Identify The Causes Of Financial Problems To Reduce Financial Stress

Identifying the causes of financial problems is the priority when financial hardship strikes.

Better yet, knowing the causes of financial problems can keep you out of financial trouble in the first place.

So, no delays. Let’s get on with today’s topic…

Causes Of Financial Problems

What causes financial distress? Here are our top 11 reasons…

- Limited money management skills & knowledge

- Personal issues

- Bad financial decision making

- High debt levels

- Low savings rates

- An unexpected decrease in income

- Health and medical issues

- Volatile stock markets & financial markets

- Thinking real estate will save you

- Family issues

- Retirement

We will go through each of these points in just a moment.

But first, let’s step back. And think about this a bit. By looking at the big picture.

To improve your understanding of exactly what causes financial problems…

Disclosure: At no cost to you, I may get commissions for purchases made through links in this post.

An Analogy To Understand Causes Of Financial Problems

Let me use an analogy to bring these opening points together.

Limit Your Chances Of Having Financial Trouble

Most of us know there are things we can do to improve our health. You know the list.

Maintain a healthy weight. Eat a nutritious and balanced diet. Exercise regularly. Drink alcohol in moderation. And by all means, don’t smoke.

By doing these things we can limit our health risks. The same goes for our financial health and money management activities.

Therefore, it is important to know the causes of financial problems.

Because by learning what causes financial stress. You can engage in the right money-related activities for your situation. To avoid financial problems in the first place.

But What If You Get In Financial Trouble Anyway?

Let’s take the analogy about our health and our finances 1 step further…

It is almost a certainty that each of us will have a health problem at some point in our lives.

So what do we do? We visit the doctor. The doctor’s first step is to do an examination. And determine the cause.

Only when your doctor knows the cause of the problem can he or she determine the best solution. And the same goes for your finances.

So, What Should You Do If You Find Yourself In Financial Stress?

If you get into financial troubles, first determine the cause. Then, come up with a solution. Just like a doctor.

For today, I’m going to play a money doctor. And review the common causes of financial problems.

Mid Article Recap: Avoiding Financial Trouble

Before we move on to the 11 causes of poor money management. Allow me to summarize what we have learned thus far.

As I said, by knowing what causes financial distress. You can change your behaviors in advance.

And avoid financial problems in the first place. Then get on with the business of setting and achieving good financial goals. To improve your money situation. And your life!

Or, if in the unfortunate event you get into financial trouble. Then, you will have a checklist to identify the cause. And determine the best solution. Just like a doctor.

Okay. Ready or not. And without further delay.

Here are our top 11 causes of financial problems fully explained. So you will know the causes of financial stress when you see it.

1. Limited Money Management Skills Is A Cause Of Financial Problems

There are a host of reasons why most people have limited money management skills and knowledge. Here are a few.

Little Education About Money Can Cause Financial Hardship

Our educational systems fail us in this regard. Most of us make it through high school and college without taking a class in personal finance.

Assuming Money Issues Are Too Complex

Money management and investing issues can seem overwhelming. But they do not have to be.

First of all, do not be intimidated. Furthermore, look for ways to simplify and streamline your finances. Finally, just get started and learn as you go.

Not Making The Time To Learn

So, most of us will not learn money management skills in school. Therefore, it’s up to us to make time to learn. We have to make the time.

Even a little basic knowledge helps. It brings you the confidence to plan and set financial goals.

Skills To Maintain a Budget

Once you carve out some time to start learning, I would focus on a couple of the basics. First of all, learn how to create, maintain, and stick to a cash flow budget.

Discipline to Build An Emergency Fund

Then find a little extra cash in your budget to build an emergency fund. The events of 2020 should provide motivation. You never know when the next financial emergency will strike.

There’s more, but before we move on to the next cause of financial problems, take the time to learn money management skills.

There are plenty of good books, websites, and financial coaches available. So, pick a resource and start learning money management skills today.

What causes financial stress? Here’s reason number 2…

2. Personal Issues Can Cause Financial Problems

Sometimes the biggest problems in life start between our ears. And lead to behaviors that hurt our well-being.

Personal finance and money management are no different. Because the personal issues described below can be the cause of financial challenges.

So, it’s a good idea to be aware of the wrong thoughts and behaviors. Since those thoughts get in the way of our success with money.

Lack Of Objectivity

Running your finances is similar to intelligently managing a business.

In my business career, I saw the most success when we first gathered the facts.

Followed by making informed, objective decisions to achieve a goal be it financial, or otherwise.

Emotional Attachment To Something

By being objective, we keep our emotions in check. Emotional decision-making will often lead to financial stress.

For example, just because your grandpa worked for General Electric and made a fortune off his General Electric stock doesn’t mean General Electric is a good investment today.

Furthermore, maybe you make the mistake of falling in love with a house you just can’t afford.

