Keep insurance needs in mind when financial planning: Bestow review.

Insurance is an important part of personal financial planning. And there are many types of insurance products to consider.

When I think about insurance, homeowners’ insurance, and automobile insurance come to my mind immediately. Also, insurance for a small business or a side hustle if you have one.

In fact, my mortgage lender requires me to have homeowners’ insurance. The law requires me to carry automobile insurance.

Life Insurance & Bestow

But what about life insurance?

No one has ever required me to insure my life. Therefore, it is an area of one’s personal financial planning that is easily overlooked. In some cases, lacking life insurance can leave a family with serious financial problems to solve.

And that is what today’s article is about: life insurance as provided by the insurance agency, Bestow.

Bestow Review

Please note that this Bestow review is a sponsored article. All information is based on my personal research. And, all opinions are my own.

In addition, the article includes affiliate links. I may get paid commissions (at no cost to you) for purchases made through links in this post.

See the Dividends Diversify disclosure statement for additional information.

What Is Bestow?

Bestow is an online insurance agency, not an insurance company. They offer what is known as term life insurance.

Based On My Bestow Review – How Are They Different?

Bestow has re-engineered the buying experience for term life insurance.

They make it super simple and more affordable. Applicants get a decision in less than 10 minutes.

Unlike other online life insurance providers, they underwrite their life insurance policies in-house with their own technology.

Source: Bestow blog

What Is Term Life Insurance?

Term life insurance is insurance that guarantees payment of a stated death benefit during a specified term. Once the term expires, the policyholder can:

- Renew for another term

- Convert to permanent coverage

- Allow the policy to terminate

The policy’s purpose is to give insurance to individuals against the loss of life.

Source: Investopedia

Why Do You Need Term Life Insurance?

If you need life insurance and don’t have it. Make a smart short-term personal finance goal to get it.

Why? Because the cash benefit paid out at the time of the insured’s death may be needed by the beneficiary for several reasons:

- To settle healthcare and funeral costs

- To pay off consumer debt or mortgage debt

- Provide for financial security and avoid financial issues

An Example of Term Life Insurance At Work

Let’s say we have a family of 4. The family consists of Mom, Dad and 2 kids below the ages of 10.

Mom & Dad’s Contributions To The Family

Mom works a full-time job and earns a nice salary of $60,000.

Dad stays at home and tends to the kid’s daily needs. He is a stay at home dad (SAHD).

Dad does not earn an income. He works just as hard as Mom, but he doesn’t receive a salary for his contributions.

An Unforeseen Accident

Unfortunately, Mom suffers a fatal accident commuting to work one day.

The death benefit payment from term life insurance at the time of Mom’s death would be a big relief for Dad and the 2 kids.

By planning for a financial need, life insurance could pay for Mom’s end of life expenses. And put some cash in the family’s pocket at a time of financial need.

Now, I apologize, that was a depressing story.

Why You Should Consider Life Insurance

But, that is what insurance is for. To insure against catastrophic events that one cannot financially afford if and when that event happens.

My make-believe family just can’t afford to be without Mom’s salary in the short term. They have a mortgage and other bills that must be paid. So the family chooses to share that risk with an insurance company.

They pay a small amount each month. And in return have financial peace of mind in case of Mom’s death. By doing so, they avoid a big financial mistake.

You now may be able to see exactly why insurance considerations are an important part of your personal financial planning.

We have now grounded ourselves in the basics of life insurance. So let’s get on with the Bestow review. And exactly how Bestow can help you acquire life insurance.

What Type of Term Life Insurance Policies Does Bestow Offer?

Bestow has life insurance plans with 2, 10 and 20-year terms.

The 2-year plan offers the following features and benefits:

2-year plans offer coverage now. And, provide flexibility to figure out long-term needs later.

Bestow’s 2-year plan features include:

- Pressure-free time to plan the long-term

- Financial protection during a life transition

- A life insurance trial, with no commitment

- Protection for Small-business owner expenses

And the 10 and 20-year plans offer these features and benefits:

The right plan to take advantage of the lowest price for decades to come.

Bestow’s 10 and 20-year plans are for those who want:

- To preserve a lifestyle for young families

- Protection against the impact of long-term debt

- Add to your long-term financial plan

- Lowest possible price to set and forget it

Source: Bestow Insurance Plans

Select Your Insurance Coverage Amount You would like Bestow To Provide

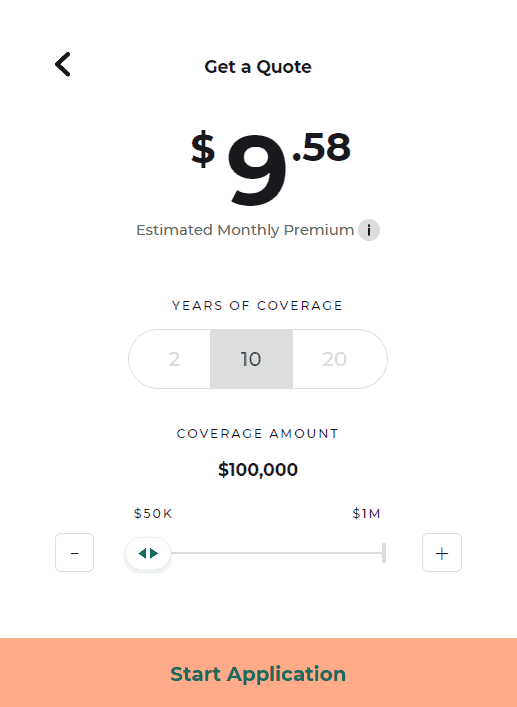

After you choose a plan, you need to select a coverage amount between $50,000 and $1 Million. And, if approved, pay a set monthly premium throughout the duration of the insurance term you selected.

