7 Keys To Wealth Building When You Start From Scratch

Let’s get right down to business today and talk about how to build wealth from nothing.

I will admit that I think about the keys to wealth building quite often.

When I was younger I was obsessed with how to get wealth. And now that I’m older, I’m obsessed with researching and writing about wealth building strategies and wealth building tips.

How To Build Wealth From Nothing

I often find myself asking these questions. What is wealth building? What is the greatest secret to wealth? How to get wealth? Are good fortune and luck required? How to maintain wealth once it is achieved?

One day recently, I was thinking about the Dividends Diversify tag line. It is “Building Wealth One Dividend at a Time”.

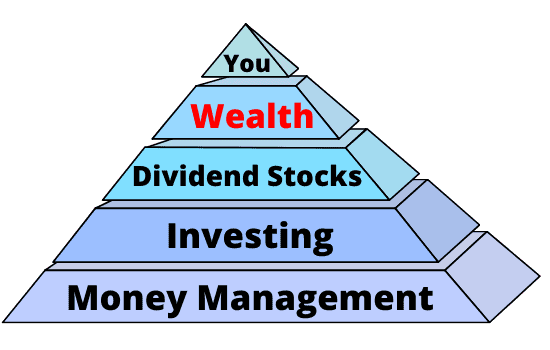

So, I devised the Dividends Diversify wealth building pyramid. Here she is:

The image shows the way I think about how to get wealth from a Dividends Diversify perspective. That is, wealth is the culmination of implementing several wealth building strategies.

Money management and investing are important to getting wealth. Therefore, they are the foundation of the wealth building pyramid.

You sit on top of the wealth pyramid. Why? That’s simple. Because you are responsible for your wealth.

The Dividends Diversify wealth pyramid now sits on all of the menu pages including the Building Wealth menu. You can find hundreds of keys to wealth building on these pages.

But for right now, let’s dig into today’s business: how to build wealth from nothing.

Disclosure: At no cost to you, I may get commissions for purchases made through links in this post.

What Is Wealth Building?

According to Fortune Builders, wealth building is the process of generating long-term income through multiple sources.

This refers to more than job-based income. It includes savings, investments, and any income generating assets.

The wealth building definition relies on proper financial planning and insight into one’s future financial goals. Many individuals will turn to wealth building as a way to secure a strong financial future.

Take note that the wealth building definition emphasizes income generating assets. Dividend stocks, my favorite income producing asset, fall into that category for sure.

Why Is Wealth Building Important?

First of all, we desire financial peace of mind. No one wants to live paycheck to paycheck. And have to worry every time the next bill is coming due.

Furthermore, unfortunate surprises happen in life. Wealth can enable you to maintain your standard of living even if you lose your earned income for a while. It’s almost impossible to go through life these days without an unexpected job loss.

An unexpected job loss happened to me. Hopefully, it won’t happen to you. But, you just never know.

Finally, most of us want a secure retirement. We can’t work forever.

Unfortunately, employer-sponsored pension plans are a thing of the past. Government-backed retirement programs can only lose money for so long.

To summarize, wealth building is important short-term, medium-term, and long-term.

- Short-term: for day-to-day peace of mind

- Medium-term: to handle those unexpected bumps in the financial road of life

- Long-term: to provide for a secure retirement

Building Wealth Takes Time

We live in a world of instant gratification. But, I’m here to tell you that wealth-building takes time. So, I urge you to start creating wealth at a young age.

Because the wealth-building tips that I’m going to present today are not “get rich quick” schemes. They are timeless wealth-building strategies.

Don’t believe me? Then take it from the book Everyday Millionaires by Chris Hogan. Mr. Hogan researched more than 10,000 millionaires during 2017 and 2018.

Here is what the book’s research showed. The average household that achieves a $1 million net worth does so at the average age of 49 years.

I’m not sure what amount of money means wealth to you. Being wealthy is different for every person. But a 1 million dollar net worth goal is a good place to start your wealth building journey.

So now, let’s go through the 7 steps on how to build wealth from nothing in detail. They represent some good financial habits you should consider adopting right away.

How To Build Wealth From Nothing: #1 Believe In Yourself

You will not get far in life if you do not believe in yourself. And you will not create success with money and wealth building. Here are a couple of tips to help you believe in your wealth building abilities.

First of all, have a positive outlook. Look at the bright side of things. Don’t dwell on the negative. Practice positive self-talk when it comes to creating success and wealth.

Furthermore, think big. Don’t be limited by your thinking. Envision what your life will be like when you have built wealth from nothing.

