7 Luxury Investments To Consider For Your Money

Today, let’s review several luxury items that appreciate in value.

Because luxury investments are 1 of many ways to put your money to work. So, to kick this off, here is a list of the best luxury items that may increase in value.

Examples Of Luxury Items That Appreciate In Value

- Jewelry made from metals or gems

- High-end watches

- Designer handbags

- Fine art

- Vintage wine

- Classic automobiles

- Luxury real estate

Disclosure: At no cost to you, I may get commissions for purchases made through links in this post.

We will review each of these luxury investment opportunities in a moment. But first, a cautionary word…

Investing in Luxury Items That Appreciate Has Risk

Not every luxury item will be an asset that appreciates in value all of the time. Furthermore, the luxury assets in this list have times where their value decreases. In the worst case, some may never increase in value.

Most importantly, asset values are influenced by the fundamentals of supply and demand. In other words, a luxury item is worth only what someone is willing to pay for it.

So, do your research before putting money into any luxury investment. Always understand what you are investing in. And, how the asset relates to your overall investment and money management objectives.

Also, don’t forget to diversify your assets. It’s never a good idea to become overweight in any one of these things that appreciate in value. Or, a particular asset class.

Whatever your circumstances, these luxury items can be good opportunities. For an investor considering greater diversification when allocating assets. Or, mostly just the fun of owning an item you love and cherish.

Later, before we wrap up, I will offer my opinion on when and in what circumstances luxury investments make the most sense. But now, on to our list of luxury items that appreciate in value.

7 luxury investments to consider for your money.

1. Luxury Items That Appreciate In Value: Jewelry

Do you want to invest in a luxury item that appreciates in value? And something you can wear to that next big social event?

Then consider jewelry that is made from precious metal. Typically, gold and platinum are thought to be the best investment metals for jewelry. And don’t forget gemstones for your jewelry collection.

Let’s discuss all 3 of these wearable luxury items that have resale value.

Gold

Gold is also known as the “yellow metal”. Investors who are gold enthusiasts are sometimes called “gold bugs”.

Gold jewelry is very well-known. And it is a popular luxury item that holds its value.

Furthermore, outside of jewelry, gold does not have many practical applications. This protects the value of gold from economic downturns and recessions.

There are other ways to invest in gold besides jewelry. They may be better and more efficient for investment purposes. Like gold bars, coins, and exchange-traded funds. But these aren’t luxury investments, like gold jewelry.

Does gold jewelry appreciate in value? The short answer is yes. Its value will have a direct relationship with the market price of gold.

The market price of gold typically appreciates during inflationary times. And, during times of severe economic and financial stress.

Thus, many investors consider gold to be an important part of a defensive investment strategy.

Platinum

Platinum jewelry is another popular luxury item that can increase in value. As a metal, it has more practical applications than gold.

But for jewelry, platinum is highly regarded out of all of the silvery-white precious metals. Its color does not change. And jewelry-grade platinum has a very high platinum content.

Platinum is a soft metal. So, it tends to scratch easily. On the other hand, the metal has a high resale value. Consider it for something with long-term sentimental value, like a wedding ring. You can make that symbol of eternal love an investment too!

Let’s stay within the jewelry category. And talk about gemstones as a luxury asset that appreciates.

Gemstones

Gemstone investing is not for everyone. But for those who love fine gemstones and beautiful jewelry, rare gems have a good history of increasing in value over time. They are another form of luxury item that appreciates.

When the stock market is declining and currencies are losing value, gemstones tend to be a reliable store of value. They are also compact, portable, and private.

Here are the top 10 gemstone assets that appreciate. They are potential luxury investments for your diversified portfolio.

- Ruby

- Blue Sapphire

- Emerald

- Spinel

- Tsavorite Garnet

- Spessartite Garnet

- Alexandrite

- Jadeite Jade

- Imperial Topaz

- Paraiba Tourmaline

Source: The top 10 investment gems

I don’t know about you. Gemstones may be a luxury item that appreciates in value. But I don’t have very many of those little jewels lying around my house!

Let’s stick with things we wear for our next luxury item that appreciates in value. That being high-end luxury watches.

2. Luxury Items That Appreciate In Value: High-End Watches

Do you like to show off a fancy timepiece on your wrist? Then you’re in luck because watches as a luxury investment option have become more popular in recent years.

Consider a watch to be a luxury item that can appreciate in value. Most importantly, you will need a good understanding of the luxury watch market. And be in no hurry to realize your profit after your luxury investment is made.

Furthermore, you must possess some pretty deep pockets to invest in a very high-quality timepiece. $5,000 is probably the minimum buy for this asset class. $10,000-$20,000 is more likely a better price range for investment purposes.

Some watch brands are considered better investment quality than others. Rolex, Omega, and Patek Philippe names are several that frequently come up. There are many more.

After you make your purchase, be sure to keep your watch in excellent condition. Also, carefully maintain the original packaging and paperwork.

Hold on to the watch for a number of years. Then look for good timing and an attractive market to sell into.

