Because Dividends Are An Excellent Source Of Retirement Income

Today I would like to review some of the best dividend stocks for retirement.

They are great holdings for a retirement portfolio. And excellent choices for anyone looking to fund all or part of their retirement with dividend income.

Ready to get started? I see no reason to delay. So, let’s jump right in…

Best Dividend Stocks For Retirement Portfolios

Here’s our list of the 15 best dividend stocks for a retirement portfolio:

- 3M (MMM)

- AbbVie (ABBV)

- American Electric Power (AEP)

- Clorox (CLX)

- Coca-Cola (KO)

- Hormel Foods (HRL)

- Johnson & Johnson (JNJ)

- Microsoft (MSFT)

- Paychex (PAYX)

- PepsiCo (PEP)

- Realty Income (O)

- Target (TGT)

- United Parcel Service (UPS)

- Verizon (VZ)

- Wisconsin Energy Group (WEC)

As a whole, this is a well-rounded group of dividend payers.

Representing several different industries for solid diversification. And for making steady dividend income to fund your expenses in retirement.

Individually, I would like to provide more information on each of these fine companies. And why I like these stocks in my retirement dividend portfolio.

Because I own them all and have so for a very long time.

Then before we wrap up, I will touch on some common threads that make these stocks similar. Plus, how to find more just like them.

Let’s go…

Disclosure: At no cost to you, I may get commissions for purchases made through links in this post.

3M (MMM)

3M is a highly diversified company providing products that impact our daily lives. For example, they make products servicing industries such as…

- Automotive

- Electronics

- Energy

- Health care

…among others.

Furthermore, the company has paid uninterrupted dividends to its shareholders for more than 100 consecutive years. And increased the annual dividend rate every year since 1958.

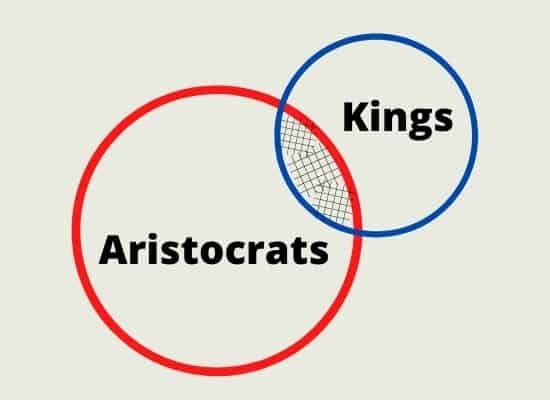

That is an impressive dividend increase streak. Earning 3M Dividend King and Dividend Aristocrat status.

Finally, I like having an industrial company in this mix of stocks. Yes, they are sensitive to the global economy. But 3M seems to just keep moving forward no matter the economic climate.

Moving right along, here is another one of my favorite dividend-paying stocks for retirement…

AbbVie (ABBV)

AbbVie was founded in 2013. Formed when Abbott Laboratories spun off its Pharmaceutical Products Division into a stand-alone company.

Every year since then the company has raised its dividend rate per share. Sometimes more than once in the same year. Making for rapid dividend growth.

AbbVie grows its pipeline of new drugs through innovation and investment in research and development. Also, making targeted acquisitions to expand its product capabilities.

Most notable, in a growth and diversification effort, the company acquired Allergan in 2019. The maker of Botox.

Any list of the best dividend stocks for retirement has to include at least one electric utility. So, here’s one I like…

American Electric Power (AEP)

Because AEP considers itself a premier electric utility company. Generating and delivering power to customers in the Midwest United States and Texas.

There’s nothing too exciting about what AEP does. Except in those rare cases when the power goes out.

That’s when people get excited. Which makes AEP an excellent dividend stock because of stable demand for its products and services.

In my opinion, AEP provides a good current dividend yield. Plus, steady dividend growth, and dividend safety.

For example, the company has paid a cash dividend every year since 1910. And from 2010 forward, AEP has increased its dividend rate every year.

Next, is another one of our quality dividend stocks for a retirement portfolio…

Clorox (CLX)

It is Clorox. The maker of the iconic bleach brand that goes by the same name.

But what you may not know is this company has tremendous strength across a variety of household goods categories. Holding the number 1 or 2 position in many of the areas it competes.

For example, Clorox also makes:

- Kingsford charcoal

- Glad bags, wraps, and containers

- Burt’s Bees personal care products

More importantly, for dividend investors is the company’s awesome dividend history and track record.

Consider these points:

- Started paying dividends every year in 1970

- Increased the dividend rate annually since 1978

- Long-time Dividend Aristocrat

So, don’t forget about this little company. That pays big dividends.

Next up, is another great dividend stock for retirement income…

Coca-Cola (KO)

I’m talking about one of the world’s leading non-alcoholic beverage companies. That being Coca-Cola.

This company’s unprecedented brand strength has been generating profits for dividend investors decade after decade.

