10 Steps For Financial Success With Your Money Goals

Today, I will lay out 10 steps for how to set financial goals and achieve them. By following this guide, you will be well on your way to financial success.

Here are the 10 steps for setting and achieving your financial goals. It will be our road map for the remainder of the article…

How To Set Financial Goals And Achieve Them In 10 Easy Steps

- Create a vision of your future financial self

- Assess your current money state

- Select from the 3 types of financial goals

- Prioritize your goals to align with your vision

- Use a proven goal-setting system

- Write your goals down and make a plan

- Use a goal tree

- Create a financial goals vision board

- Take action and work on your plan

- Monitor your progress to assess your results

Next, we will go through each of these 10 steps in detail…

Disclosure: At no cost to you, I may get commissions for purchases made through links in this post.

And after you are done, but before you go. Be sure to check out all of our…

Guides and Posts for Success with Money

But for now, let’s dig into today’s topic…

1. Create A Vision Of Your Future Financial Self

When you take a trip or start a journey, it’s important to have a destination in mind.

For example, you wouldn’t just jump in your car. And start driving. Without a clear idea of where you are going.

And the same can be said for your financial goals. Because it’s inefficient when you don’t have a good idea of your financial destination.

Develop your financial vision by asking yourself questions like…

- What kind of job will I have?

- How much money will I make?

- Where will I live?

- What kind of house will I live in?

- What kind of car will I drive?

- How will I spend my money?

- How long do I want to work?

Furthermore, make sure your vision is yours and no one else’s. So, listen and learn from others. But learn to cut your unique path to financial success.

Finally, this is the time to think big. And dream big.

As a result, don’t have limiting thoughts. That restricts your vision of your best future financial self.

Next, if you want to know how to reach financial goals. Not only do you need a vision of the future. But you need to know where you are at right now.

Let’s talk about that next…

2. Assess Your Current Money State

So, I suggest you take stock of your current money state. To do so, ask yourself some more questions.

For example…

- How much money do I have?

- Do I have an adequate emergency fund?

- Where is my money located?

- What are my investments?

- What property do I own?

- How much do I make?

- How much do I spend?

Take as much time as you need to get these important answers.

If you don’t know the answers. That’s okay for now. Determining them may become part of setting your short-term financial goals.

Hopefully, you are starting to see what I’m getting at. Because creating financial goals and achieving those goals starts with 2 things.

It’s like any other journey you or I undertake in life.

First, where am I at? And second, where am I going?

Don’t try to set and achieve financial goals without knowing those answers. Because having a firm grasp on them is essential.

I suggest you consider the finance app from Personal Capital. It is an excellent tool. For getting a handle on your current money state.

For managing expenses, budgeting, and seeing all of your investments in one place. The app is hard to beat.

Plus, it’s free to…

Sign up and use Personal Capital

Then with that knowledge of your current and future states in place. You are ready for step 3 in setting personal financial goals.

Specifically, choosing the best ones for your unique situation…

3. Select From The 3 Types Of Financial Goals

And you should be aware, that there are 3 types of financial goals to choose from.

Let’s discuss…

Short-Term Financial Goals

First, we have short-term financial goals. Those goals you want to achieve within the next 12 months.

Here are some examples of short-term financial goals for you to consider:

- Establish an emergency fund

- Put the right insurance in place

- Establish a monthly budget

- Reduce expenses

- Improve your credit score

- Refinance your debt

- Payoff credit card debt

- Negotiate a pay increase

- Declutter and sell your stuff for cash

- Start investing

- Invest in your employer-sponsored retirement plan

- Read a book about personal finance

Medium-Term Financial Goals

Next, start thinking about medium-term financial goals. They are the goals that will take longer than 1 year to achieve. But not more than 5 years.

Here are some examples of medium-term financial goals for you to consider:

- Save for a down payment on a home

- Get a higher paying job

- Start a side hustle

- Create a plan for your money and put it to work

- Create your end of life documents

- Open and invest in an IRA account

- Further your education

- Maximize your incentives at work

- Payoff student loans

- Save for something you value

- Hire a financial advisor if you need one

- Build a relationship with a money mentor

Long-Term Financial Goals

Finally, set your long-term financial goals. They are your financial goals that will take more than 5 years to accomplish.

Here are some examples of long-term financial goals for you to consider:

- Maximize your earning potential

- Eliminate all non-mortgage debt

- Save for retirement

- Build your retirement castle

- Pay for your children’s education

- Make an end of life plan

- Live off dividends

- Become financially independent

- Become a millionaire

- Leave a financial legacy for your children

Now you know the three types of financial goals. And some examples of each.