Ask yourself these questions. What job will you have? Who will you spend your time with? Where will you live? What will you do with your free time?

This is all part of creating your limitless story about wealth. And money affirmations can help with that.

How To Build Wealth From Nothing: #2 Spend Less Money

Now, I will be the first to tell you that it’s difficult to scrimp and save your way to wealth. It takes more than just saving money. But, living below your means is one of the essential elements of how to build wealth from scratch.

Think about your spending on these 4 big-ticket items. Then consider how you can reduce your costs and save money. Here the keys to wealth building as it relates to saving money.

Build Wealth By Saving On Housing Costs

Do not buy more home than you need. And avoid living in expensive areas. If you want to know how to get wealth, then these 2 things will go a long way to keeping your housing costs in check.

Why is that? A bigger home than necessary leads to more expenses. Utility bills are higher. There are more rooms and features to maintain, repair, and remodel. Your home insurance will cost more.

Furthermore, expensive locations come at an additional cost. For example, your real estate taxes will be higher. Also, the price of goods and services will be higher in and around the area.

Most merchants and service providers price to what the market will bear. And they know people in high price areas more likely have the ability to pay higher prices.

Create Wealth By Saving Money On Transportation

Transportation is the next big spending area. Watch out for your automobile costs when you are attempting to build wealth from zero.

In my opinion, here are the best ways to save money on getting around.

Buy, Don’t Lease Your Auto

Sure, there are circumstances when leasing a car may make more sense.

But for most of us, buying is the most cost-effective way to go. This is because we are going to keep our vehicles for as long as possible.

Leases have a limited duration. When the lease is up, you either have to lease again or buy the vehicle anyway.

Keep leasing and you always have a car payment. Are you going to buy it when the lease is up? Then why not buy it in the first place.

Buy A Used Vehicle

Do your research and buy a low mileage good condition vehicle. This way someone else has paid for the steep depreciation when a new car is driven off the new car lot.

Maintain Your Vehicle Cost-Effectively

Have your vehicle serviced regularly. Get the oil changed. Rotate the tires. Replace the air filter.

I have had my best luck with independent repair shops. Reputable ones that do quality work can be hard to find. But they are worth it.

Dealerships charge high prices for maintenance work. And, they have a reputation for pushing unnecessary repairs.

Keep your vehicle as long as practical

The goal here is to out of a monthly car payment. According to the USA today, the average age of cars on the road is about 12 years.

So here’s what I suggest you do. Let’s say you bought a 2-year-old used car. And, have a 5-year loan on that car. Once the loan is paid off, keep the car for another 5-7 years.

Once the loan is paid off, put the loan payment in a savings account each month. Then pay for your next car with cash from your savings. In the meantime, that little pile of cash can double as your emergency fund.

This is exactly what I did when I was younger. And now?

I drive an 11-year-old car with 150,000 miles on it. I haven’t had a car payment in many years.

Minimize Food And Beverage Costs To Get Wealth

Next up are your food and beverage costs. My wealth building tips are pretty simple here.

Limit dining out. Those restaurant bills can add up fast.

When you do want a break from shopping and cooking, consider carrying out. Save the tip for table service. And have your beverages from the options in your home.

Drinks have high markups in restaurants. Especially, alcohol.

When you shop for groceries, check for when your favorite items go on sale. Then stock up.

We check our grocery store ad flyer that comes in the mail every week. We are still old school and buy all of our groceries at a physical store.

Avoid impulse items like chips and cookies. Aside from saving money, they aren’t very good for your health.

Spend Wisely On Your Activities When Building Wealth From Zero

The last big area to look for cost savings are your activities. This is kind of a catch-all category. But saving money on leisure activities is another key wealth building tip.

We all need to have fun and diversion when we are not working. That’s an important part of success. And success is important to achieving our goal of building wealth from nothing.

Decide what’s important to you. And spend money on that.

Maybe it is to travel. Or, going out with friends. Maybe it’s exercise and exercise equipment. I don’t know what it is for you.

Just choose your priorities. Then set up a budget category for leisure and entertainment.

Do a good job controlling expenses in the other big-spending categories. Stay on your budget. Then, you shouldn’t feel guilty about spending money on leisure activities that are important to you.

Save Money Using Rakuten

Finally, make sure you sign up with Rakuten. Using Rakuten for all of our online purchases is the easiest money we have ever saved money.

Save money on all of your online purchases including Amazon. And get $10 cash just for signing up and making your first purchase.

You don’t need to buy anything special to save money. Just buy something you would be buying anyway. Sign up here.

