How To Use Dividend Income To Help Fund Your Retirement

You have questions and we have answers. Leading us to today’s question: can you retire on dividends?

So, let’s jump right into today’s Q&A…

Can You Retire On Dividends?

Yes, you can retire on dividends.

However, it first requires a dividend investor to maintain discipline over a long time horizon. By saving consistently and investing in high-quality dividend stocks.

Furthermore, some cases will require supplementing those dividend payments. And doing so with other forms of retirement income.

Next, allow me to turn the answer to today’s question into 5 ways for retiring on dividends.

These are the exact ways to build up my dividend income for retirement that I used…

Disclosure: At no cost to you, I may get commissions for purchases made through links in this post.

5 Ways To Make Retiring On Dividends A Reality

- Start dividend investing now

- Live below your means to feed your dividend portfolio

- Be careful with high dividend yields

- Reinvest your dividends leading up to retirement

- Supplement your dividend income during retirement

First, let’s explore these requirements one by one. To better explain how anyone can retire with dividends.

Second, I will provide an example. This way, you will be able to see exactly how the process works in practice. So you too can retire with dividends!

Then, when you are done, but before you go. Be sure to check out all of our…

Dividend Stock Investing Articles and Posts

But for now, back to today’s 5 ways. To prove out the answer to the question: Can you retire on dividend stocks?

1. Start Dividend Investing NOW While You Are Working

I hate to burst your bubble right away. But, I must.

You need to start dividend investing at a young age.

Because I’m not selling you on a get-rich-quick scheme. Dividend investing for retirement takes a good deal of time.

Thus, the most important thing you can do is this. Get started dividend investing now! For a secure retirement in the future.

Because the more time you have to save and invest. It means the more your dividend-paying stocks will compound into wealth over time.

So, get started building your dividend portfolio for retirement. And I suggest you start today.

Because every journey starts with a first step.

Even if it means buying just one share of stock. Or, by selecting one of the many index funds for dividend income in retirement.

On the other hand, if you have already begun dividend investing. Keep going.

And set your sights on number 2…

2. Live Below Your Means To Feed Your Dividend Retirement Portfolio

Because our second way to retire off dividends means building out your dividend stock portfolio. Investing in the dividend stocks of your choosing. And doing so regularly.

As a result, you must create fresh capital for investment.

It is generated by living below your means. Which is a big part of any personal finance plan. And more specifically, your retirement planning.

So, dust off your monthly budget. And look for ways to either…

- Increase your income

- Decrease your expenses

By doing one or both, you create excess cash. That can be used to build your dividend retirement portfolio.

Then, invest as much of that excess cash flow. Into your dividend-paying stocks.

So, now you know these two things. First, you need time. And second, you need money to start a dividend income retirement plan.

They are the two most important ingredients. And perhaps the most difficult to come by.

However, with that foundation in place. You are ready for number 3…

3. Be Careful Of Building Your Retirement Portfolio With High Dividend Yields

Choosing the best dividend stocks for your retirement portfolio is very important. And many things go into selecting the best dividend stocks.

But some aspects are more important than others. When building a dividend retirement portfolio.

As a result, allow me to offer up one thing that I learned over the years. Specifically, don’t chase high dividend yields.

I know it’s tempting to do so. For the additional dividend income, they provide.

On the other hand, they typically indicate greater investment risk. The risk is that the stock’s dividend may not be sustainable in the future.

And dividend reductions are the last thing you want. When attempting to retire on dividend income.

What is a high dividend yield? Well, the answer to that question may be different depending on who you ask.

If you ask me, I say high dividend yields are more than 5% to 6%. As a result, I target stocks with dividend yields in the 3-5% range.

To find them, I normally look through the lists of Dividend Kings and Dividend Aristocrats.

Then, as I select and invest in these great dividend payers, I also suggest putting into practice number 4 on today’s list…

4. Reinvest Your Dividends Leading Up To Retirement

While you are working and adding fresh capital to your dividend retirement portfolio. This is a great time to reinvest your dividends. Right back into one or more of the stocks that paid them.

This is an important element in compounding your wealth through dividend investing.

So, either leave instructions with your stock broker. To automatically reinvest back into the stock that paid them.

Or, let your dividends accumulate in cash. And invest that cash lump sum. Into the dividend stocks of your choosing every month or so.

For some of the best stock tips delivered to your inbox every month. You should check out the Motley Fool Stock Advisor.

This leads us to our fifth and final way to improve the odds you can retire with dividends…

5. Supplement Your Dividend Income With Other Sources

You already know it takes plenty of time. Also, there is money required to retire with dividends. And unfortunately, dividends alone may not cover all of your expenses.

However, if you follow the guidance in number 2, living below your means. Your expenses will be lower. Increasing your odds for success.

Nevertheless, it’s a good idea to create multiple income streams for your retirement years. Beyond dividends to support a comfortable lifestyle.

Social security is the first and most obvious choice. And if you have a qualified retirement plan from work. For example, a 401(k). You have other great resources for generating retirement income.

Finally, don’t forget about working part-time.