But there are so many to choose from. So, how do you decide which ones to select?

That topic is next. As part of the 10 steps about how to set financial goals and achieve them.

Click and save for later on Pinterest!

4. Prioritize Your Personal Finance Goals To Align With Your Vision

To choose your short-term goals, evaluate the answers to the questions I posed in step 2. Where you assessed your current money state.

If any of those questions remain unanswered. Make a short-term goal to get the answer.

For example, are you not sure how much money you spend each month? If so, set a short-term goal to track your spending. Until you know.

Also, be sure to take care of critical needs. Such as having the right insurance in place. And establishing an emergency.

To choose your long-term goals, consider the vision of your future financial self. That you created in step 1 of today’s plan.

Select long-term financial goals that align with that vision.

Finally, for selecting your mid-term financial goals. Choose them by connecting the areas between your short and long-term goals.

This way, your goals are aligned with your vision. And aligned with each other. It makes for a comprehensive financial plan.

Now, you have your goals selected. Next, it’s time for you to know exactly how to set financial goals.

5. Use A Proven Goal-Setting System

To do so, I suggest using a proven goal-setting system. And there are two that I recommend.

Starting with SMART goals…

Setting SMART Goals

SMART goal-setting is a popular choice. It says each of your goals should have the following 5 attributes:

Let’s discuss each one…

- Specific

- Measurable

- Achievable

- Realistic

- Time-bound

Specific

The first step in making a SMART financial goal is to make it specific.

To do so, answer these questions:

- Exactly what is to be accomplished?

- Who needs to be involved?

- Why is it important to achieve the goal?

Do not become concerned about being overly detailed. The more details about the goal that you can document, the better.

Because you will become more clear on exactly what you want. And how to achieve the financial goals you are setting.

Measurable

Make your financial goals in life measurable.

To do so, answer this: what information are you going to use to measure your progress en route to the goal. And determine whether the goal has been achieved?

Fortunately, financial goals tend to be easy to measure. So, make yours measurable.

Achievable

We want to stretch ourselves. And make financial goals that are challenging. The types of goals that will improve our finances in big ways.

On the other hand, there is no need to set a goal if it can’t be achieved. By being specific, you should come to understand whether the goal is achievable.

Realistic

A realistic goal has 2 important characteristics.

First, the goal should make sense for your current financial situation. Second, confirm you have the resources to achieve the goal.

Here’s an example…

Becoming a billionaire may be an achievable long-term financial goal. After all, it has been done. Bill Gates and Warren Buffet have done it.

You might say if Bill and Warren can become billionaires, it’s achievable. So, I can do it too!

Now, I would admire your positive thinking. But I would argue that for most of us, becoming a billionaire is not realistic.

It’s just not relevant. So don’t waste your time. Unless you truly believe it is realistic.

Time-Bound

You must set a date to achieve your goal.

First of all, having a deadline will increase your sense of urgency.

Furthermore, a time constraint will increase your odds of success.

Finally, when multiple steps are involved to achieve the goal? Then an end date allows you to work backward.

To make sure each intermediate step can be completed in time. To support the timing of the end goal.

Okay. That wraps up a brief review of setting SMART goals. Next, I have another goal-setting system for your consideration….

Setting HARD Goals

The HARD goals setting system is not as well known. But I like it too.

It says each of your goals should have these 4 attributes:

Let’s discuss each one…

- Heartfelt

- Animated

- Required

- Difficult

Heartfelt

A heartfelt goal is something you care about deeply. Because when you care. Your chances of success increase significantly.

If you don’t deeply care about a goal. Why set it in the first place?

However, don’t be careless. Just because you don’t care about having an emergency fund. That does not mean you shouldn’t have one.

Animated

Making a goal animated means creating a vision in your mind. About what achieving the goal looks like and feels like.

Just like you created a long-term vision of your future financial self. Create a vision for each one of the goals that you have now selected.

Daydream about it. Think about it often. And make the goal come alive in your mind.

Required

Make your goals required. Because if you feel like a goal is required for your financial success. Then the more likely you are to accomplish that goal.

Difficult

Finally, your goals should be difficult. Using a different word, make them challenging.

By making your goals difficult, but not unachievable. That is where true financial transformation will take place.

Bringing your finances to the next level.

Finally, in my opinion, the SMART goals and HARD goals work well together.

SMART goal setting takes into account more tactical and practical steps. While HARD goals bring in the intangibles such as your emotions and most intimate desires for money.

Combine both systems for the ultimate goal-setting success with your finances. Or, just use the system that best suits your style.

