Pondering The Dynamics Of Dividend Payments

As far as I can tell, the dividend investing tipping point is not a formal phrase used among dividend investors.

On the other hand, I have found some value in thinking about the concept over the years. Specifically, as it relates to achieving financial freedom with dividend stocks.

Allow me to explain…

What Is Dividend Investing Tipping Point?

First, at a stock level, the dividend stock tipping point is when your initial stock investment is returned over time in the form of cash dividends.

Second, and more importantly, at a dividend portfolio level. The tipping point is achieved when annual dividend payments are sufficient to pay your bills.

The above are my definitions. Other investors may think of it differently. And that’s okay.

Why Is Dividend Investing Tipping Point Important?

The dividend tipping point is important at the stock level because it serves as a safety-net mindset.

Providing a higher degree of confidence that money will not be lost on an investment. Perfect for the most conservative and risk-averse investors.

While at the portfolio level, achieving the tipping point means earning enough dividends so working for a living is optional.

This is sometimes referred to as living off dividends. One of the big goals of many dividend investors.

With that overview taken care of. Let’s explore this topic a little more deeply…

Disclosure: At no cost to you, I may get commissions for purchases made through links in this post.

Dividend Tipping Point Explained Using The Dividend Payback Method

First of all, it’s common for businesses to evaluate potential investments using the payback method. It’s popular because of its ease of use.

The business owner or her financial analyst simply estimates the annual cash returns expected from an investment. Then computes a payback period using the required upfront cash outlay.

For example, let’s say the investment will cost $10,000 upfront. And return higher profits every year in the future amounting to $2,500 annually.

Thus, the payback period is 4 years. Calculated as $10,000 divided by $2,500.

And a dividend investor can think of stock investments the same way. Using a stock’s dividend yield at the time of purchase. And an estimated future dividend growth rate.

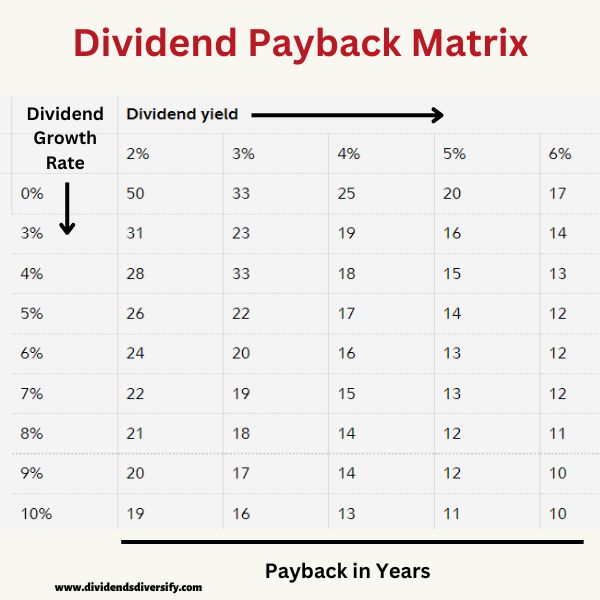

Here’s a table that does the calculations for you…

Table 1: Dividend Payback Matrix

Simply use the table to find the right dividend yield and dividend growth rate for the stock you want to buy. The number at the intersection of the two values represents the years required to recoup your initial investment in a dividend stock.

What is the benefit of this exercise?

Well, it’s not super beneficial, in my opinion.

However, it does provide you with the dividend stock investing tipping point at the individual security level. In other words, the number of years required for your initial outlay to be returned in the form of cash dividends.

Is The Dividend Payback Method Useful?

Certainly, on some level the dividend payback method is useful. Mostly for understanding one of the worst-case scenarios involved when investing in a dividend stock.

Because it gives the investor an idea of when they will break even. And when they can hopefully start turning a profit from a dividend stock that does not increase in value.

But, I would ask, why buy and hold a dividend stock like that in the first place?

Now, let’s move to the other definition of dividend investing tipping point that I offered up at the beginning of the article…

Dividend Tipping Point Explained For Living Off Dividends

This tipping point is the one most of us dividend investors are after. Specifically, making enough passive income from dividends to cover our living expenses.

The result?

Working for “the man” or “the woman”, whatever your case may be, is no longer required.

Or, to quote an old country music song, “Take This Job And Shove It”. This is much easier to say to your boss after reaching your dividend stock investing tipping point.

When this is the goal, it pays to learn as much about dividend investing as possible. For this, I suggest you consider…

The Financial Freedom Investing Course

…offered by Simply Investing. Because knowledge pays off when it comes to investing your money.

However, this big question always follows…

How Much Money Does It Take To Reach The Dividend Investing Tipping Point?

Because it takes a good chunk of money to retire off dividends.

However, it is fairly simple to calculate your portfolio’s dividend investing tipping point.

First, determine how much money you need each year to pay your bills.

Take your current expenses. Then make sure you adjust the number down.

Why?

To account for expenses that will go away when you are no longer working. Such as lunches out, commuting costs, and proper clothes for your workplace.

Second, don’t forget to increase your expenses for new costs you may incur.

Things like travel expenses now that you have more free time. Or, health insurance premiums that your employer was covering on your behalf.

Then divide your annual expenses by your dividend stock portfolio’s dividend yield.

Let’s put some numbers behind this discussion to make it clear…

Example Of Money Required To Hit The Dividend Tipping Point With Your Stock Portfolio

For example, let’s say you need $50,000 a year to support your desired lifestyle. And you have been constructing a solid stock portfolio that has a 4% dividend yield.

Then, $50,000 divided by 4% (or .04 for those of us that aren’t math wizards), and boom you have it…

In this example, you would need $1,250,000 invested to hit your dividend stock tipping point. Calculated as $50,000 divided by, 04.

Yes. That’s a lot of money.

So, it’s a good idea to be very careful telling your boss what they should shove and where they should shove it!

At least until you are very confident your portfolio’s dividend investing tipping point has been achieved. Making it possible to retire on your dividend earnings.

One last very important topic, then I will wrap it up. I promise…

Income Taxes And Dividend Investing Tipping Point

Because we must address the topic of income taxes. However, I won’t bore you with a long tax discussion.

Just remember…

Don’t make dividend investing mistakes by disregarding income taxes. Because they will lengthen the time required to achieve your tipping point.

Regardless of whether we are talking about the payback method for a stock. Or the tipping point for your portfolio’s dividend income to cover your living expenses.

Consult with your tax advisor on this topic. Because dividend tax rates can be as little as zero. Or, as high as 20% of your dividend income.

It completely depends on your specific tax situation. Which will be a little different from someone else.

So, to sum it up…

Good dividend investors take into account income taxes when calculating their dividend stock tipping point.

Okay. As promised, let’s wrap it up…

Understanding Dividend Investing Tipping Point

Use the dividend payback method to calculate the tipping point for an individual dividend stock. Or, for your dividend portfolio, make the calculations necessary to determine when you can achieve your tipping point and live off dividends.

To repeat what I said at the start, these are just my definitions. And how I like to think about the rules of dividend investing over time.

Others may have a different view of what exactly the tipping point for dividend stocks is. And what it is not.

Thanks for reading and before you go, check out our article archives covering…

The Ins and Outs of Dividend Investing

Author Bio: Tom Scott founded the consulting and coaching firm Dividends Diversify, LLC. He leverages his expertise and decades of experience in goal setting, relocation assistance, and investing for long-term wealth to help clients reach their full potential.