Because a side gig can add a little more money to the pot. As well as keeping you sharp and active in the world. That is when you aren’t enjoying your almost endless hours of retirement living.

Example Of How You Can Retire On Dividends

Okay. Next, let’s put these ideas to work.

Using an example of exactly how retiring on dividends can become a reality.

Start Dividend Investing NOW

First, open a brokerage account. The Webull app is one of my favorite commission-free tools to buy and sell dividend stocks.

Select a dividend stock of your choosing. Mutual fund, or an exchange-traded fund paying dividends. Then make your investment.

Also, consider opening an Individual Retirement Account (IRA). They are solid choices for buying and holding dividend stocks. Because of the tax advantages they offer.

Live Below Your Means And Invest Regularly

When it comes to dividend investing, remember this: consistency is key. So, I suggest setting up a program where you invest a set amount every month.

Doing so into the dividend stocks or dividend-paying exchange-traded funds of your choosing. And reinvesting dividends shortly after they are received.

Let’s say you can scrape up $500 a month. Investing it in dividend stocks that you hold in an IRA.

For choosing the best dividend stocks. And buying them at the right times.

You should check out the Simply Investing Report and Analysis Platform.

Done right, you can build a dividend portfolio that yields 4%. Also, many of the stocks you own will increase their dividends annually generating as much as 6% dividend growth.

Plus, over the long run, let’s say your dividend retirement portfolio also benefits from about 6% annual increases in your stock prices.

Because stock prices will often rise along with the dividends. Creating a 10% total annual return.

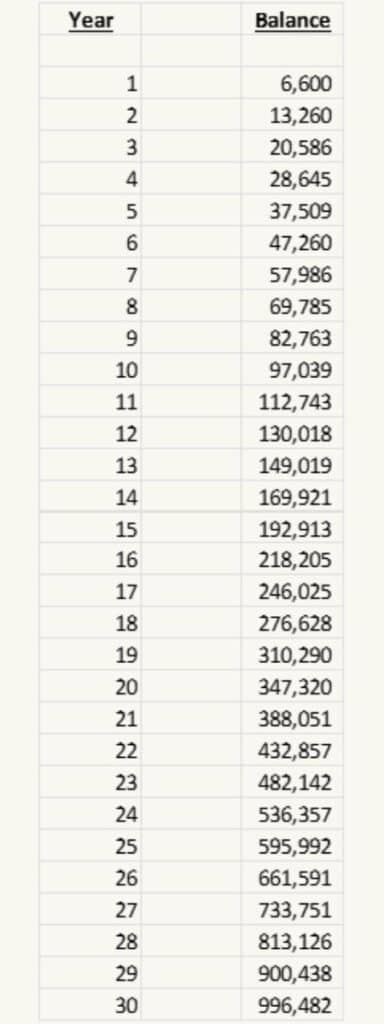

Here is one possible result. Assuming $6,000 is invested in dividend stocks at the beginning of each year. Done by accumulating $500 of cash per month.

Table 1: Model Dividend Retirement Portfolio Balance By Year

Of course, this is just a model. Your investment results will never be this smooth and predictable.

Some years you will do better. While some years you will do worse.

And during the worst years, your portfolio may shrink. Because of declines in the overall stock market.

But over the long run, historical data suggests earning a 4% dividend yield. And a 10% total return is possible.

Leaving you with a nearly 1 million dollar dividend portfolio for retirement. Paying approximately $40,000 per year in dividends.

That is, as long as you remain disciplined and consistent. Investing the $500 a month during good times and bad.

But, you say, that’s not enough dividend income to cover your expenses.

And I say, I understand. So…

Supplement Your Dividend Income With Other Sources

Remember number 5. Where I suggest supplementing your income from other sources.

For example…

The average social security benefit is about $20,000 per year.

Perhaps you could pick up another $15,000 each year working part-time. And taking withdrawals from your 401(k) plan. That you built during your working years.

Put it all together and that’s about $75,000 in annual income. Which is more than the median household income in the United States.

Plus a 1 million dollar dividend stock portfolio. That you never have to touch. As long as you can live off the income from this example.

Not bad for 30 years of work. And believe me. The time passes faster than you can imagine.

However, if that’s still not enough money to live off of dividends as part of your retirement planning. Then look to reduce your expenses.

Real estate and housing tend to be the biggest component of a household budget. So, finding a cheaper place to live can go a long way toward your goal to retire off dividends.

Okay. That’s all I have for today.

Allow me to wrap up with a few parting thoughts…

Can You Retire On Dividends?

Can you retire on dividend income? Yes, it is entirely possible to do so.

But it takes a long-term, disciplined approach of living below your means, saving, investing, and when necessary supplementing your dividend payments from other sources.

Thus, if you haven’t started yet. Start now and get your financial house in order. So you can retire off dividends in the future.

Finally, if you liked this article. Check out more of our…

Complete Guide to Dividend Investing for Retirement

Author Bio: Tom Scott founded the consulting and coaching firm Dividends Diversify, LLC. He leverages his expertise and decades of experience in goal setting, relocation assistance, and investing for long-term wealth to help clients reach their full potential.