How To Build Wealth From Nothing: #3 Make More Money

After you have your expenses under control and on budget, it’s time to focus on a plan to make more money. When you are trying to build wealth with no money, making more money is critical.

Negotiate A Pay Increase

Know what your skills are worth. Stay on top of salaries and wages in your field.

If you are not getting paid at market rates, ask your employer for a raise. If the answer is no, ask what you need to do to get one.

Get A Higher Paying Job

If your current employer won’t pay market value, then look for a new employer that will. Sometimes changing employers is the quickest way to make more money.

Increase Your Market Value

Now you are receiving market value for your skills. But, you are not done. Improve your skills to increase your market value.

Whatever you decide to do with your job or career, think about this. Figure out what you are good at. Then, be great at it.

The best investment you can make is in yourself. Your active income, from whatever you choose to do for a living, should be your primary cash generator.

Take advantage of every training opportunity you have access to. What options does your employer offer? Either on the job training or more formal continuing education are both beneficial.

Building Wealth May Require A Second Income

Once you have focused on your primary job or your career, consider making money from a second income. Second incomes can come from these 3 sources.

Find part-time work. Perhaps a retail store in your town needs someone a few hours on the weekends to assist customers.

Freelance. Do you have a skill that is in demand? For example, are you an accountant? Then, consider doing tax returns on the side. Or keep books for a small business.

Side hustle. Side gigs and side hustles have become popular options for making extra money. Drive for Uber, walk dogs for Rover, or start a blog. Here’s a fun way to make some extra cash.

Company Match

Does your company have a sponsored retirement plan that they contribute to on your behalf? Then make sure you a participating at the minimum level to get the maximum company contribution.

This is part of your compensation package. It’s like free money, so don’t waste it. Unlike asking your boss for a raise, this will meet with no resistance. It’s yours, so it’s important in how to get wealth.

Generate Rental Income

Renting out a room in your home doesn’t require you to make any extra investment. Services like Airbnb make it easy to connect with interested renters. And you can make a significant income depending on the size and condition of your place along with your location.

Assess Your Earnings Capabilities When Building Wealth With No Money

I’ve given you a wide range of options to consider in making more money. Make sure you self-assess from time to time.

Why? You can’t do it all. Perhaps you can make the most money by solely focusing on your primary job or career. Maybe not, I don’t know.

It’s up to you to decide the best use of your most valuable resource, time.

How To Build Wealth From Nothing: #4 Reduce Or Eliminate Debt

So far in our quest to build wealth from nothing, we have saved money. And, we are making more money.

Making more than you spend opens up other wealth building strategies. One of those strategies is to reduce your debt. And not take on any new debt.

With any excess income after expenses, I want you to pay off high-interest debt. That being credit card debt.

Interest rates on credit card debt average about 19%. There is no better use for your excess cash than paying off your credit card bills. Pay off your credit card debt as fast as you can.

We have already addressed the loan on your car. By keeping your vehicle an average of 10-12 years, you will eliminate your auto loan soon.

Next up is student loan debt. The average interest rate on student loan debt is about 6%. This isn’t too bad. But I suggest with any excess cash, pay off your student loan debt after your credit cards.

Finally, if you own your home, you have a mortgage. Mortgage rates are at all-time lows.

Refinance and lower your monthly payment as much as possible. This is a great way to save money. Remember, saving money is rule number 1 when it comes to building wealth from nothing.

How To Build Wealth From Nothing: #5 Invest Excess Funds

Recall that I said early on that building wealth takes time. The average first-time millionaire is 49 years old.

So, you might be in wealth building stages 1, 2, and 3. Remember they are:

- Spend less money

- Make more money

- Pay off debt

Given time, you will be ready for more wealth building tips. What is more?

Building wealth from nothing means investing. That’s wealth building tip #4.

Investing Wisely Is A Core Wealth Building Strategy

What to know how to get wealth? Answer: start investing. Here are a few things to consider when you do.

Invest regularly

Have the money pulled out of your paycheck and deposited in your company-sponsored retirement plan. Don’t try to time the stock market. Invest each month whether stocks are up or down.

Invest in low-cost exchange-traded funds (ETFs)

When you are building wealth from nothing invest in stocks through ETFs.

An ETF is an investment fund traded on a stock exchange that holds assets such as stocks, commodities, or bonds. Most ETFs track an index. For example, a stock index like the S&P 500. Or, a bond index.

ETFs provide other benefits important to successful investing. They typically are low-cost and tax-efficient investments.

