I’m just speaking from my experience.

Automatic reinvestment keeps putting a company’s dividends to work instantly. Creating more momentum for a dividend snowball.

Now, onto step 4…

4. Be Calm & Patient: The Dividend Snowball Strategy Takes Time To Work

Unfortunately, creating a dividend wealth snowball is not a get rich quick investment strategy. It takes time for the power dividend compounding to work.

So, think and invest for the long-term. Put your dividend snowball plan in place. Set it and forget it. Be calm and practice patience.

Just get started making money from dividends. When your snowball grows. You will be glad you did.

Last but not least, step 5…

5. Monitor Your Dividend Snowball Crossover Point

The dividend crossover point is when you reach your annual or monthly dividend income goal. That you set as part of your income snowball strategy.

Perhaps your goal is to cover all of your expenses with dividends. That is one definition of financial freedom using dividends.

And why I suggested you track your expenses. Using Personal Capital. As I mentioned in step 2.

On the other hand, your goal might be to make a certain dollar amount of dividends every month. For example, making $500 a month in dividends. Or, $1,000 a month from dividends. Even more, is possible!

These amounts of dividends may not cover all of your expenses. But you might have a side hustle, part-time job, or retirement income to cover the rest.

I can’t tell you what your dividend crossover point should be. But I can say this. Set a dividend income goal. Then use this 5-step dividend snowball plan to achieve it.

That covers the 5-step dividend compounding plan. But, before we wrap up, I want to cover 2 more topics. First, an example.

Dividend Snowball Example

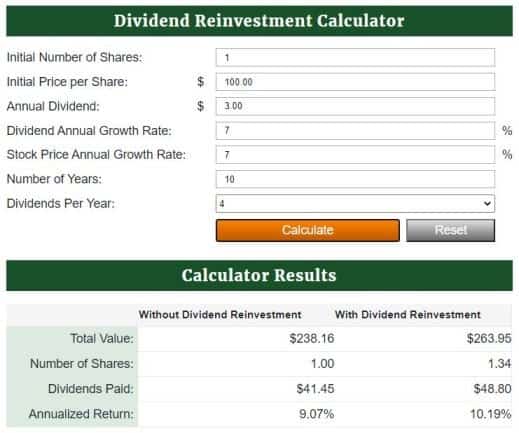

So, I played around with an online dividend reinvestment calculator. To show you an example of a dividend wealth snowball.

Assumptions For Compounding Dividends Example

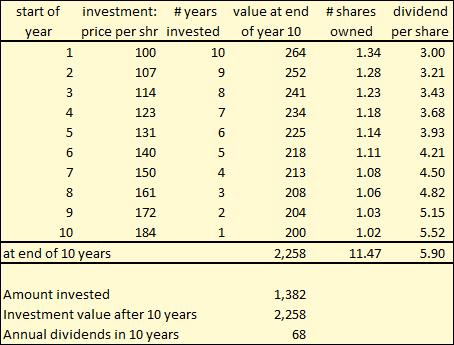

I assumed at the start of each year our investor bought 1 share of stock. And they repeated that snowball investment plan for 10 years.

At the beginning of the plan, the stock started with a 3% dividend yield. And both the stock price and dividend increased by 7% each year.

Here is what my input assumptions looked like in the dividend reinvestment calculator.

Results From The Dividend Compounding Example

I ran the calculator for each of the 10 years and got this result.

By investing about $1,400 over 10 years, our investor ended up with a market value of more than $2,200. And, receives $68 in annual dividends.

But these are some pretty small numbers. Because investing less than $150 a year isn’t much. On average, that’s less than 45 cents per day. We can do better than that.

Instead, let’s say she invested each month of the year. Rather than just once at the beginning of each year. In other words, investing a total of $16,500 by purchasing 1 share every month over the 10 years.

Then, she would have about $27,000 market value and more than $800 of annual dividends at the end of 10 years.

Revisiting Some Steps In The Investment Snowball Plan

Like I said in step 4. Creating a dividend snowball takes time and patience. But just imagine if you could save and invest $500 a month. And do that for 25 years.

Then you are talking about a big dividend snowball effect. And the bigger it gets, the faster it grows.

That’s why step 2 is so important. That is making more money and saving more money to feed your dividend snowball investing plan. Especially in the early years to get it rolling.

But it’s not as important as getting started dividend investing. The sooner you start, the more time you will have for compounding dividends. Refer to step 4, time and patience.

One last point, before we wrap up.

Understand How Taxes Will Impact Your Dividend Snowball

In most cases, you will be required to pay taxes on the dividends you receive. But, the amount of tax depends.

Depends on what? Your specific tax situation.

Dividends & Taxes

In certain cases, no taxes will be due. But this may only be a small probability. Especially if you are successful at making more money (step 2).

Furthermore, it depends on the type of dividend stock you invest in. Some company’s dividends are “qualified” and receive preferential tax treatment. In the form of lower tax rates.

Other company’s dividends are not qualified. And are taxed as ordinary income.

So, when it comes to the amount of your taxes on dividends. Do the research specific to your situation. Or consult with a tax expert.

Dividends & Individual Retirement Accounts

Also, consider starting your dividend snowball in an Individual Retirement Account (IRA). Depending on the type of IRA, you may either defer taxes until retirement.

Or, if you fund the account after paying taxes on your earnings, your dividends and gains will never be taxed. This is called a Roth IRA.

Once again, consult with your tax advisor. And choose the best option for your situation. In either case, the dividend snowball effect will work much faster in a qualified retirement account like an IRA.

Open your IRA and get your dividend snowball rolling with tax-advantaged dividend compounding in a qualified retirement account.

How To Grow A Dividend Snowball: Wrap Up

First, put the power of compounding dividends to work in dividend growth stocks.

Then, add to your investments frequently and reinvest the dividends.

These two concepts are the essence of a snowball investment strategy.

To make it easy, remember the 5-steps for building a strong dividend snowball:

- Choose dividend growth stocks for your investments

- Add new money to your investments regularly

- Reinvest all dividends received

- Be patient and give this investment strategy time to work

- Continue until you reach your dividend crossover point

Now, take advantage of the snowball effect. And start compounding your dividends right away.

More Reading About Compounding Dividends

I hope you enjoyed reading about this snowball wealth plan. Here are some other good articles to check out.

- How to create a $2,000 a month dividend portfolio

- How to know if a dividend stock is a good value

- Should you invest in utility stocks for dividends?

My Favorite Resources For Building My Dividend Snowball

- Trade stocks for free with the Webull app

- Get dividend stock recommendations from Simply Investing

- Get top stock picks from Motley Fool

- Manage all of your finances with Personal Capital

Disclosure & Disclaimer

Author Bio: Tom Scott founded the consulting and coaching firm Dividends Diversify, LLC. He leverages his expertise and decades of experience in goal setting, relocation assistance, and investing for long-term wealth to help clients reach their full potential.