Because Creating A Dividend Portfolio For Retirement Is Easier Than You Think

The purpose of this article is to outline how to build a dividend retirement portfolio. So, when we are done, you will have a plan for living off dividends in retirement.

Let’s not waste any time. Here’s exactly how to go about it…

Creating A Dividend Retirement Portfolio In 5 Easy Steps

To break this topic down into manageable pieces, let me offer you this 5-step dividend portfolio building retirement plan:

- Think long-term

- Choose an investment strategy and follow it

- Select the best dividend stocks to fit your strategy

- Consider ETFs as an alternative to dividend stocks

- Follow best practices for living off dividends in retirement

Okay. Those are the steps. Also, the outline for the rest of the article.

Now, let’s dig into the details…

Disclosure: At no cost to you, I may get commissions for purchases made through links in this post.

And if at any point in time you are feeling overwhelmed. Especially with the terminology.

Then be sure to check out our…

Compressive Guidebook About How Dividends Work

Otherwise, let’s keep moving. Because your dividend income in retirement depends on it!

1. Building A Dividend Retirement Portfolio Requires Long-Term Thinking

First, and just to set the record, successful dividend investing requires a lot of time. So, get your head straight and develop a long-term mindset.

Most importantly, what I’m proposing here is not a get-rich-quick scheme.

With your head firmly attached to your shoulders. And pointing in the right direction. Creating dividend income for retirement is possible.

But before you even consider investing in your first dividend stock. I want you to think about the big picture…

2. Establish A Dividend Investing Strategy For Building Your Retirement Portfolio

Specifically, I want you to consider 3 possible dividend retirement investment strategies.

What you are going to learn about is the big tradeoff. Balancing current income today versus dividend growth in the future.

Because dividend yield and dividend growth are typically inversely related.

Think about it using this old expression. “You can’t have your cake and eat it too”.

In other words, it’s hard to get both high dividend yields. And high dividend growth.

Optimizing this tradeoff is what these strategies are all about…

Strategy #1: High Dividend Growth And Dividend Reinvestment

This dividend investing approach focuses on stocks with lower dividend yields. But with greater potential for rapid dividend growth. Thus increasing dividends per share in future years.

This strategy is perfect for anyone 20-30 years before retirement. Or an individual that will have other sources of income. So, dividend income for retirement will not have to carry the entire workload.

What to look for in the dividend metrics:

- Current dividend yield: ½% to 3%

- Potential for annual dividend growth: 8% to 12%

Let me tell you this. When you own a company that routinely declares large dividend increases. It is very rewarding.

Because you know your investment is on solid ground. And you will soon be enjoying a higher level of dividend income for retirement.

Strategy #2: High Dividend Yield And Dividend Harvest

The next approach for earning dividends emphasizes stocks with higher dividend yields. Unfortunately, going this route for stock selection results in lower dividend growth potential.

However, pursuing higher dividend yields is important in some cases. Mainly for investors at or very near to their retirement years. And needing to maximize current cash flow from dividends and interest.

Also, you can start with strategy #1 when you are younger. Investing for dividend growth and reinvesting dividends.

Then gradually shift to strategy #2 as you get closer to retirement. For higher dividends, to fund your living expenses.

What to look for in the dividend metrics:

- Current dividend yield: 4% to 5% and higher

- Potential for annual dividend growth:1% to 4%

Strategy #3: Balanced Growth And Dividend Income

Finally, the last strategy seeks to find the “sweet spot” between strategies one and two.

Attempting to get as much dividend income today. Without giving up too much opportunity for dividend growth in the future.

What to look for in the dividend metrics:

- Current dividend yield: 3% to 5%

- Potential for annual dividend growth:4 – 8%

Even though I started aggressively dividend investing 20 years before retirement. And could have chosen strategy #1.

Strategy #3 is what I have pursued over time. Because I think it represents the best of both worlds.

Where you can have your cake. And maybe take just a bite or two of it. Without making a hog of yourself!

To quote another one of my favorite sayings: “pigs get fat, but hogs get slaughtered”.

So, let’s you and I be pigs and get fat off our dividends. Not hogs that get slaughtered. At least when it comes to dividend investing.

Okay. Enough of picking on these poor farm animals.

Let’s talk about selecting dividend stocks…

3. Choose The Best Stocks For Your Dividend Retirement Portfolio

Once you have chosen your desired dividend retirement strategy. That best fits with your situation in life.

It makes selecting and investing in the best dividend stocks for your retirement portfolio much easier. Because you have a framework in place that will guide your investment decisions.

So, let’s talk a bit about how to invest in dividend stocks for retirement…

Look At Key Metrics Before Investing

Successful dividend investors examine stocks carefully before investing.

While a lot can go into picking the best dividend stocks. Some metrics are more important than others. When learning how to build a dividend portfolio for retirement.

Let’s discuss…

Dividend Yield And Dividend Growth

We have already covered these metrics fairly well. So, I don’t want to repeat myself.

Since the dividend retirement strategy that you choose to pursue. Will guide you to stocks with the right dividend yields. Also, the dividend growth profile to meet your objectives.

