Your Guide to All Articles About Dividend Investing

First of all, dividend stocks are my absolute favorite type of investment. I can’t gush about them enough for their wealth-building capabilities.

Furthermore, dividend stocks are a big part of Dividends Diversify.

Do you know what I like to say? “Build your success one dividend at a time”. It’s that simple.

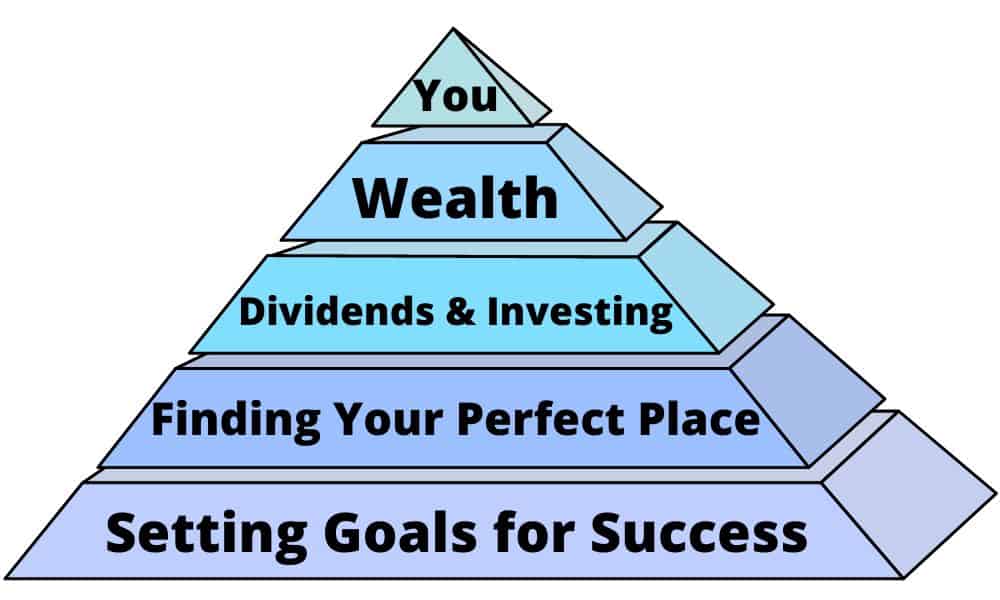

So, they sit close to the top of the success pyramid.

Let’s cover all of our bases on this investing strategy. Here is an outline of what I have in store.

Dividend Stocks And Dividend Investing Articles By Topic

- How dividends work

- FAQs about dividends

- Dividend investing resources

- How to make money from dividends

- How to retire on dividends

- Reviews of select dividend-paying companies

- Fill out your dividend calendar

- Dividend stock groups for building a foundation

- Other ways to get dividends

- Dividend investing success stories

1. How Dividend Stock Investing Works

Do you want to be a successful dividend investor? Then check out this growing series of articles about how stock dividends work.

Start with the namesake and capstone article:

Then put your newfound knowledge to work on one of my favorite topics.

Then move on to some of these articles. They dive into specific dividend investing topics in greater detail.

- How to start dividend investing with little money

- A guide to dividend growth investing

- What I learned from Dividend Investing 101

- 10 rules of dividend investing to follow

- How to fine-tune your dividend strategy

- 17 battle-tested dividend investing tips

- 10 dividend investing errors I made as a beginner

- 7 benefits of dollar-cost averaging dividend stocks

- The pros and cons of dividend stocks

- 15 pros and cons of reinvesting dividends

- The bird in hand dividend theory

- Dividend irrelevance theory explained

- The importance of dividend policy

- 5 types of dividends and which one is best

- 7 ways to find dividend stocks

- How to analyze dividend stocks after you find them

- Using the Gordon Growth Valuation Model

- How to forecast future dividends

- 30 stocks for a dividend portfolio

- Dividend vs. growth investing explained

- 10 ways to avoid capital gains tax on dividend stocks

- How to generate compounding dividends

- 7 dividend investing goals for beginners

- Best dividend investing ideas right now

2. FAQs About Dividends

You have questions. We have answers.

Here are some responses to frequently asked questions from readers…

- Can you live off dividends?

- Why do companies pay dividends?

- How many dividend stocks should you own?

- How much should you invest in dividend stocks?

- Are dividends free money?

- What are homemade dividends?

- Are dividend stocks worth it?

- Are dividends better than capital gains?

- When are dividends better than interest?

- Is a high dividend yield good or bad?

- Why do companies increase dividends?

- What is a good dividend yield?

- Can you lose money on dividend stocks?

- How much can you earn from dividends?

- What is a good dividend payout ratio?

- Can you get rich off dividends?

- Do index funds pay dividends?

- What percentage of your portfolio should be in dividend stocks?

- How much can you make in dividends with $50K?

- How much in dividends can you make with $100K?

- How much money do you need to live off dividends?

- When should you buy dividend stocks?

- Why you should not buy dividend stocks?

- Are dividend stocks safe?

- What is dividend reinvestment?

- Should you reinvest dividends?

- Do dividends increase over time?

- What’s the point of stocks without dividends?

- Do growth stocks pay dividends?

- Are dividend stocks good for young investors?

- What is the dividend investing tipping point?

- Are stock dividends guaranteed?

