Apple Dividend Stock Analysis

Apple’s dividend growth has been attractive in recent years. And Apple stock continues to trade at a high price.

So, let’s closely examine Apple’s dividend metrics and stock. I will do this by walking through an Apple dividend stock analysis.

Some questions I want to answer…

Disclosure: At no cost to you, I may get commissions for purchases made through links in this post.

Is Apple a dividend stock? And if so, is Apple a good dividend stock?

What about Apple’s dividend growth and safety? Is it time to buy Apple stock? Or is the stock price too high?

These are just a few questions I want to address. And I will do so with the aid of my Simply Investing report.

I subscribe to the Simply Investing Report & Analysis Platform. And you may like to read my review: The tools Simply Investing provides a dividend investor.

But before we dig into Apple’s details, I want to point out a few highlights from this article…

Apple Stock Review: Key Takeaways

1. Having paid increasing quarterly cash dividends since 2012, Apple is a dividend stock.

2. However, its dividend yield is low because of the rapid rise in Apple’s stock price. Thus, not providing much income per dollar invested.

3. On the other hand, the combination of regular, rising dividends and large increases in the stock price has made Apple an excellent investment for long-term total returns.

4. But the rise in the stock comes at a price. That being valuation. Leaving me to debate if now is the right time to add to my shares.

5. Regardless, Apple stock fits my goals as a dividend investor and represents a solid long-term stock to hold in my dividend portfolio.

Ready to buy or sell Apple? Or any stock for that matter?

I use the Webull app to trade stocks for free. Its stock information and trading capabilities are very powerful.

There’s much more. So let’s dive in. We will start with a brief review of the company’s operations.

Apple: Company Background

Headquartered in Cupertino, California, Apple is in the business of mobile communication devices, media devices, and personal computers.

In addition, they sell a variety of products related to software, services, accessories, networking solutions, and third-party digital content and applications.

The company’s hardware products include the:

- iPhone smartphone

- iPad tablet computer

- Mac personal computer

- Apple Watch

- Apple TV

Apple’s software includes:

- macOS, iOS, watchOS, and tvOS operating systems

- iCloud

- Apple Pay

Digital content and services are composed of the:

- Apple Music

- iTunes Store

- App Store

- Mac App Store

- TV App Store

- iBooks Store

Now, a few words about Apple stock. Then we will move on to the Apple dividend.

Apple Stock Split History

Apple stock has split several times during its history as a public company. For example, in 2020, the Apple stock split was on a 4-for-1 basis.

So, I will use this opportunity to discuss investing lessons I have learned from stock splits.

Stock splits have little economic consequence. They merely function to bring the stock price down to a lower level.

At the same time increasing the number of outstanding shares. Therefore, market capitalization remains the same, reflecting the company’s value.

What about a shareholder at the time of the split? Once again, nothing happens that has an economic consequence.

Using my Apple shares held in 2020 as an example…

After the stock split, I had 4 times as many shares. With a per-share value of 25% of the pre-split stock price. And now receive dividends worth 25% of the old Apple dividend rate per share.

So, I receive the same cash in my pocket from dividend payments. Thus, as a current shareholder, a stock split has little to no economic value.

Apple Stock Symbol

For your reference, Apple stock trades on the Nasdaq stock exchange. It trades under the ticker symbol AAPL (NASDAQ: AAPL).

Next up. Let’s review all the knowledge needed about dividends on Apple stock.

Does Apple Pay A Dividend?

Yes. Apple pays a dividend.

There are 2 rules here at Dividends Diversify and for my stock portfolio.

First, I only review stocks that pay dividends. Furthermore, I invest in every stock that we study.

Only investing in dividend-paying stocks is one of my financial management philosophies. Other money rules I live by are to manage my money proactively, online, and for free.

To do this, I use Personal Capital. You can too. Since Personal Capital is free to sign up and use.

Next, let’s work through the dividend metrics. Then we will know exactly how Apple’s dividend works.

Apple Dividend Per Share

Like most stocks that pay dividends, Apple has an annual forward dividend rate per share.

The forward dividend is the most recent quarterly dividend paid. Multiplied by the 4 calendar quarters the company pays dividends each year.

By taking the forward dividend and dividing it by the stock price we get the Apple dividend yield…

Apple Dividend Yield

Historically, Apple has had a meager dividend yield. Usually, less than 1%.

And when a stock’s dividend yield is so low. It makes me question whether there are better dividend investments for passive income to invest in.

Let’s explore this thought a bit more…

Why Is The Apple Dividend So Low?