You can dive a little deeper here, into the topic of good dividend yields.

Dividend Safety

When building the best dividend portfolio for retirement income, dividend safety is important too. The last thing you want to do is invest in a company that reduces its dividend after you buy it.

Not only will your dividend income for retirement be reduced. But the stock will usually decline in value too.

If you invest in dividend stocks long enough. You will surely endure one or more dividend reductions. As I have.

Let me tell you. They are no fun.

One way to improve the dividend safety within your portfolio is to assess and avoid excessively high dividend yields altogether. For example, yields much higher than 6% deserve extra scrutiny.

A second way to evaluate dividend safety is to review a stock’s dividend payout ratio. In the most general terms, a lower dividend payout ratio is a better indicator of dividend safety.

On the other hand, a higher dividend payout ratio is not always a bad thing.

Because a good dividend payout ratio depends upon the company. Plus, what business and industry they operate in.

Dividend History

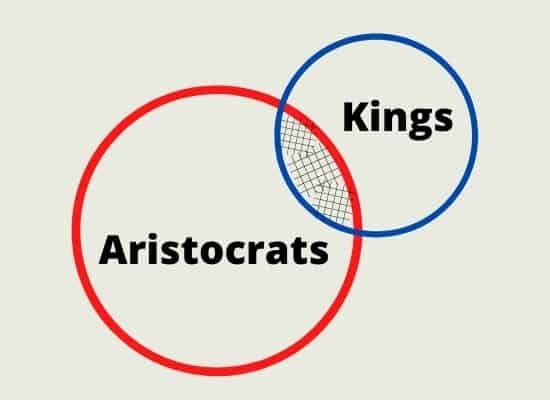

Finally, we have the concept of dividend history. For this, you can look to the Dividend Kings and Dividend Aristocrats.

They are stocks with long and rich dividend histories.

Since longer track records of paying regular dividends to shareholders. And increasing those dividends on an annual basis is very positive.

They are both signs of strong dividend stocks to consider for your retirement portfolio.

Let’s talk portfolio diversification next…

Own Enough Stocks And Diversify Among Them

First, you want to own enough dividend stock for retirement but also diversification purposes. Make sure no one stock makes up too much of your dividend retirement portfolio.

On the other hand, I suggest not buying too many.

Because it takes time to do your research before investing. Plus, you should monitor all the stocks you invest in periodically.

But own too many. And your portfolio becomes difficult to monitor and manage.

So, what number of dividend-paying stocks should you own?

I’d say somewhere between 20 and 25. That is a good number from my perspective.

And here’s another point about diversifying your portfolio…

Ensure Your Stocks Are From A Variety Of Industries

Make sure the stocks in your portfolio represent a variety of different industries.

For example, even if you own 25 individual stocks. If all 25 are electric utilities, then your portfolio is not diversified.

So, try and have representation across these typical dividend-paying industries:

- Utilities

- Energy

- Financials

- Real Estate Investment Trusts

- Consumer Staples

- Health Care

- Materials

- Telecommunications

- Technology

- Industrials

Okay, with all that dividend stock picking background covered. Let’s get to what you want to know.

Specifically, some good dividend stocks for retirement portfolios. I will break them down by each of the 3 dividend retirement strategies I described earlier.

Categorizing these stocks by strategy is part art and part science. Since dividend yields can change quickly as stock prices go up and down.

Finally, these are just some dividend stock suggestions to give you some ideas for further research. After all, it’s your money!

Examples Of Dividend Stocks That Emphasize Dividend Growth

First of all, these companies and their stocks fit strategy #1:

- Abbott Labs (ABT)

- Apple (AAPL)

- Automatic Data Processing (ADP)

- Home Depot (HD)

- Hormel Foods (HRL)

- Microsoft (MSFT)

- NextEra Energy (NEE)

Examples Of Dividend Income Stocks That Emphasize Current Dividend Income

Next, the following stocks work well with dividend retirement strategy #2:

- AT&T (T)

- Altria (MO)

- Enbridge (ENB)

- International Business Machines (IBM)

- Philip Morris (PM)

- Verizon (VZ)

- W.P. Carey (WPC)

Examples Of Dividend-Paying Stocks That Balance Dividend Income Vs Dividend Growth

And finally, these stocks align pretty well with strategy #3:

- 3M (MMM)

- AbbVie (ABBV)

- American Electric Power (AEP)

- Clorox (CLX)

- Coca-Cola (KO)

- Johnson & Johnson (JNJ)

- United Parcel Service (UPS)

Before I move on to our next topic, don’t feel like you need to pick and monitor dividend stocks on your own. Because I don’t, and neither do you.

Top Resources For Building And Maintaining Your Dividend Retirement Portfolio

First, I use the Motley Fool Stock Advisor. For excellent stock picks delivered to my inbox every month.

Second, I like the Simply Investing Report & Analysis Platform. And I like it for two reasons.

Like Motley Fool, Simply Investing also provides recommendations on the best dividend stocks. And when to buy them.