Finally, you may cancel your policy at any time.

Is A Bestow Life Insurance Plan Right For You?

If you’re in generally good health and between the ages of 21 and 55, a policy offered by Bestow might be a great fit for you. A medical exam is not required and after applying, you will get a decision with minutes.

If you need assistance, Bestow offers non-commission customer support. They can also provide advice from licensed insurance agents.

If Bestow Is Only An Agency, Then Who Provides the Insurance?

Bestow policies are provided by North American Company. In the event of a policy payout, this is the company that will make the payment to you.

North American has been in business for more than 130 years. The independent rating agency, A.M Best, rates North American: “A+, Superior”.

The rating is based on the financial strength, operating performance, and the ability to meet their obligations to North American policyholders.

Source: Why Choose North American

How Much Does Bestow Life Insurance Cost?

The quick answer to that question is…..it depends. It depends on your age, height, weight and other risk factors.

But one of the things I really like about the Bestow application process is that you can get a quote without having to provide your contact information.

Therefore, you can privately get a fast quote and decide if it fits within your budget. If it does and you are ready to move forward, then complete the application process and provide your contact information.

How To Get a Quote and Apply For Bestow Life Insurance

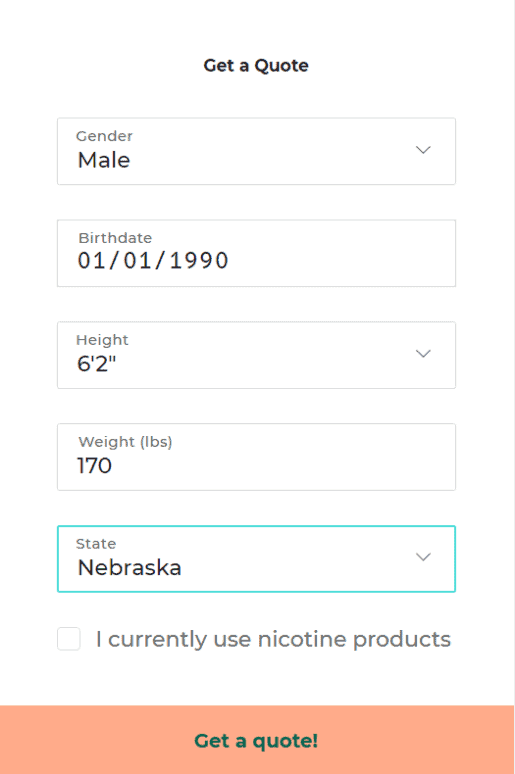

I thought I would work with Bestow’s online quote tool to provide you with an example.

I followed this link to the Bestow quote page. And then put in some hypothetical information.

The information below is not real and does not relate to me. I wish I was born in 1990!

Let’s face the facts, I’m just a little older than that. But as the saying goes, you are only as old as you feel. And, I must say, I feel pretty good.

Anyway, here is what I input:

After typing in that information, I clicked “Get a Quote!” and it brought me to this page:

I then selected the term of the life insurance policy and the amount of coverage I desired.

I chose a 10-year term and $100,000 of coverage. These are personal decisions that you will need to make and consider carefully during the application process.

I then received my quote as indicated above. There is a disclaimer in the information circle where it reads “estimated monthly premium”.

Here is what it said:

I stopped the process there. Since I wasn’t going to sign up for insurance at the time of writing this article.

If you are ready to move forward with your financial goals in life insurance, click start application and answer all the required questions. The application process is secure and data encrypted to protect your privacy.

Once you complete the application you will receive a decision from Bestow within a matter of minutes. It’s just as easy as that!

Bestow Review – Summary

- Bestow is an insurance agency

- They provide fast access to term life insurance

- Bestow life insurance is a good fit for generally healthy 21-55-year-olds

- Bestow, does not require a medical exam as part of the application process

- Getting a quote takes only a few minutes

- The application is completed online after you receive your quote

- The application process is secure and data encrypted

- Insurance coverage is provided by A+ rated North American Company

- Bestow offers non-commissioned customer support and advice from licensed insurance agents

- You may cancel your policy anytime

You can get started today and check life insurance off your personal financial planning checklist. And have the peace of mind that comes with it.

Insurance is very important and critical once you have a family and people who depend on you. I’m fortunate to have term life through my work at a good cost.

That is a great workplace benefit SMM! Knowing you have a family, I’m glad you have it. Tom

Hi Tom,

Seems like a great service! Fast and easy, with no time-consuming medical exam.

Cheers,

Miguel

Hi Miguel. Yes. I think it is a pretty good option for many. Tom

Great review! Do you have life insurance yourself?

I only have it through work, but it’s not much. I did buy life insurance (term) when I had a mortgage that was much higher. Now, since I can pay off my mortgage if I wanted to, I don’t buy term life insurance.

I think when you are financial independent protecting yourself against salary loss is less important.