Watches, as a luxury investment, are not for an uneducated passive investor. So make sure you buy a piece you are happy with whether you make a big profit or not.

Next up, consider this popular fashion accessory a possible luxury investment.

I’m talking about handbags. A fashionable luxury item. And another one of the things that appreciate in value.

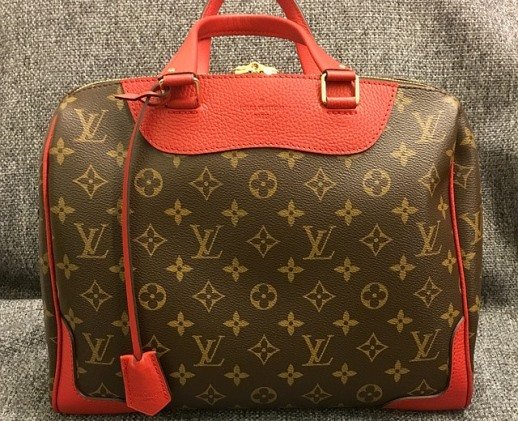

3. Luxury Items That Appreciate In Value: Handbags

Believe it or not, certain handbags are considered legit investment pieces. And yes, they are unique investments for sure.

Similar to investment-grade watches, you need to know what you are doing in this area. That being said, handbags may be one of the best designer items to invest in.

Fashion trends and tastes are highly changeable. If the trends move in the wrong direction, you just might be left holding the bag.

First of all, to buck changing trends, look to invest in timeless, classic brands and designs. Furthermore, establish your budget for the investment. Finally, research vintage luxury handbags that are always in demand.

Like watches, certain brands tend to have the most investment value. Louis Vuitton, Christian Dior, Chanel, and Hermès are frequently mentioned.

Look for vintage pieces that are in good condition. And just like art that we will get to next, make sure the handbag is authenticated before you invest.

Do you want a brand new handbag as an investment? Rather than a vintage bag?

That’s more of a challenge because what’s in style today, may not be in style 10 or 15 years from now. When investing in a NEW handbag you will need a good eye and a crystal ball to make a profitable luxury investment.

So far we have talked about jewelry and fashion items. Things that hold value, and that we wear.

Next, let’s talk about some other types of luxury investments and luxury items that appreciate in value. We will start with fine works of art.

4. Luxury Items That Appreciate In Value: Fine Art

Fine art has a long history of being a luxury item that appreciates in value.

As with most investments, increased demand equals increased asset appreciation. And, as a luxury item, art is no different when considering luxury items to buy.

However, several unique factors will help you make smart investments in art. That increases the value of art over the long term.

Here are some suggestions on how to buy art that will appreciate. And provide you with enjoyment for many years to come:

- Buy something you love so you desire to keep it as a long-term investment

- Buy an original that is signed by the artist

- Iconic figures or images generally retain value

- Controversial or political pieces with historical significance also fare well in resale

- The notoriety of the artist is a safer investment choice

- But art from emerging talent can have more upside potential

- Obtain certificates of authenticity and retain your proof of purchase

- Quality framing will make your art look better and protect your investment

Source: How to buy art that will increase in value

Our next luxury item that has the potential to increase in value is also pleasing to your palate.

That luxury investment is wine. One of my favorite things that appreciate in value.

5. Luxury Items That Appreciate In Value: Wine

Does wine appreciate in value? To be honest, most wine isn’t suitable for smart long-term investing. Furthermore, it’s unlikely that you’ll find a vintage that produces significant returns.

However, investment-grade wine has a reasonable chance of appreciating in value over the long term, typically at least five years. It is another example of a luxury investment.

Investing in luxury items like wine has a host of challenges from sourcing to storing to selling. Get it right and make some money. Get it wrong and just enjoy your bottle of wine.

Source: Collecting & Investing in Wine – Costs, Risks, How to Buy

Next up, let’s discuss cars. They are also possible luxury items that increase in value. Yet another form of alternative investment type.

6. Luxury Items That Appreciate In Value: Classic & Vintage Automobiles

The average automobile is a depreciating asset. I’m pretty sure my 2009 Toyota Camry is worth less every year that I have owned it.

I don’t even bother to value it and add it to my net worth calculation. The same goes for my wife’s 2007 Toyota Corolla. So, don’t think about the vehicles you use for everyday purposes. They are typically not luxury items that appreciate in value.

On the other hand, classic cars and vintage automobiles are a different story. They can be a luxury item that appreciates in value.

But, only a handful of classic cars will make for profitable luxury investments. So you want to make sure you buy a car with the best investment potential. Factors such as scarcity, brand, age, image, and desirability are important. They will impact the value of a classic car.

Some brands, especially Ferraris, tend to appreciate and are reliable investments. And, other brands that were ignored in the past can suddenly spike in value.