In addition, Simply Investing provides an interactive database covering hundreds of the best stocks. It has all the latest dividend metrics in one place. Perfect for monitoring your portfolio.

You can learn more about Simply Investing here.

Okay. But you say to me, Tom, that all sounds good. But how do you build a dividend portfolio for retirement the easy way?

And my response is…

Use exchange-traded funds (ETFs). Here’s how…

4. Consider The Best ETFs For Your Dividend Retirement Portfolio

Because ETFs are also a solid choice. So, let’s explore this topic…

When To Choose ETFs Versus Individual Dividend Stocks

There are a couple of situations when using ETFs to create a dividend retirement portfolio makes the most sense.

First, when you feel you don’t have the combination of time and expertise. To analyze, select, and invest in individual stocks.

Second, when you are just starting. And do not have enough money to provide for adequate diversification by investing in 20-25 stocks.

Thus, in these cases, choose index funds instead of individual stocks. Here’s how to go about it…

Apply The Same Principles When Choosing Dividend ETFs As Stocks

And the good news is the approach we have already discussed. Doesn’t change much.

First, choose your dividend retirement strategy. Then select index funds that align with your choice.

Here are some examples of ETFs to consider for building your best dividend portfolio for retirement. Once again, I have aligned them with one of the 3 investment strategies.

I specifically like Vanguard dividend ETFs. But I have listed some funds from other good investment houses too.

Examples Of Dividend ETFs That Emphasize Dividend Growth

First of all, these ETFs fit strategy #1:

- Vanguard Dividend Appreciation ETF (VIG)

- Vanguard International Dividend Appreciation ETF (VIGI)

Examples Of Dividend Income ETFs That Emphasize Current Dividend Income

Next, the following ETFs work well with dividend retirement strategy #2. Best for building a high yield dividend retirement portfolio.

- SPDR Portfolio S&P 500 High Dividend ETF (SPYD)

- iShares Preferred and Income Securities ETF (PFF)

Examples Of Dividend-Paying ETFs That Balance Dividend Income Vs Dividend Growth

And finally, these ETFs align pretty well with strategy #3:

- Vanguard High Dividend Yield ETF (VYM)

- Vanguard International High Dividend Yield ETF (VYMI)

- The Real Estate Select Sector SPDR Fund (XLRE)

Okay. Before I wrap up, one last important topic. About dividends and retirement.

5. Best Practices For Living Off Dividends In Retirement (Before & During)

Because I believe you can retire on dividends. But there is more to it than just buying and managing stocks or mutual funds.

For example…

Start Dividend Investing Sooner Rather Than Later

I mentioned at the beginning of this article that dividend investing is a long-term strategy. And it is.

So, the sooner you get started, the better.

Thus, allowing more time to compound your wealth. Before needing to tap that wealth during your retirement years.

Live Below Your Means To Feed Your Dividend Portfolio

Once you have started. Look for ways to feed your retirement dividend portfolio as much fresh capital as possible.

Do this by scrubbing your monthly budget. Looking for ways to make more money and spend less money.

Then funnel the excess cash you create into your dividend investments.

Reinvest Your Dividends Before You Retire

Before you know it, you will want to take your dividends to pay the bills. But until then, reinvest them back into your dividend stock portfolio for retirement.

Time and dividend reinvestment are important keys to compounding your wealth. And increasing your dividend income stream over time.

Keep Your Investment Costs Low

Next, keep your investment costs low. For example, buy your dividend stocks and ETFs using a zero-commission stock broker.

I like the Webull app for fast, commission-free trading. Plus, the app has great stock research capabilities.

In addition, avoid mutual funds that charge high management fees. If you do not want to own individual stocks. Then stick with the low-cost ETFs I mentioned earlier in the article.

Supplement Your Dividend Income During Retirement

Finally, it takes quite a bit of money to live off dividends in retirement.

For example, consider a million-dollar dividend portfolio. A sizeable sum that only a limited number of people may ever attain.

Even by pursuing strategy #2 – high dividend yield and dividend harvest. $50,000 in annual dividend payments may be the most you can safely generate.

So, don’t overlook other potential sources of retirement income such as…

- Social security

- Employer-sponsored retirement accounts

- Private pensions

- Side hustles

- Part-time work

…for making your golden retirement years as financially comfortable as possible.

Okay. That’s it.

Allow me to wrap up with a few parting comments…

How To Build The Best Dividend Retirement Portfolio

Now you know the keys to success. Specifically for building a dividend stock portfolio for retirement.

They are:

- Thinking long-term

- Having a sound investment strategy

- Choosing dividend stocks that are consistent with your strategy

- Considering exchange-traded funds when it makes sense

- Using best practices for how to live off dividends in retirement

Thanks for reading. And good luck with your retirement planning.

If you liked this article, check out more about…

How to Create Dividends for Retirement

Or, our robust archives for dividend stock investors…

Our Handy Dividend Investing Guides

Author Bio: Tom Scott founded the consulting and coaching firm Dividends Diversify, LLC. He leverages his expertise and decades of experience in goal setting, relocation assistance, and investing for long-term wealth to help clients reach their full potential.