Invest For Free Using Webull

You need a brokerage account to invest money in stocks. I use Webull. Through Webull, you can buy ETFs without paying commissions.

Invest any windfalls

A cash windfall is a one-time receipt of money. Maybe you received a bonus at work? Don’t spend it. Invest it. Or use it to pay down debt first.

Reinvest all dividends

An exchange-traded fund tracking the S&P500 will pay you dividends.

Dividends are payments made by a company to owners of the company’s stock. They are normally in the form of cash.

This is one of the keys to building wealth through investing: reinvest all dividends automatically back into the investment that paid them. This way, you won’t be tempted to spend your dividends.

Think About The Long-Term

Finally, when it comes to investing in stocks, think long-term. The stock market will go down. And that can be scary when you are losing money.

But over the long term, history shows the stock market has always gone higher. Remember, building wealth takes time.

Put time on your side and think long-term. Especially when it relates to investing in stocks and the stock market.

How To Build Wealth From Nothing: #6 Practice Good Money Management

Money management refers to how you handle all aspects of your finances. We have talked about some of the big areas of money management, like saving money and debt pay off already.

But there are other aspects to money management that are important when it comes to building wealth from nothing.

Sometimes the “devil is in the details”. And, I don’t want to leave anything out when it comes to your quest for wealth. The more efficient you are, the more effective you will be at building your wealth.

Here are few good money management practices to adopt right away.

Set Up Direct deposit

Set up the balance from your paycheck to automatically and directly deposit into your bank account.

Don’t mess around with a paper paycheck. I want you to get your money as fast as possible.

Automate Credit Card Payments To Your Bank Account

This is important. Never, ever miss or make a late credit card payment.

The interest and fees will eat up your cash fast. And by now, you have paid off all of your credit card debt. So each month you will be paying the balance in full.

Automate All Recurring Bill Payments

There are other bill payments I want you to automate. Here’s what comes to mind for most people:

- Mortgage

- Car payments

- Student loans

- Electric bill

- Gas bill

- Water bill

Take the time to set every one of these recurring expenses to auto-pay directly from your checking account. Never worry about a late payment again. Or, the need to write a paper check.

Then go paperless with all of your bills and investment accounts. There is no need to have paper documents to deal with each month. Finally, set up an efficient means to store all of your account user names and passwords in one secure place.

How To Build Wealth From Nothing: #7 Develop Good Personal Habits

Most of what we have discussed thus far relates directly to our money habits. But there is more to building wealth from nothing.

What’s that? Good personal habits.

You won’t have success, money, and wealth if you are sloppy with your habits.

Here are a few good habits to consider.

Work Hard. Few people that know how to get wealth will tell you that they didn’t have to work hard to achieve it. Hard work is the price of admission.

Take Care Of Yourself. You need a high energy level to build wealth from nothing. Exercise regularly. Eat well. Get enough sleep.

Keep Good Company. My mother used to say “you are who your friends are”. Surround yourself with successful people that take care of their money. And money will find you too.

Look for a mentor in your job or career. Mentors are everywhere.

It doesn’t have to be a formal relationship. Just identify people in your world that have accomplished something that you want to accomplish.

Observe them. Ask them questions. And, listen. Listen very closely to what they have to say.

Be A Good Person. Have a positive attitude about money and life. Treat others fairly and with respect.

Don’t achieve your success at the expense of others. Give back when you are able.

Finally, by being a good person. And creating a positive vibe. You have a much better chance of attracting financial abundance.

Example: How To Get Wealth

| Saving per month |

| Investment returns |

| # Years |

| Result |

Okay. So I have laid out 7 good wealth-building tips for you to follow. And a menu of suggestions and options within each tip.

Let’s put some numbers to it. I want to go back to the research from the book Everyday Millionaires.

Recall that the research behind the book indicated the average age of a first-time millionaire is 49 years old. I’m not saying $1 million is the definition of wealth.

Wealth could mean more money or less money to you. What I am saying is $1 million is a good benchmark for an example.

So let’s give our example a name. How about Alexandra, or Alex for short.

Assumptions: How Can You Build Wealth?

Here’s what we know about Alex.

- Alex graduated from college at age 21

- She is a young professional trying to make it the business world

- Alex is now 25 and has no credit card debt

- In another year, Alex will have paid off the loan on her first car

- She plans to keep her car for at least another 5 years, maybe more

The question: How much does Alex have to invest in an S&P 500 index fund each month to become a millionaire by age 49?