Two things impact a stock’s dividend yield.

First is the annual dividend rate per share authorized by the company’s board of directors. The second is the stock price.

Furthermore, changes to a stock’s annual dividend rate are infrequent. So, most changes to the dividend yield are due to fluctuations in a stock’s price.

Finally, a stock’s dividend yield moves in the opposite direction of the stock price.

Putting these pieces together, here is the result.

Apple’s stock price has risen dramatically over the long run. Thus, Apple’s dividend yield percentage has remained low.

I prefer to purchase stocks with higher dividend yields. The best dividend stocks for me have yields between 3%-5%. But I do make exceptions to this rule. Especially for such a high-quality company as Apple.

Let’s continue our Apple stock analysis. And review a few other facts about the Apple dividend.

How Often Does Apple Pay Dividends?

Apple’s dividend frequency is every 3 months or 4 times per year. Each quarterly dividend payment is one-fourth of the annual rate.

What Is The Apple Dividend Schedule?

Here are some of Apple’s key dividend dates. That you want to be aware of.

First, Apple pays dividends in the following months: February, May, August, and November.

Furthermore, the Apple dividend is typically paid by the 15th day during these months.

Finally, historically the dividend is paid on a Thursday.

So, the actual payment date can range between the 12th and 18th days. During the month Apple pays its dividend.

Since Apple’s dividend payable dates can vary. It is a good practice to check its investor relations website. Or their latest dividend announcement press release.

These sources will provide the exact date for each quarterly dividend that is approved and upcoming.

When Is The Apple Ex-Dividend Date?

As a potential new shareholder or one looking to make an add-on buy, you may want to receive the next dividend payment from Apple. To do so, you must complete your investment before the ex-dividend date.

Apple’s ex-dividend date falls on Friday before when its dividend is paid.

Once again, refer to Apple’s website for the precise date. Or its quarterly press release announcing the next dividend.

On the other hand, be a long-term buy-and-hold investor in Apple stock like me. Then you will be sure to receive every dividend the company approves, declares, and pays. There is no need to worry much about the dividend dates.

So, let’s talk about the dividend history of Apple next…

When Did Apple Start Paying Dividends?

The answer to his question is it depends. Depends on what?

Whether you want to know the first time Apple started paying dividends. Or, the second.

I will assume we are talking about the second time. That being the case, Apple’s recent dividend history started in 2012.

Apple – A Dividend Achiever

First, Apple management has increased the dividend yearly since it was reinitiated in 2012. Furthermore, Dividend Achievers are companies with increasing dividends for 10 consecutive years.

But there is a little more to Apple’s dividend history. Versus what has happened since 2012. Let me explain…

Apple Dividend History

Before 2012, the company paid a dividend to its shareholders. They did so from 1987 to 1995.

After 1995, the Apple dividend was suspended. Until it was reinstated in 2012.

It is clear management has debated. The benefits and drawbacks of paying dividends.

Apple Dividend Growth Rate

We know that Apple’s dividend percentage is meager. When this is the case, I want this stock to have fast dividend growth.

Let’s say about 8% each year or more.

Because organic dividend growth is important. It’s 1 of the 3 concepts in building dividend wealth.

Over the long term, Apple’s dividend growth has met my expectations over the long run.

But what about the more recent Apple dividend raises?

Recent Apple Dividend Increase

I thought recent Apple dividend increases were on the low side.

So, I am anxious to learn about the next Apple dividend increase and the new payout rate.

For the record, Apple typically announces its dividend increases in late April. Or early May.

This company’s business fundamentals and cash flow are strong. So, I think investors deserve larger dividend increases than what has been offered recently.

Can dividend policy give us any clues about the future of Apple’s dividend? Let’s see…

Apple Dividend Policy

To my knowledge, Apple does not communicate a formal dividend policy to the public.

While I prefer it when a company is transparent about its intentions for dividends. Apple’s approach is not a red flag. Many companies operate this way.

I do know this. This company is very proud of the cash returned to shareholders. Both in the form of dividends and share repurchases. They routinely update and present a schedule on their website that shows their history in this area.

But Apple does have a dividend policy. Even if they choose not to communicate it to us.

And from looking at Apple’s actions, I can put together a dividend policy statement on their behalf.

These are my words. Not Apple’s…

The dividend policy of Apple is to:

1. Pay quarterly recurring cash dividends

2. Announce an annual increase to the quarterly dividend during the 2nd calendar quarter of each year

3. Share approximately 15-25% of accounting earnings with investors in the form of dividend payments

Actions speak louder than words, as the saying goes. And this is how Apple has been operating since it reinitiated the dividend in 2012.