Consider some of their leading brands…

- Coke and Diet Coke

- Minute Made juices

- Honest Tea

- Power Ade sports drinks

- Dasani water

…just to name a few.

As an owner, you will be in good company. Because Warren Buffett, through Berkshire Hathaway owns many shares.

Finally, Coca-Cola started paying dividends in 1920. Has paid a cash dividend every quarter since then. And has increased the dividend rate per share annually since 1963.

Now that’s what I call dividend royalty!

And we are just getting rolling here. Because I have another one of the best dividend stocks for retirement accounts coming next…

Hormel Foods (HRL)

As we transition from soft drinks to food and snacks. I’m talking about another Dividend King. Specifically, Hormel Foods.

Like the Clorox Company that we discussed earlier. Hormel has a powerful stable of brands. With more than 50 and counting.

Such as…

- Dinty Moore

- Jennie-O

- Skippy

- Planters peanuts

- Spam

Looking at the company’s dividend, we see a rich history and track record.

Since Hormel has paid a quarterly dividend every year since its stock market debut in 1928. While increasing the annual dividend rate per share annually since 1966.

And our list just keeps getting better. Because we are moving to one of the very best dividend-paying stocks for retirement accounts…

Johnson & Johnson (JNJ)

I’m talking about the stock issued by the diversified health care company Johnson & Johnson. Helping people live longer healthier lives with their robust assortment of products.

When I think of a great dividend stock. I think of JNJ.

Why?

Because of these characteristics…

- Recession resistant business

- Provides essential goods and services

- Benefits from the aging demographic trend

Next, with annual dividend increases dating back to 1963. JNJ is yet another Dividend King on our list of the best income stocks for retirees.

Finally, this is a perfect stock. For setting up an automatic dividend reinvestment plan.

And now for a company and stock that is completely different…

Microsoft (MSFT)

As we move on to the technology company called Microsoft. Providing products and services in the following areas:

- Productivity and business software

- Cloud computing

- Tablets, games, and computer accessories

Unlike many of the other stocks, we are discussing today. Microsoft has a low dividend yield. More often than not it is less than 1%.

So, the stock doesn’t provide much current income. But annual dividend growth is typically strong. A 10% or so dividend increase each year is fairly common.

Finally, Microsoft is creeping up on Dividend Aristocrat status. Having increased its dividend every year since 2003.

Next up is one of my favorite “under the radar” stocks paying dividends trading in the stock market. A top dividend stock for retirement that so many people seem to overlook.

Paychex (PAYX)

Founded in 1971 and trading publicly for the first time in 1983, Paychex provides a diverse set of services to its clients.

Including…

- Payroll processing

- Human resources management

- Compliance and employee services

One of the things I like about Paychex is management’s willingness to share roughly 80% of the profits with shareholders.

They do so in the form of dividend payments. Plus the company has a strong balance sheet.

However, it’s important to note that sometimes during periods of higher unemployment, the company will pause dividend growth. But as soon as the economic picture brightens, solid dividend growth typically resumes.

Next, back to another well-known company. Because of its strong brand recognition.

Yet another one of our top-notch dividend stocks for retirement portfolios…

PepsiCo (PEP)

Yes, Pepsi goes head to head with Coca-Cola in pursuit of soft drink sales. But this company has so much more product diversity because of its snack food business.

Including products like…

- Lay’s chips

- Doritos

- Fritos

Not the healthiest stuff to eat. But so tempting and tasty.

Better yet, Pepsi has been using its excess cash flow to pay dividends every quarter since 1965. And increasing the dividend rate per share annually since 1973.

Next, what dividend investor couldn’t fall in love with this company. A great income stock for retirees…

Realty Income (O)

Because this real estate investment trust (REIT) is known for paying monthly dividends.

That’s right Realty Income is a monthly dividend stock. And, in my opinion, one of the best ones to boot.

To make money, the company owns and leases out thousands of commercial properties located mainly in the United States. Some of their high-profile tenants include…

- Walgreens

- 7-Eleven

- FedEx

- Walmart

- Home Depot

Then most of the profits are paid to us shareholders in the form of dividends. And having paid and increased its dividend since 1994, Realty Income is a Dividend Aristocrat.

Okay. Here I have another one of the good dividend growth stocks for your retirement accounts…

Target (TGT)

Specifically, the multi-channel retailer Target. Whether you desire in-store shopping, ordering online for home delivery, or picking up your order at the store.

Target has your needs covered.

And your shopping convenience is front of mind. Servicing customers across all of the major population centers in the United States.

As for its dividend history, the company has paid a cash dividend every quarter since it started trading as a public company in 1967.

Then beginning in 1972, Target increased its dividend rate per share. And has done so every year since then.

Speaking of home delivery. Next is a leader in that growing industry.

And another one of our best dividend stocks for retirement income making today’s list…

United Parcel Service (UPS)

It is United Parcel Service. Known as UPS for short.