Here are a few classic cars with the best investment potential as well as cars that appreciate in value:

- Lamborghini Diablo

- 1957 Ferrari 410 Superamerica SIII

- 1967 Volkswagen Beetle

- Mercedes-Benz 190

- 1984 Pininfarina Azzurra

- 1998 Porsche 911 Turbo S

- 1994 Mazda RX-7

- 1972 BMW 2002

- 1998 Porsche Boxster

- 1973 Datsun 510

- 2002 Porsche 911 Carrera

Source: Classic cars with the best investment potential

Let’s move on to our last luxury investment option. We will finish with a more traditional asset class, real estate. But this time we are talking about luxury real estate investing.

Real estate investments are a big part of many investors’ asset allocation. So, it may be one of the best luxury items with profit potential.

7. Luxury Items That Appreciate In Value: High-End Real Estate

There are several characteristics of high-end, luxury real estate that go beyond just a high price tag.

For example, the property must be unique, exclusive, and of superior quality. Furthermore, buyers will want access to high-end shopping, dining, the arts, or even majestic outdoor settings.

Some ways to get involved with luxury real estate investments include:

- Luxury condominiums

- A lavish vacation home

- Custom construction on an exclusive property

- Ownership interest in a luxury apartment community

Aside from some of the special factors I mentioned, many of the same rules of real estate apply to luxury real estate investing. For example, square footage, location, amenities, and quality will significantly influence future investment value.

Another benefit of luxury real estate. It could also have a high rental value. Thus you may be able to produce income from your asset if you choose to do so.

That wraps up the review of luxury investment options. Items that can appreciate in value. Jewelry, cars, art, wine, and more as potential luxury investments.

Who would have thought? And I want you to know that I do not personally invest in any of these asset classes.

But that begs an important question. When might it make sense for an investor to try their hand at luxury items that appreciate in value? Let’s discuss this very important point before I wrap up.

Source: Investopedia

When Does It Make Sense To Invest In Luxury Items?

First of all, investing in luxury items is not the place for a beginning investor to get started. Typically, luxury investments should be left in the hands of an advanced investor.

The luxury investment area is best suited for an individual that has all of their basic investments covered. Also, deep knowledge about the type of luxury item being bought.

Here is what I mean by an advanced investor. Someone that has

- Liquid investments including cash emergency funds

- A fully funded retirement account

- Substantial equity in a primary residence

- Carefully selected stocks, bonds, or exchange-traded funds

- Time, ability & desire to research luxury investment options

Once those bases are covered, I suggest looking to your interests and hobbies for a collectible or luxury item to invest in. This will be different for each one of you.

Depending on where your interests lie. Figure out what might be some of the best things that appreciate in value. Then invest, but be selective.

Examples Of When Luxury Investments Make Sense

For example, do you like art? Then look for a good investment as well as a piece of art you will enjoy in your home or office.

Do you appreciate a good bottle of wine? Then, find a few to collect and “lay down” for a few years. And see what happens to their value.

Are you ready to retire and downsize? Then consider trading your current home for a luxury condominium property. Both as a nice place to live and a long-term luxury investment opportunity.

Have you always wanted a classic car that may also appreciate in value? Then impress the in-laws and neighbors with your new Lamborghini Diablo!

I’m sure you see where I’m coming from here. And get the idea I’m trying to drive home. Investing in luxury items that appreciate in value is not for everyone. But, it might be for you.

So, let’s wrap up with a summary list of luxury items that appreciate in value. 7 luxury investment options to consider as an advanced investor. All of which are excellent things that appreciate in value.

Summary: 7 Luxury Items That Appreciate In Value

Looking for luxury items to buy as an investment? Today, we discussed 7 such things that hold value over time. And maybe even make you a nice profit while you participate in the joy of ownership.

Furthermore, they are physical assets. So, they can diversify an investment portfolio composed of financial assets.

On the other hand, are you seeking income from your investment portfolio? Then there are better options to consider than luxury investments.

But generating investment income was not the point of this article. The point was 7 luxury investments to consider for your money. They are:

- Jewelry

- High-end watches

- Designer handbags

- Fine art

- Vintage wine

- Classic cars

- Luxury properties

More Info & Reading About Investments That Appreciate In Value

Are you interested in more conventional investments? Then we have you covered…

- 20+ investment types and investing tips

- Dividend stocks for steady income

- Manage all of your assets with Personal Capital

Author Bio: Tom Scott founded the consulting and coaching firm Dividends Diversify, LLC. He leverages his expertise and decades of experience in goal setting, relocation assistance, and investing for long-term wealth to help clients reach their full potential.

I think this is a fantastic post on exposing some luxury items that really do make sense to buy – if you maintain an investor’s mindset.

For example, I have a very good friend who purchased a brand new Toyota Supra MK 4 in 1994 at $34k and now they $60k with an investor’s mindset. They never drove the car, they simply held onto the investment and now, almost 3 decades later, that same investment is worth over double.

It’s really just a matter of mindset and how you plan to treat these valuables.

Great post – and thanks for sharing!

The MMW

Thank you. It’s always a good idea to consider all options when it comes to our money and investments. Sometimes there is value in items we may have never have given much thought about. Tom