Or finally, when it comes to the stock market, remember the old saying “Be fearful when others are greedy”. Many people struggle with stock investing because they let their emotions drive their decisions.

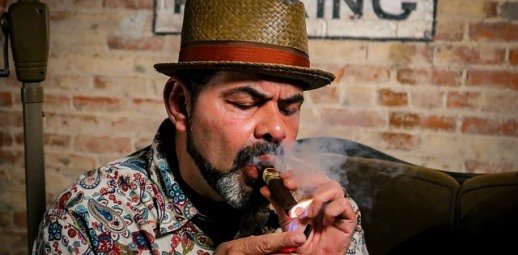

Addiction

Addiction to drugs, alcohol, and gambling can be at the root of financial problems. Decide if you need help. And if you do, go get it. Your family and your finances will thank you.

Ego

Okay. Big egos are a personal “pet peeve” of mine. I can’t stand people with big egos.

Furthermore, an ego can lead to financial problems. You know the person I’m talking about. They have to have an expensive car, the largest house, exotic vacations, the finest dining, and the best cigars.

Those belongings and desires cost a lot of money. And most of those folks with egos are on the money treadmill. They keep making money and spending money, but never really get anywhere with their finances.

So, when you think about money, please check your ego at the door.

Trouble Trusting Other People

When it comes to money, you have to trust someone. There are good financial institutions and financial advisors. And, there are bad ones.

Do your homework and pick the right people and entities to get involved with. Most of us are not born with financial skills. We have to learn from someone.

And, we can’t bury our money in the backyard. We have to trust banks and brokerage firms in our modern society today.

Okay. It’s time for item number 3. In our list of causes of poor money management…

3. Bad Financial Decisions Will Cause Financial Problems

It should go without saying, that your decision-making is very important. It is important both in life and concerning your finances.

Bad decisions can lead to financial hardship. This is so important that I wrote an entire article about bad financial decisions.

Furthermore, bad financial decisions stem from the first 2 topics we just discussed: lack of knowledge and personal issues.

Finally, I discovered nearly 40 bad financial decisions when researching and writing that article. In summary, they fell into 5 broad categories:

- Bad spending habits

- Poor financial management

- Irresponsible investing practices

- Shaky personal judgment

- Difficulties with debt

Be sure to check out that article so you know all the areas where you may make a bad financial decision.

Otherwise, let’s continue our discussion. About what causes financial distress. Here’s item number 4…

4. Debt Is Our Next Big Cause Of Financial Problems

Many of the topics we are discussing today cause financial problems.

On the other hand, high levels of debt are often the result. And high debt levels will cause more financial problems for sure.

Here is an interesting way to think about debt. Debt follows the natural cycle of our lives. This is what I mean…

Student Loans

We graduate from high school. For many of us, college is the next step. College is expensive so we take on student loans.

Credit Card Debt Can Cause Financial Hardship

As we enter our late teens and early 20s, there are just so many things we want. Nice clothes, the latest electronics, travel, and more.

But we have little money. And make little money at this stage of life.

So what do we do? We load up our credit cards to buy and have the things we want.

Automobile Loans And Leases

Now college is over and most of us need a car to get around. So we get that car and now have an automobile loan.

Moving Out On Our Own And Mortgage Debt

Living with our parents gets old. Or, we want to get out of that apartment and own our own space.

It’s just natural. We want to find the perfect place to live and move out on our own. And, to do so, we take on a mortgage.

Before you know it, we are 30 years old and loaded with debt for not finding a cheaper location and way of life. Then, have an emergency or lose a source of income and that debt will cause all kinds of financial problems.

But there’s much more. Before we move on, just know that debt follows us through the natural cycle of our lives in the modern world.

So don’t take debt lightly just because the world makes debt seem okay.

As a result, I want you to think long and hard every time you are considering increasing your debts. Make it one of your top financial goals to use debt wisely.

Then I want you to think long and hard about this next topic. As you learn about what causes financial stress…

5. Low Saving Rates Cause Financial Problems

So far, we have identified these causes of financial problems:

- Limited money management skills

- Personal and behavioral issues

- Bad financial decision making

- High debt loads

What do all of these financial challenges lead to? The answer is a low savings rate.

Believe it or not. Many financial experts recommend saving at least 20% of your gross income.

In contrast, the 2019 personal savings rate in the United States was less than 8%. That’s a pretty big gap from the 20% recommendation.

The great thing is. Saving money is in your control. So, don’t let it become one of your causes of poor money management.

Because item number 6 may be out of your control…

6. Unexpected Decrease In Income Results In Financial Trouble

A sudden and unexpected decrease in income can lead to financial troubles.

Usually, this is a result of a job loss. And one’s investment income can’t make up the difference.

The recessions of 2008 and 2020 prove this out. During these times unemployment rates increased dramatically.

