Optimize Your Planning With Mid-Term Money Goals

Let’s focus on medium-term financial goals and how they fit with your short-term and long-term financial objectives.

What Are Medium-Term Financial Goals?

First, goals are an outcome or a result that you would like to achieve.

Furthermore, they can relate to any aspect of your life. Such as friends, family, money, education, or work. However, this article focuses on personal finance goals.

More specifically, medium-term financial goals are…

desired outcomes related to your money, investments, and financial security.

Also known as mid-term financial goals. And unlike other types of goals, their results are to be achieved in more than 1 year. But, less than 5.

To help you out, later, I will provide several medium-term financial goals. But for now, let’s cover some additional important information…

Disclosure: At no cost to you, I may get commissions for purchases made through links in this post.

The Importance Of Medium-Term Financial Goals

In my opinion, medium-term financial goals are critical for becoming financially successful.

Because they provide the support for achieving your long-term financial goals. Which are to be achieved in more than 5 years.

And the necessary vision for the future. To determine your short-term financial targets required within the next 12 months.

Hopefully, you are starting to see how your financial planning is interconnected. From your short-term to long-term goals.

If not, here’s how to think about it…

How To Plan Your Medium-Term Financial Goals

To create your medium-term goals, first, establish a vision for your long-term future self. As it specifically relates to your money.

Developing Your Vision Of The Future

To do so, think out 10 years. Create a money vision by asking yourself questions like…

- How much money will I have?

- When do I desire financial independence?

- Will I be retired?

- Will I have family members financially reliant on me?

By asking and answering questions like these. Your long-term financial goals become clear.

Short And Medium Term Financial Goals

Next, set medium-term financial goals that support your long-term ones.

Finally, create short-term financial goals to help achieve your medium-term financial goals.

By going about financial goal setting this way. Your intentions are aligned and connected.

Providing for the activities today. That will help you achieve your desired outcomes 10 or more years in the future.

Sometimes this is referred to as a goal tree. To further your understanding, I will give you a goal tree example later on in the article

Types Of Goals

But for now, let’s explore the 3 types of financial goals that we have touched upon.

- Long-term: More than 5 years out

- Medium-term: Between 1 to 5 years

- Short-term: Less than 1 year

I will do my best to provide some examples of each of these types of financial goals. But understand, everyone’s situation is a little different.

For example, one person’s long-term goal. Might be another person’s mid-term financial goal. It all depends on your unique situation.

Thus, feel free to move these financial goals examples around. To put them in a time frame that makes sense for your current life situation.

Start With Your Long-Term Financial Goals

I always encourage people to think about long-term goals first. In this way, your activities today, tomorrow, next month, and next year support your long-term future objectives.

But realize that your long-term financial intentions take time to achieve. Typically, at least 5 years. They should support your vision for your future financial self.

Examples of Long-Term Financial Goals

Some examples of possible long-term financial objectives include:

- Maximize your earning potential

- Start a business

- Buy a house

- Invest in a rental property

- Eliminate all non-mortgage debt

- Payoff your mortgage

- Save for retirement

- Save for your children’s education

- Create a long-term plan for your money

- Make an end of life plan

- Become financially independent

- Become a millionaire

Move On To Mid-Term-Term Financial Goals

Next with your long-term vision established. And some long-term financial goals selected to make your vision a reality. You are ready to work on your medium-term objectives.

Remember to select mid-term financial goals supporting your long-term money plan. Also, they should have a time frame to completion of more than 1 but less than 5 years.

Medium-Term Financial Goals Examples

Some mid-term financial goals examples include:

- Invest in yourself

- Further your education

- Earn a promotion

- Maximize your incentive plan at work

- Get a higher paying job

- Eliminate credit card debt

- Payoff student loans

- Save for a down payment on a home

- Save for something you value

- Put money away for something fun

- Hire a financial advisor

- Build a relationship with a money mentor

Set Your Base With Short-Term Financial Goals

Next, you should move on to your short-term money desires. They should support your medium-term goals. And they should be accomplished in less than one year.

A lot can be accomplished in a year. So, there are many short-term financial goal possibilities.

But don’t get overwhelmed. Choose the one that connects most closely to your medium-term financial goals. They should also serve to quickly eliminate the causes of financial stress in your life.

Also, realize that as one short-term goal gets accomplished. Another one can be set to replace it.

