How Dividend Stocks And Dividend Investing Can Make You Rich

For today’s dividend Q&A, we have can you get rich off dividends?

Putting the pieces together, our question and answer are…

Can You Get Rich Off Dividends?

Yes, dividends can make you rich.

However, it requires regular investment in high-quality dividend stocks, low investment costs, a tax minimization strategy, and a great deal of time in the market.

Now, allow me to turn this answer to today’s question into a 5 step guide for getting rich off dividends…

5 Easy Steps To Get Rich Off Dividends

- Live below your means

- Regularly invest and reinvest in dividend stocks

- Keep investment costs low

- Defer income taxes

- Have a lot of patience

First, let’s explore these steps one by one. To better explain how anyone can retire rich with dividends.

Second, I will provide an example so you can see exactly how the steps work in real life.

So you can become a dividend investment millionaire…

Disclosure: At no cost to you, I may get commissions for purchases made through links in this post.

Then, when you are done, but before you go. Be sure to check out all of our…

Dividend FAQs and How-To Guides

Now, back to today’s 5 steps. To prove out the answer to the question: Can you get rich off of dividends…

1. Live Below Your Means

Step 1 comes from the old saying “it takes money to make money”. Thus, to create some excess cash, you need to live below your means.

It’s a pretty simple formula. Either make more money, spend less money, or do both. To live below your means and create some excess cash flow.

If you need some tips on how to get started. Or how to squeeze out more savings than you currently generate. Then I suggest our article about improving personal cash flow.

Once you have accomplished this step. No matter how big or small the amount of money. It’s time for step 2…

2. Regularly Invest And Reinvest In Dividend Stocks

While there are several ways you can go about dividend investing. Most dividend investors select one of two methods.

Dividend Stocks or Dividend ETFs

Either select individual dividend stocks. Or, choose to invest in one or more exchange-traded funds (ETFs). That pick dividend-paying stocks on your behalf.

If you are not quite sure what direction to take. Then I recommend this write-up on how to choose between funds or stocks that pay dividends.

Now, if you have decided to go with an exchange-traded fund. You might like to know that I lean toward Vanguard funds.

Furthermore, highlighted in this article are 5 solid Vanguard dividend stock ETFs. Also, understand that going the ETF route will save time on investment research.

But that’s not to say identifying and selecting individual dividend stocks is a bad idea. Not at all. Many dividend investors love doing so. Myself included.

If you are interested, start learning about best practices for dividend stock selection. Get some help if you need it.

For assistance when I’m researching stocks for my dividend portfolio. I use the Simply Investing Report and Analysis Platform.

Simply Investing provides a robust interactive platform. Including the best dividend stocks to buy. And when to buy them.

In either case, step 2 is straightforward. Simply invest your savings in dividend stocks.

Dividend Reinvestment

Finally, your dividends will start to roll in after making your first investment.

So, make the right choice about dividend reinvestment. For getting rich, always choose to reinvest your dividends!

Either do so automatically back into the stock that paid them. Or, let the dividends accumulate in cash. Until you are ready to put the cash into the stock of your choice.

Just don’t take the dividends paid and spend them! No way. That’s not part of this how-to guide.

If you like. Learn about my journey reinvesting dividends. Then you will know exactly what I’m saying.

Otherwise, onto step 3…

3. Keep Investment Costs Low

First, regardless of whether you choose individual dividend stocks or funds. Never pay a per-share commission to trade your stocks.

Commissions are simply not necessary. Not for do-it-yourself dividend investors like you and me.

For example, I buy and sell my dividend stocks for free using the Webull app. It’s easy to sign up and fund your account. After you do, trade stocks for free!

Second, if you decide to get your dividend payments through funds. Then make sure to choose funds with low expense ratios.

That’s why I recommended the article about 5 Vanguard dividend stock funds. Because Vanguard typically has some of the lowest fund expense ratios in the industry.

Ready or not, step 4…

4. Defer Income Taxes

One of the fastest ways to get rich with dividends is to take advantage of every tax break available. Specifically, buying and holding your dividend stocks in a traditional individual retirement account (IRA).

Now, when it comes to taxes, everyone’s situation is a little different. So, it’s best to consult with your tax advisor.

But, here are a couple of thoughts to consider that apply to everyone…

First, a traditional IRA account allows the investor to contribute on a pre-tax basis from earned income. Thus that income from your job avoids taxation. So, you have more leftover to invest.

Second, after you put the money in a traditional IRA, investments grow on a tax-deferred basis. Thus, you won’t have to pay taxes on any of your investment gains or dividends until you withdraw the funds in retirement.

Then, last but not least, step 5…

5. Have A Lot Of Patience

Regular readers know that I like to say “dividend investing is a journey, not a destination”.

Because it takes time, patience, and discipline. To get wealthy with dividend investing.

Furthermore, dividend investing is not a get-rich-quick scheme. Yes. You can get rich from dividends. But, it is unlikely you will do so quickly.

So, buckle up and get ready for a long road trip. Furthermore, never let stock market volatility sway you from this investment strategy.

Thus, I will say it again. Time, patience, and discipline are required. As a result, the sooner you get started dividend investing, the better.

Okay. So, what are your thoughts? Can you get rich off dividends?

In case you are not convinced yet. Let’s look at an example…

Example Of How You Can Rich Off Dividends

To put this 5 step guide to work. And more specifically answer today’s question: Can you get rich off dividends?

What follows is an investment strategy I have used for many years. So, it’s a narrative based on my own experience.

However, the numbers have been changed and the facts have been altered to apply to current-day situations.

Yeah. Unfortunately, I’m old.