- Are monthly dividends better than quarterly?

3. More Dividend Stock And Dividend Investing Resources

We all have to learn and get better at what we do. Getting better every day is one of the keys to success.

To become better dividend investors, here are some of my favorite resources to level up your dividend investing game.

Books, investment newsletters, advisory services, and some of my informative articles are the focus here.

- The Little Book Of Big Dividends – Book Review

- Simply Investing review: picking dividend stocks made easy

- Utility Forecaster investment newsletter review

- Comparing Dividend Kings vs. Aristocrats

- A comprehensive guide to the Dividend Achievers

- How to build a dividend portfolio from monthly dividend stocks

- 5 points about million-dollar dividend portfolios

- Dividend stocks vs. index funds: How to decide

4. Making Money From Dividend Stocks

Making money from dividends is the goal. Right?

Building a growing passive income stream is what dividend investing is all about. At least, in my humble opinion.

So, here is a group of “how-to” articles that discuss just that…

- How to start a dividend portfolio

- Build a portfolio paying dividends every month

- How to build a 12-month dividend portfolio

- How to earn dividend income

- Beginner’s guide to $50 in monthly dividends

- Make $100 a month in dividends

- Collect $200 a month in dividends

- Earn $500 in monthly dividends

- Amount needed to make $500 in monthly dividends

- Get $1,000 a month in dividends

- $2,000 in dividends every month!

- Make $3,000 a month in dividends

- How to make $5,000 a month in dividends

- How to make $100k a year from dividends

- How to snowball your way to dividend wealth

- 5 easy ways to increase dividend income

- How to make a passive income dividend portfolio

5. How To Retire On Dividends

Next, if you are interested in using dividends in retirement. To fully fund your lifestyle. Or, just supplement your income.

Then start with this…

Or, check out these supporting articles if you know exactly what you are looking for…

- Can you retire on dividends?

- 3 dividend stock retirement strategies

- 15 best dividend stocks for retirement

- 5 best ETFs for retirement income

- How to build a dividend retirement portfolio

- 5 steps to calculate dividends needed in retirement

- Should you reinvest dividends in retirement?

6. Reviews Of Select Dividend-Paying Companies

Here are some of my favorite dividend growth stocks. Click on the stock you choose, and it will take you to a dividend stock review I completed for the company.

Or you can go directly to my dividend portfolio here to check out my stock holdings.

7. Fill Out Your Monthly Income Calendar With Dividend Stocks

Many dividend investors like to identify stocks by when they pay their dividends. Investors do this to smooth out their stream of passive income cash flows.

The timing of dividend payments shouldn’t be your only reason for investing in a stock. However, it is something to consider as you make your investments.

To help you out, here are several articles to assist in filling out your dividend calendar:

- 7 monthly dividend stocks

- Stocks that pay dividends in January

- Dividend stocks that pay in February

- Stocks that pay dividends in the month of March

- Stocks paying dividends in April

- 15 stocks that pay dividends in May

- June dividend stocks

- Top stocks paying dividends in July

- August dividend payers

- Stocks paying dividends in September

- Companies paying dividends in October

- Best stocks paying November dividends

- December dividend payers

- January, April, July, and October dividend payers

- Stocks for February, May, August, November dividends

- Get dividends in March, June, September, December

8. Dividend Stock Groups & Sectors For Building Your Foundation

Dividend-paying stocks are typically clustered in certain stock market sectors or in other logical groupings.

Periodically I will pick a sector or stock group and analyze a few stocks within it to compare and contrast. Highlight a specific issue the sector is encountering. Or, simply pick a theme and present ideas that fit that theme.

Furthermore, everyone has to start somewhere. It would be nice if you had the money to invest in 25 or 30 dividend stocks, but that may not be the case.

If so, start with 1 and try to build to at least 3 for diversification. Then shoot for 5.

Here are several different groups of dividend-paying stocks to consider. Hopefully, an article here fits your needs as a dividend investor…

- Investing in utility stocks for high dividends

- 7 good dividend stocks to buy and why

- 5 consistent dividend stocks to buy and hold

- 3 Dividend Kings

- 7 best dividend stocks for passive income

- 10 top dividend stocks to hold long-term

- 20 best dividend stocks for growing wealth

9. Other Ways to Get Your Dividends From Stocks

Individual stocks are not the only way to invest in dividend stocks. Many mutual funds, exchange-traded funds (ETFs), and even Robo-Advisors can do the work for you.

Learn about some excellent options here:

- 5 best Vanguard dividend ETFs for long-term investing

- Vanguard dividend appreciation ETF (VIG) review

- Vanguard high dividend yield ETF (VYM) review

- Vanguard International High Dividend ETF (VYMI) review

- Vanguard utilities ETF (VPU) review

I am a big fan of Vanguard dividend stock ETFs in case you hadn’t noticed.

10. Dividend Stock Investing Success Stories

I love a success story especially when it comes to dividend investing.

So, check out some of my friends’ dividend-investing success stories.

- Dividend investing success stories – Volume 1 – Trent

- Dividend investing success stories – Volume 2 – Mark

Author Bio: Tom Scott founded the consulting and coaching firm Dividends Diversify, LLC. He leverages his expertise and decades of experience in goal setting, relocation assistance, and investing for long-term wealth to help clients reach their full potential.