Because of its vast investment in trucks, airplanes, distribution centers, and technology, UPS has created a strong economic moat. Making it tough for competitors to enter and compete with them in this field.

Most importantly, economic moats protect profits. And UPS management is more than willing to share those profits with stockholders in the form of dividends.

Furthermore, with the trend toward more shopping online. Which typically means home delivery. UPS has benefited from higher demand for its services.

Finally, for nearly 50 years, the company has either maintained or increased its dividend rate per share. Rewarding investors with a rising stream of dividend income.

Next is another popular dividend stock for retirement income.

Verizon (VZ)

Being the big telecommunications provider, Verizon. A supplier of both wireless and wireline telecom services across the United States.

The company owns and operates one of the largest networks in the U.S. And is pushing its business forward with more super-fast fiber optics capacity. Also, 5G technology to power the “internet of things”.

By investing in Verizon you get one of the higher dividend yields. While not compromising dividend safety.

What you won’t get is fast dividend growth.

Although the company increases its dividend every year. Those increases are typically small. Roughly 2%.

As Verizon must use large amounts of its cash flow. To maintain its network and capabilities.

So, add more retirement income to your portfolio now. Knowing you will sacrifice some dividend growth in the future.

It’s the classic high dividends vs growth tradeoff.

Okay. Last but not least on today’s list of best dividend stocks for a retirement portfolio…

Wisconsin Energy Group (WEC)

Closing things out with a second regulated utility company similar to AEP discussed earlier. But this time, we are talking about Wisconsin Energy Group.

WEC is one of the largest electric generation, distribution, and natural gas delivery holding companies in the United States. Wisconsin, Illinois, Michigan, and Minnesota make up its primary service areas.

As I mentioned before, regulated utilities are a great source of steady and reliable dividend income. And WEC is no different.

Over time, investors have received dividends every quarter since 1942. While management has increased the dividend annually since 2004.

Okay. That completes today’s list of some of the best dividend stocks for retirement portfolios.

But, before I wrap up. Just a couple more important points I think you should consider…

What All Of These Best Dividend Stocks For Retirement Have In Common

I selected these stocks because they have 3 things in common. Specifically, they all…

- Pay a good amount of dividend income right now

- Increase their dividends every year

- Have appreciating stock prices over the long-run

You can pick and choose among them. To emphasize current income, faster growth, or a blend of both. It is an excellent group of stocks for optimizing your dividend retirement strategy.

Finding, Managing, and Monitoring The Best Dividend Stocks For Retirement

Successful dividend investors do 3 things well. Those things are…

- Search for, identify, and buy the best dividend stocks

- Monitor those stocks’ performance periodically

- Hold those stocks for the long-term

To improve your odds of success in these areas. Here are two of my favorite resources to do so…

First, I like the Motley Fool Stock Advisor. For stock recommendations delivered to my inbox every month.

Second, from a different perspective, I also like the Simply Investing Report & Analysis Platform.

Because Simply Investing provides an interactive database covering hundreds of companies. Great for keeping up with all the latest dividend metrics. And monitoring the stocks owned in your retirement portfolio.

Furthermore, Simply Investing provides recommendations on the best dividend stocks. And when to buy them. Helping you to buy the best stocks when they are attractively valued.

You can learn more about Simply Investing here.

Your retirement finances are important. So, don’t short-change yourself. Find the best tools and resources and use them to your advantage!

After all, no one can or wants to work forever. And you don’t have to. Not with a steady stream of dividend income coming in every month.

Okay. Let’s bring this to a close…

Wrap Up: Best Dividend Stocks For Retirement Portfolios

Today, I shared 15 of the best dividend stocks for retirement income. All have rich histories of paying dividends. And increasing those dividends regularly.

From my perspective, quality dividends from stocks to fund retirement are an excellent option. But it takes time and discipline.

So, get started sooner rather than later.

If you have already begun, then consider adding one or more of these stocks to your retirement investments for solid long-term total investment returns:

- 3M (MMM)

- AbbVie (ABBV)

- American Electric Power (AEP)

- Clorox (CLX)

- Coca-Cola (KO)

- Hormel Foods (HRL)

- Johnson & Johnson (JNJ)

- Microsoft (MSFT)

- Paychex (PAYX)

- PepsiCo (PEP)

- Realty Income (O)

- Target (TGT)

- United Parcel Service (UPS)

- Verizon (VZ)

- Wisconsin Energy Group (WEC)

Of course, you can pursue dividend retirement investing through index funds, mutual funds, or exchange-traded funds (ETFs) too.

But I think picking stocks is more fun!

Thanks for reading. And before you go, check out more of our…

Helpful Dividend Investing Articles

Or, really dial into financial planning with this…

7 Step Guide to Dividends and Retirement

…to make the most out of your money!

Author Bio: Tom Scott founded the consulting and coaching firm Dividends Diversify, LLC. He leverages his expertise and decades of experience in goal setting, relocation assistance, and investing for long-term wealth to help clients reach their full potential.