Here is another one of the causes of financial difficulties. And I sincerely hope this isn’t the case with you…

7. Health And Medical Issues Cause Financial Problems

Health issues can cause financial problems in two ways. First of all, health care is expensive.

Furthermore, one’s poor health can make it difficult to earn an income whether the issue is a result of illness or an accident.

To avoid health issues from causing financial problems, be sure to check your insurance coverage. Do you have adequate health and disability insurance coverage in place?

8. Volatile Financial Markets Can Lead To Financial Problems

I write a lot about investing here at Dividends Diversify. Investing doesn’t have to be difficult, but a lot of people make it out to be.

For example, I read an article recently in the Wall Street Journal about an individual investor. The story went like this…

After the financial crisis of 2008, the man needed to play catch-up with his retirement portfolio. Up until this year, he was earning nearly 20% a year through a complex investment called exchange-traded notes.

When the pandemic hit, he lost nearly every cent. He said, “I’m 67 years old and I’m basically bankrupt in just two weeks.”

This is a clear example of volatile financial markets being a cause of financial problems. It is also an example of bad financial decision-making.

Never take investment chances you do not understand. It’s one of the causes of financial risk you can control and reduce.

And you should. Especially with money, you can not afford to lose.

Next up, is reason number 9. In our list of what causes financial distress…

9. Thinking Real Estate Will Save You

I remember a lot of my friends getting frustrated with the stock market in years past. It happened after the dot com bubble burst in 2000.

My friends turned to real estate investments. Only to get burned in the real estate crash of 2008-2009.

Don’t get me wrong, real estate can be a productive part of one’s finances. And it probably should play a role.

But don’t be fooled. Unless operating in real estate is your primary business. Your home and/or a rental property probably won’t bail you out from financial problems.

So, if you are thinking about moving to a new state. Or, an area within the state you currently live.

Be smart about it. And make good choices. By not getting in over your head with real estate.

Last but not least. Our final item on this list of what causes poor money management.

10. Family Issues That Cause Financial Problems

Family and the bonds that families create can be priceless parts of our lives. But family issues can also cause financial challenges. Here are three issues that come to mind right away.

Divorce – 2 people under one roof will save money. Once you split up those savings are gone. And the legal expenses associated with divorce can be costly.

Unplanned parenthood – Kids are expensive. Having children if you can’t afford them causes financial problems.

Even planned parenthood can cause financial problems. As fully explained in “The Millionaire Next Door” keeping kids on economic outpatient care is a recipe for financial stress.

So get those kids “off the payroll” by the time they reach their early 20s.

That’s easy for me to say. Because I’m not a parent.

11. Retirement Can Cause Financial Problems

We can’t work forever. Age will catch up to all of us. So retirement is necessary. And longer retirements are becoming the norm these days.

Retirement is supposed to be one of the best times of life.

But, if you are not financially prepared, retirement can also be a source of financial problems. Or, in the best case require you to work a job on the side.

Summary – Causes Of Financial Problems

Knowledge is power. And if you know the causes of financial problems, you have a good shot at avoiding those problems.

Furthermore, put the best FREE tool to work. And get on top of your money situation.

For this, I recommend Personal Capital.

Because Personal Capital is an outstanding app. To pull your spending, budget, and investments together in one place online.

Better yet, Personal Capital doesn’t cost a penny to sign up and use! So, put Personal Capital to work today. And start improving your financial picture.

Finally, remember these top causes of financial problems:

- Limited money management skills & knowledge

- Personal issues

- Bad financial decision making

- High debt levels

- Low savings rates

- An unexpected decrease in income

- Health and medical issues

- Volatile stock markets & financial markets

- Thinking real estate will save you

- Family issues

- Retirement

Further Reading About Financial Problems And Opportunities

- Get cash rebates on all your only purchases

- The most affordable states in which to live

- Solutions for the worst money problems

Author Bio: Tom Scott founded the consulting and coaching firm Dividends Diversify, LLC. He leverages his expertise and decades of experience in goal setting, relocation assistance, and investing for long-term wealth to help clients reach their full potential.

Hi Tom,

Lots of wisdom here. From my own experience and observations, education, discipline, and patience are key. You need to know what to do, and then do it consistently over time.

Cheers,

Miguel

Well said, Miguel. Throw in a dash of good luck and lots of hard work and most anyone can be on their way to financial peace. Tom

Great summary Dr. money doctor! 🙂

I think in addition to family a lot of financial problems (just like a lot of relationship problems) stem from what you grew up with as a child. If you saw your parents practice frugality and if your parents were humble and tried to save money, you may be more than likely to emulate it.

Sometimes I find though the opposite can happen (e.g. if your family was very poor you may grow up wanting the best things… or if your family was very poor you may grow up wanting to be very wealthy and financially free) though so what do I know.

I think what you are saying is that there are a lot of variables that come into play when it comes to financial problems. Everyone is a little different I guess. Tom