Put The Power Of Compound Dividends To Work In Your Portfolio

Albert Einstein said, “compound interest is the 8th wonder of the world”. And I think the same can be said for compounding dividends.

So, let’s explore this important concept as it relates to compounding your dividend income with dividend growth stocks…

2 Ways To Make Compounding Dividends

There are two ways that dividends compound.

First, by reinvesting dividends, a dividend investor earns more dividends in the future off the dividend income he or she has earned in the past.

Second, by holding dividend growth stocks for the long term, an investor receives company-declared dividend increases on top of prior dividend increases.

Both of these concepts have a compounding cash flow effect. Thus, exponentially increasing the money earned from dividends over the long run. And accelerating progress to a dividend investing tipping point.

Next, let’s dig a little deeper into these concepts. So you can accelerate your cash flow from dividends…

Disclosure: At no cost to you, I may get commissions for purchases made through links in this post.

Dividend Reinvestment Is Required To Compound Dividends

Just like compound interest, to compound dividends you must reinvest the dividends you receive. Thus, you can’t take your dividends in cash and spend them.

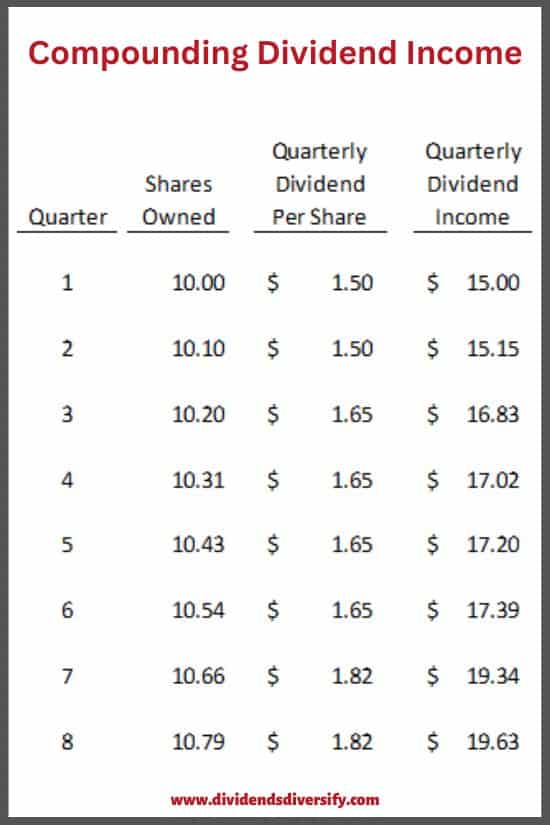

Let’s say you buy 10 shares of a company’s stock for $150 per share. At the time of your purchase, the company was paying a quarterly dividend of $1.50 per share.

At the end of your first quarter of ownership, the company pays you a dividend of $15 (10 shares times $1.50). Assuming the price of the stock hasn’t changed and you reinvest the dividend, you now own 10.1 shares.

Next, after your second quarter of owning the stock, the company once again pays a $1.50 per share dividend. As a result, your new dividend received is $15.15.

As a result, you are earning dividends on your dividends. Thus, beginning the compounding process.

Now that you know dividend reinvestment is required. Allow me to explain the two ways to go about it…

Automatic Dividend Compounding

The best way to reinvest dividends is to do so automatically.

You can reinvest dividends automatically back into the stock paying them, just by instructing your stock broker to do so.

Or, you can participate in company-sponsored dividend reinvestment plans. Thus, bypassing the need for a brokerage account altogether.

Manual (Non-Automatic) Dividend Compounding

The other way to reinvest dividends is to do so manually.

Here you purchase the best dividend-paying stocks through your stock broker. But instruct your broker to deposit them in cash to your account.

After a while, the cash from dividend payments will accumulate. Then, periodically take that cash and invest it in the dividend-paying stocks of your choosing.

Finally, when you choose to reinvest dividends. Understand that it is a great way to benefit from dollar cost averaging.

Okay. Now let’s cover the second way to make compounding dividends.

Hold Dividend Growth Stocks Long-Term To Compound Dividends

By investing in stocks that increase their dividend rates frequently, dividend investors enjoy a second dividend-compounding effect.

Let’s continue our example, this time using a table to illustrate. For simplicity, I going to assume the company’s stock price stays constant at $150 per share.

Of course, our investor continues to automatically reinvest each quarterly dividend received.

And here’s the good news…

At the start of the 3rd quarter, the company announces a 10% increase in its dividend rate per share. Thus, each share owned now earns a quarterly cash dividend of $1.65.

Better yet, a year later they announce another 10% dividend increase. Increasing the dividend rate per share to $1.82.

As a result, by the end of year 2, our investor is earning $19.63 in cash dividends per quarter. That’s 31% more money coming in from dividends, without having to invest another penny since the initial investment.

This example illustrates the power of compounding dividends. In addition, over the long run, the price of a dividend growth stock normally goes up. Further increasing the investor’s total return.

Over time and by exercising patience, you can also create a dividend snowball effect to improve your overall financial status. Just like I’m showing in the illustration.

This leads me to the next obvious question…

Examples Of Compounding Dividend Stocks

Specifically, where do you find dividend stocks that behave like the one in the example? Well, the list of Dividend Aristocrats is a good place to start.

Because Dividend Aristocrats are stocks in the S&P 500 stock market index. They have raised their dividend per share annually for at least 25 years in a row.

Several examples of Dividend Aristocrat stocks include:

- Automatic Data Processing (ADP)

- Clorox (CLX)

- Coca-Cola (KO)

- Hormel Foods (HRL)

- Johnson & Johnson (JNJ)

- NextEra Energy (NEE)

- Real estate company Realty Income (O)

- Target (TGT)

- Walmart (WMT)

With stocks like these and others, you can build your compounding dividend portfolio to produce a growing passive income stream.

Also, try the Simply Investing Report & Analysis Platform. For recommendations on the best dividend stocks, with good dividend yields, and when to buy them.

I also like the stock recommendations sent to my inbox every month. Delivered by the Motley Fool Stock Advisor.

Full Disclosure: I own shares in each of the companies listed above. And have done so for many years. Decades in some cases.

Why? Because it takes time, patience, and discipline to compound dividends.

Unfortunately, what I’m talking about is not a get-rich-quick scheme. Therefore, getting started at a young age is a great idea.

So, allow me to wrap up with a few parting thoughts…

Compounding Dividends: Wrap Up

First of all, if you have been wondering, do dividends compound? Then, I say yes. It is similar in some ways to earning compound interest.

Furthermore, if you want to know how dividend compounding works. Then look at these two ways:

1. Dividends compound for those who consistently practice dividend reinvestment.

and…

2. Compounding dividends result from companies increasing their dividend rate per share.

Finally, total investment returns are further enhanced by rising share prices.

Put those three things together, and that’s what dividend investing for a growing income stream is about!

Thanks for reading.

And be sure to check out our other…

Articles about Dividend Growth Stock Investing

Author Bio: Tom Scott founded the consulting and coaching firm Dividends Diversify, LLC. He leverages his expertise and decades of experience in goal setting, relocation assistance, and investing for long-term wealth to help clients reach their full potential.