But, the story, the process, and the steps remain the same. So you can walk in my humble footsteps…

Step 1: Live Below Below Your Means

When I was 22 years old, fresh out of college, and working as a hotshot Certified Public Accountant. And spending every penny I made.

My Dad sat me down one day and explained that I needed to start saving. He used the phrase “start paying yourself first” at the end of every month.

And, believe it or not, this 22-year-old listened to his father. Imagine that!

So, I scrubbed my budget to the bone. And I was able to come up with a spare $500 a month.

Not easy, but I did it. Fortunately, I was a CPA making a good income for being such a young kid.

Step 2: Regularly Invest And Reinvest In Dividend Stocks

Between my work, friends, and social life I didn’t have a lot of extra time. So, I wasn’t interested in identifying, selecting, and managing a dividend stock portfolio.

As a result, I decided to go with 1 exchange-traded fund. In my opinion, one of the best dividend-paying index funds.

Specifically, the Vanguard Dividend Appreciation ETF (VIG).

It’s a blue-chip fund that holds blue-chip dividend growth stocks.

For more information, you can read my in-depth review of the VIG ETF.

Steps 3 and 4: Keep Costs Low And Defer Taxes

Furthermore, my Dad suggested I think about using my savings for funding my retirement in the distant future. And to do so through an IRA.

So, I decided to open a traditional IRA to benefit from the tax advantages IRAs offer.

At that point, I had selected an ultra-low-cost Vanguard ETF to be purchased and held in the IRA.

Step 5: Patience And Discipline Prevail

Each year when I prepared my tax return, I made sure I still qualified to contribute to my traditional IRA. When I verified that, I made the maximum contribution of $6,000.

Where did that $6,000 come from? It came from the $500 a month I was making and socking away in my savings account.

What I also learned is I received a tax deduction for contributing to my IRA. Since for most years I was in the 20% tax bracket, I invested $6,000 but it only cost me $4,800 out of pocket.

Calculated as $6,000 minus ($6,000 times 20% tax rate). This equals $4,800. Or, only $400 per month after tax.

This all came about as a result of scrubbing my monthly budget. Living below my means. And, paying myself first by investing in a dividend stock fund held in a traditional IRA.

Okay. Can you get rich from dividend stocks?

I think so. But let’s put some numbers to the story…

How To Get Rich Off Dividends

This is what we have…

First of all, $6,000 was invested in the Vanguard Dividend Appreciation ETF (VIG) at the start of each year. Only $4,800 out of pocket after taxes by investing in a traditional IRA account.

Furthermore, over time, VIG generated investment returns of 10% per year. Broken down as approximately 2% from the dividend yield and about 8% from capital gains.

As a side note, dividends and capital gains are a strong combination. For anyone looking for long-term total investment returns.

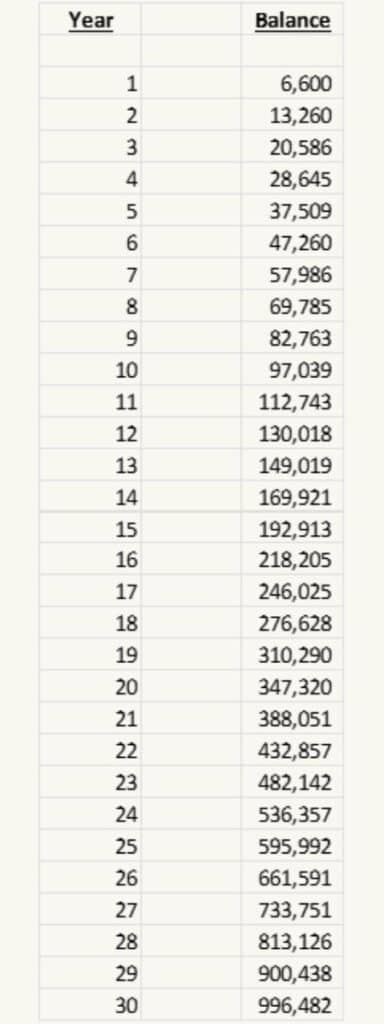

Finally, the table below shows how my dividend portfolio grew over the years…

Let me tell you, it took patience. And a lot of discipline to make that $6,000 investment every year. But, I’m glad I did.

Because years later, I was rich off dividends. Or, you can call it being a dividend millionaire. Furthermore, the dividend portfolio was making nearly $20,000 per year in passive income from dividends.

Please note, however, that this table is a model. Not my real results. As I said the story is true, but the numbers and facts have been changed.

Most noteworthy, no one earns 10% every year from dividend stocks. Some years will be much better. While some years dividend stocks will lose money.

Thus, the growth from a dividend portfolio is not a smooth ride. That’s where the discipline to stick with a dividend growth strategy comes into play.

However, the journey can take you to the same place. That being status as a dividend millionaire. Making nearly $20,000 per year in passive dividend income.

With all that said, allow me to wrap up with a few parting thoughts.

Can You Get Rich Off Dividends?

Yes. You can get rich off dividends by patiently investing in dividend stocks over time.

It requires investing regularly using a dividend investment strategy, emphasizing low investment costs, and taking advantage of tax benefits offered by qualified retirement accounts.

Follow the steps discussed today. And you too can get rich off dividends by retiring with a millionaire dividend portfolio.

More Reading About Making Money From Dividends

Hungry for more? Then check out all of our…

Dividend Posts and Dividend Stock Reviews

Author Bio: Tom Scott founded the consulting and coaching firm Dividends Diversify, LLC. He leverages his expertise and decades of experience in goal setting, relocation assistance, and investing for long-term wealth to help clients reach their full potential.