Furthermore, it is important to understand one thing related to dividend policy. Specifically, companies are not required to pay dividends. And a company may change its dividend policy at any time.

Next, let’s discuss the company’s business fundamentals.

Revenue Gains Support Apple Dividend Growth

I will start with the “top line”, specifically revenue.

Apple’s revenue hit a historical peak in 2015 at $234 billion. During 2016, as sales volumes declined, there were concerns about the future revenue-generating capacity of the company.

First Revenue Uncertainty

At the time, the iPhone accounted for a large portion of the company’s revenue and profit. The smartphone market was maturing. And their competition was catching up.

In addition, customers were upgrading their phones less frequently. This was mainly due to the annual changes from phone to phone becoming less dramatic.

As sales slumped, so did the stock price. The stock made a bottom in early 2016.

Then Apple Revenue Growth Resumes

Since then, revenues and the stock have taken off. The company has gone through a fundamental transformation.

They have turned into a business centered on not just how many devices it ships. But into one built around high-end features and services for those devices.

Revenue peaked again in fiscal 2018 checking in at a little over $265 billion. After a pause in revenue growth in 2019. Revenue growth has been dramatic!

Thus, I would conclude that Apple is a high-growth stock with a dividend.

Revenue & Product Pricing

Finally, Apple has implemented a premium pricing strategy with its newer iPhones.

High prices may protect and even enhance their profit margins. On the other hand, higher prices may come at the expense of lower unit volumes in future years.

Apple Dividend Payout Ratio Based On Earnings

Apple’s earnings have been historically strong. They have grown nicely in the past.

Based on earnings, Apple’s dividend payout ratio runs comfortably low.

A lower dividend payout ratio is a positive metric. It shows the company has ample room to raise dividends in the coming years. Or withstand an earnings drop without needing to reduce the dividend to conserve cash.

Apple Dividend Payout Ratio Based On Cash Flow

Apple generates plenty of free cash flow. Most recently the dividend consumed just a small fraction of that cash.

Management directs most of their excess cash toward share repurchases. That’s another shareholder-friendly practice, along with paying dividends.

However, I would prefer if a larger portion of their cash flow was directed toward dividend increases. Since the company has more than enough dividend payment capacity to do so.

Next, let’s debate the future of Apple’s dividend.

Apple Dividend Growth Forecast

Given the modest payout ratios, the Apple dividend rate has room to be increased even if earnings growth stalls out.

But, I do not expect profits to falter. Earnings may not grow as fast as they have over the past seven years. But they should grow 6-8% annually assuming the company continues to invest in its future.

Then by holding the dividend payout ratio constant. Shareholders would be rewarded with a similar amount of dividend growth.

So, for my planning purposes, I will assume a 6-8% annual Apple dividend growth rate in future years.

I think this is a very sustainable level of dividend payment growth. But we need management to make it happen. Easier said than done, I suppose.

Maybe I will be surprised by higher dividend growth. Unlike other slower-growth technology stocks that pay dividends.

Next, let’s check on Apple’s financial position. I have a feeling it will be solid. But let’s complete our due diligence.

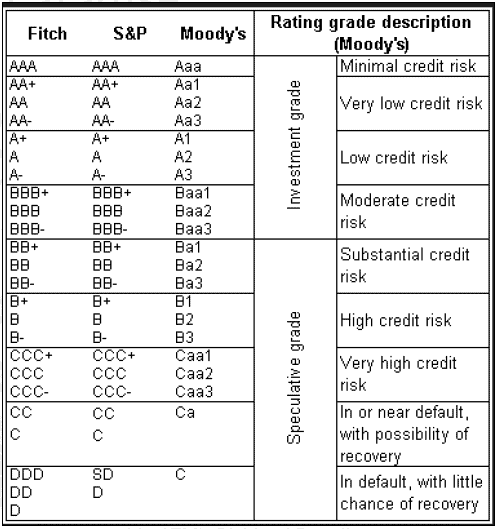

We will look at credit ratings. Also, capital structure in the form of debt to equity.

Apple Credit Rating

Apple carries a strong investment-grade credit rating from Moody’s and S&P, respectively.

Credit Rating Evaluation Grid

As of this writing, only two US companies hold the highest triple-A credit rating. They are Johnson & Johnson and the software company Microsoft.

So, based on the credit rating, it is pretty clear that Apple will be able to meet both its short-term and long-term obligations as they come due.