That gives her 24 years or 288 months to invest. Finally, I’m going to assume her investment in the S&P 500 returns 10% annually.

And the answer is $840 per month. That’s a lot of money each month, I know. But you have to start somewhere. And the most important thing is to start.

| Savings per month | $840 |

| Investment returns | 10% |

| # Years | 24 |

| Result | ~ $1,000,000 |

What if Alex can only come up with savings of $250 per month? Given the other assumptions, that will build her wealth to almost $300,000 by the time she is 49.

| Savings per month | $250 |

| Investment returns | 10% |

| # Years | 24 |

| Result | ~ $300,000 |

Let me assure you, there are a lot of 49-year-olds right now that wish they had a net worth of $300,000.

Editors note: The videos that play above and in the site’s margin illustrate the primary financial content found on Dividends Diversify. They are consistent with the category pages at the top of the site. And specifically highlight:

- Dividend stocks

- Investing

- Building wealth

- Money management

So, be sure to check out some of our other great articles.

Next, allow me to offer some concluding thoughts about today’s article…

Summary: How To Build Wealth From Nothing

Here are the 7 keys to wealth building. Use the wealth building strategies discussed today to start building your wealth from nothing.

And remember, building wealth takes time. It’s hard to build wealth fast, so you might as well build wealth slowly using these wealth building tips. Start today!

The 7 Keys To Wealth Building

- Believe in yourself

- Spend less money

- Make more money

- Pay off debt and avoid new debt

- Invest your excess funds

- Implement good money management practices

- Practice good personal habits

Other Wealth Building Resources

Author Bio: Tom Scott founded the consulting and coaching firm Dividends Diversify, LLC. He leverages his expertise and decades of experience in goal setting, relocation assistance, and investing for long-term wealth to help clients reach their full potential.

Great post Tom! I liked how you demonstrated the $1,000,000 net worth in investable assets at 49 if you invest $840 a month. When someone is in their early 20’s and is able to save $840 a month, they will likely earn more as their career advances and can save even more, so it might become easier to save.

Good point GYM. It is an oversimplification. Most people will be able to increase their savings rate over time even if they are unable to save a lot in their early 20s. But the basic theory still holds. Get started early and improve the savings rate as the year’s pass. Tom

Hi Tom,

Great tips! The only one we don’t follow is that we lease our cars. Of course, it’s more expensive. But, it’s important to us to have the latest technology in our cars, and that they always be under warranty.

Cheers,

Miguel

Thanks Miguel. It’s important to spend money on things that are important to you. I have to laugh because I have no tech in my car beyond a gas-powered engine 🙂 Tom

Awesome post Tom, and timely for me since I too am starting over. I am good in some areas and horrible in others. Within the past year, I feel like I’ve made some of the worst money decisions in my life, including buying an expensive condo (closing in June) and borrowing from my Roth 401k to do it. But the past is the past and there’s no use crying over spilt milk.

However, I am trying to make progress. I started cooking to help reduce eating out expense. I’ll be moving to a more affordable state to help with closing costs. The only debt I plan to incur in the future is a) furniture for the new condo and b) another home to be my primary residence when I move. Other than that, I plan to get rid of my car, student and furniture loan within 2 years. I plan to payback my 401k loan in about 3-4 years. I plan on paying off all three investment properties in 15-20 years.

I’m hoping the rental income and dividend income will help me achieve wealth some day. Unfortunately, I recently turned 40, so I don’t have a lot of time. 9 years might be too soon for me, but I’m shooting to retire in about 13 years to coincide with when I will retire from my job.

I always enjoy reading your posts Tom. This one in particular is one of my favorites. Very useful insights.

Hey DP. Thanks for sharing all of your thoughts and inspiration. You can do it. Congrats on turning 40. Whether you achieve you goal at 49 or 53 it makes little difference. The big thing is you have a thoughtful plan to do so. Tom

That was a fantastic read, Tom. I love the parts where you cover pointers that, for once, does mean something when it comes to wealth building. I was also waiting for a point on real estate investment, which I believe to be a healthy investment factor. Nonetheless, fantastic post, and keep up the excellent work.

Thank you Pri. Yes. Real estate is a great option for building wealth. Thank you for bringing it up and adding real estate investments to the conversation. Tom

Thank you for posting this informative article. The points you mention will definately help one who wants to build wealth. If you want to fulfill your specific goals & objectives then you need to start investing now. You can take help of Wealth Management App to become financially secured & independent.

Hi and thank you for the kind words. And I agree. The right tools are an important part of building wealth from nothing. Then managing the wealth one has created. Tom