Next, a very important point on your way to setting and achieving your objectives for money…

6. Write Your Financial Goals Down And Make A Plan

So, take what you have from setting your SMART and HARD financial goals. And write them down if you have not already done so.

Because documenting your goals is critical.

Doing so builds your commitment. And the act of writing things down helps you clarify your thoughts. As you focus on goal achievement.

Then for your goals that will take many months to achieve. Make a plan.

Fill the plan with shorter-term milestones. That work in support of ultimate goal achievement.

Sometimes a goal tree can help with this process of achieving your financial goals. By making sure they are connected to form a cohesive strategy.

Let’s cover this topic next. It’s step 7 out of 10 about how to set financial goals and achieve them…

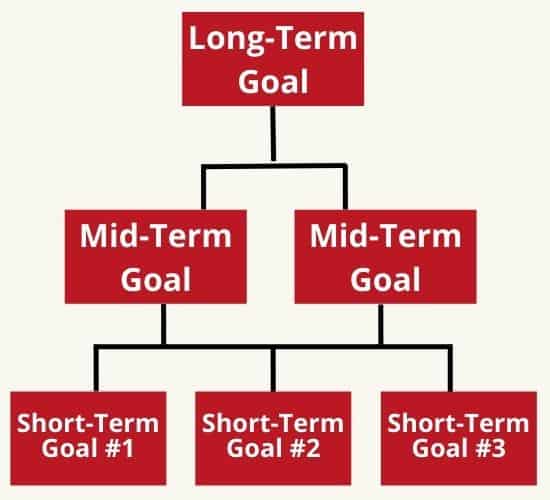

7. Use A Goal Tree

A goal tree is a great tool. It is used to outline and visualize milestones along your journey.

In other words, the stepping stones that are required. To achieve challenging long-term financial goals.

What is it? Well, just picture a tree.

Where your short-term goals are the roots in the ground. Medium-term goals are the trunk and main branches. While long-term goals are the canopy of leaves.

Thus, the roots, trunk, and branches serve to connect and support the leaves. Just like your short and medium-term goals come together to support your long-term goals.

Here’s another tip to help you achieve your goals after setting them…

8. Create A Financial Goals Vision Board

A financial goals vision board is a collection of images, phrases, and inspirational quotes. It represents your hopes and dreams for your money, finances, and financial independence.

If you haven’t figured it out by now, I’m big on vision. And a vision board is a way to bring your financial vision to life. In a tangible form.

Its purpose is to help you see what success looks like. Also, to motivate and inspire you along the way to reach your goals.

To create your board…

First, find images that display your financial vision.

For example, a picture of your dream home you hope to build someday. The furnishings that will go in it. And the patio for enjoying your outdoor space.

Second, gather supplies for your financial vision board.

Such as an open wall, corkboard, or poster board. Put it in a visible place. So you will see it every day.

Finally, use the images you have collected and mount them on your vision board.

Use spacial and time elements. To create your board in a way that depicts your vision of the future.

In this case, your dream home. Representing one of your challenging long-term goals.

Next up, is step number 9 for setting and achieving financial goals…

9. Take Action And Work On Your Plan

Now that you have your financial journey mapped out. From short-term steps to long-term vision. By choosing and setting your objectives for money.

It’s time to get busy and work on your plan.

Establish a to-do list for every day and every week. And be sure to have some tasks for accomplishing your most important financial goals.

10. Monitor Your Progress To Assess Your Results

From time to time step back and look at your progress. Are you on the schedule you set as part of making time-bound goals?

What setbacks have you encountered? And how can you learn from them?

Finally, identify your successes. And the goals you have achieved. Be sure to celebrate and reward yourself along the way.

As your journey continues, replace completed goals with new ones as you see fit.

Okay. That’s about all I have for today.

If you have made it this far. Be sure to check out all of the resources at…

the Goalry Financial Goal Mall

…for all of your financial resource needs.

Otherwise, allow me to wrap this up…

How To Set Financial Goals and Achieve Them

Financial success can be yours by following these 10 steps for setting and achieving your financial goals…

- Create a vision of your future financial self

- Assess your current money state

- Select from the 3 types of financial goals

- Prioritize your goals to align with your vision

- Use a proven goal-setting system

- Write your goals down and make a plan

- Use a goal tree

- Create a financial goals vision board

- Take action and work on your plan

- Monitor your progress to assess your results

More Reading About Goals And Goal Setting

Author Bio: Tom Scott founded the consulting and coaching firm Dividends Diversify, LLC. He leverages his expertise and decades of experience in goal setting, relocation assistance, and investing for long-term wealth to help clients reach their full potential.