Apple Balance Sheet

Apple typically carries a modest debt-to-equity ratio. But that doesn’t tell the full story.

Since the company also carries a large amount of cash and short-term marketable securities on its balance sheet. Thus, if management chose to, they could pay off a sizeable portion of debt with these liquid assets.

So, taking the credit ratings and capital structure from the balance sheet into account, Apple has a firm financial position.

And what does this strong financial position provide? Dividend safety. A few words on that topic next. Since seeking secure dividends is one of the top dividend investing rules I live by.

Apple Dividend Safety

The Apple dividend appears very safe from a reduction in the foreseeable future. I base this assessment on several areas we have reviewed so far.

Specifically,

- The company’s solid business fundamentals

- Apple’s dividend rate compared to earnings and cash flow (payout ratios)

- Apple’s dividend history and a low dividend yield

- Strong credit ratings and balance sheet

So, we have spent a lot of time on Apple’s dividend.

But an Apple stock analysis would not be complete without looking at the stock’s valuation.

We will check that area next. And then wrap this up.

Apple Stock Valuation

I like to judge a stock value with several methods and sources. Then conclude value.

Several of the methods I like to use are:

- Apple dividend discount model

- Apple’s stock price-to-earnings ratio

- Simply Investing Report

Note that this valuation discussion is at the time of this article update. Furthermore, value metrics can change quickly as stock prices and business circumstances shift.

The Simply Investing Report is a great resource. It provides an always up-to-date call on valuation.

Apple Dividend Discount Model

The single-stage dividend discount model considers several factors we have covered thus far. And one item we have not. They are…

- Current annual dividend payment

- Projected Apple dividend growth

- My desired annual return on investment

The calculation indicates Apple stock is overvalued using the dividend discount model assumptions above.

This is not surprising to me. Because of Apple’s low dividend percentage.

Simply Investing Report

The Simply Investing report assesses stock valuation using several metrics including:

- Stock price to earnings ratio

- The current dividend yield versus the historical dividend yield

- Stock price to book ratio

Stocks meeting their criteria using these metrics are considered undervalued and trading at an attractive price for purchase.

But based on my last check of the Simply Investing report. Apple stock is considered overvalued.

Apple Stock Price to Earnings Ratio

The Apple stock price to the last year’s earnings looks slightly high.

It doesn’t seem that long ago when Apple’s price to earnings was in the teens. Back in the day when its growth prospects were being questioned.

Is It A Good Time To Buy Apple Stock?

We have looked at several valuation methods. And it appears the stock is overvalued at the time of this article update.

Furthermore, the low dividend yield is an additional consideration for me. Leading to my investment conclusion…

Apple Stock: Buy Or Sell Or Hold

I have no plans to buy Apple stock at this time. On the other hand, Apple is a great company.

So, I am happy to be a long-time Apple shareholder. And intend to hold my shares. Having no intention to sell anytime in the foreseeable future.

Apple Stock Analysis Conclusions & Wrap Up

Apple stock has grown to a mid-size dividend stock in my dividend investing portfolio. But the low dividend yield and the recent level of dividend increases during the last few years lead me to this question…

Is Apple A Good Dividend Stock?

Apple isn’t a typical dividend stock, in my opinion. First, it doesn’t operate in a traditional steady-demand industry like consumer staples or utilities. Thus, you probably won’t be able to fund your retirement expenses from Apple’s dividend payments.

Furthermore, the company’s growth partly depends on managing short product life cycles. Also, continual and consistent product and service innovation are required for growth.

However, I believe Apple is a good dividend stock. It can be a solid holding in a dividend portfolio for regular income.

Finally, the company is building a long track record of dividend increases. But, the Apple dividend percentage is lower than I prefer. And lower than more traditional dividend stocks. But dividend growth and share price appreciation have more than made up for that.

So, I will let this winner ride on in my portfolio. But look to put new money in other dividend investment ideas for now. There are many other good dividend-paying stocks in the market for me to consider before adding to Apple at this time.

If You Enjoyed This Apple Stock Analysis – Here’s More Reading

My Favorite Dividend Investing And Finance Resources

- Trade stocks for free with the Webull app

- And stock analysis from Motley Fool

- Or dividend stock recommendations from Simply Investing

- Manage your finances for free with Personal Capital

Disclosure & Disclaimer

Author Bio: Tom Scott founded the consulting and coaching firm Dividends Diversify, LLC. He leverages his expertise and decades of experience in goal setting, relocation assistance, and investing for long-term wealth to help clients reach their full potential.