Examples of Short-Term Financial Goals

Some examples of short-term financial goals include:

- Assess your current money state

- Establish an emergency fund

- Put the right insurance in place

- Establish a monthly budget

- Reduce expenses

- Improve your credit score

- Refinance your debt

- Start a side hustle

- Declutter and sell your stuff for cash

- Rent out a room in your home

- Start investing

- Read an investing book

- Create a plan for your money

Next, let’s put this all together into an example using the concept of a goal tree…

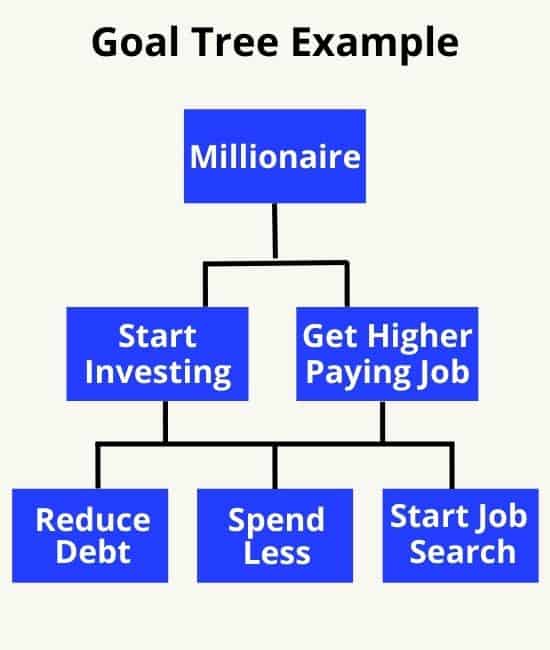

Goal Tree

A goal tree helps visually break down a large goal. And does so into smaller tasks that must be achieved first.

In this way, a very large and challenging goal can be made easier to achieve. It also helps keep your financial goals aligned. So they complement each other.

Let’s go through the steps we have talked about today. Using an example of a goal tree.

Goal Tree Example

First, here’s a potential long-term vision to consider…

Achieve adequate wealth for financial independence. To have the life I desire. And have that life on my terms.

Second, here’s a long-term financial goal that makes the vision a reality…

- Become a millionaire

Third, select medium-term financial goals that support the long-term financial goal. For example…

- Get a higher paying job

- Start investing

Finally, choose some short-term financial goals. Such as…

- Start a job search

- Spend less money

- Reduce debt

Then, as you accomplish your short and mid-term financial goals. Replace them with others that support your long-term goal of becoming a millionaire.

As you can see, a large goal is broken down into smaller and smaller ones. Which ultimately reveals the weekly and daily tasks you need to be working on.

Think of it just like a tree…

Your short-term financial goals are the roots. That sends strength to the trunk forming a solid foundation. For the beautiful canopy of leaves at the top.

So, you have chosen some goals. That are connected and aligned. Next, is setting them for success…

How To Set Your Financial Goals

First, when setting a goal you want to be much more specific than the example I shared in the goal tree.

For example, consider the goal of spending less money. You must determine exactly how much less. And what items you will trim from your budget to achieve it.

This makes the goal specific and measurable. Then determine when you will achieve the savings.

Because setting a deadline is important. Doing so will help build your commitment.

Finally, when you set your savings target. Make sure it is achievable and realistic. Stretch yourself. But don’t waste time on things that can’t be achieved.

This goal-setting example is an adaptation of the SMART goal system. It says to make them:

- Specific

- Measurable

- Achievable

- Realistic

- Time-bound

Next, it’s time to get to work on achieving your big dreams. And small ones too…

How To Achieve Your Financial Goals

First, write them down.

Doing so will force you to clarify your thinking. And make sure all of the elements from the SMART system are included in what you write.

Second, brainstorm a list of activities that support your desires. Looking back up at the goal tree example, I can come up with plenty.

Here are a few examples:

- Improve resume

- Network with a new person every month

- Update monthly budget

- Brown bag lunch

- Set up a monthly automatic deposit to a savings account

Finally, sit down at the start of each week. And integrate the activities into your daily routine. Also, a to-do list if you keep one.

Tools And Tips For Achieving Success

Regardless of what objectives you set for yourself. Always seek out the best tools and resources.

Here are a few that fit well and can help you out…

First, make your resume the best it can be to secure a higher-paying job. For this, I like MyPerfectResume.

Second, reducing expenses and saving more money should be on everyone’s financial goal list. That’s why we use the cash rebate app from Rakuten.

Because every little bit of savings adds up in the short term. To help you with your big long-term hopes and money vision.

Finally, try the free online tool from Personal Capital. It’s great for managing expenses, budgeting, and pulling your investments together in one place.

Okay. That’s my take on financial goal setting. Allow me to wrap up with a few parting comments…

Wrap Up On Medium-Term Financial Goals

Medium-term financial goals should be the cornerstone of your financial goal planning.

By approaching your financial goal setting with a goal tree. Your daily activities support your overall financial objectives.

Which in turn supports your medium-term financial goals. Allowing you to accomplish your long-term financial goals. Consistent with your vision of the future.

Finally, good luck. No matter what financial outcomes you desire to accomplish.

Now. Get busy.

Selecting, setting, and achieving your financial goals. With an emphasis on medium-term financial goals that hold it all together.

More Reading To Make The Most Of Your Money

If you like this article. Check out all of our…

Money Management Articles and Guides

For more reading, you might also like these:

Author Bio: Tom Scott founded the consulting and coaching firm Dividends Diversify, LLC. He leverages his expertise and decades of experience in goal setting, relocation assistance, and investing for long-term wealth to help clients reach their full potential.