Will The Coca-Cola Dividend Continue To Rise?

It’s time for a Coke dividend review.

Let’s take a close look at all of the Coca-Cola dividend metrics. We will do this by working through a Coca-Cola stock analysis.

Is Coca-Cola a good dividend stock? Are Coca-Cola shares (NYSE: KO) a good investment? Are Coke’s shares a good buy?

I want to answer these questions for you and many more.

Disclosure: At no cost to you, I may get commissions for purchases made through links in this post.

Let’s cover 2 of them right away. They will serve as key highlights from the rest of this Coca-Cola stock analysis.

Is Coca-Cola A Good Dividend Stock?

Coke has paid quarterly dividends since 1920. And management has been increasing the dividend annually since 1963.

The company has strong brand recognition. Combine all of these facts with Coke’s consistent business model and my answer is yes. Coca-Cola is a good dividend stock.

Are Coca-Cola Shares A Good Investment?

Investments, including dividend stocks, should always be evaluated against one’s investment objectives. If your objectives include:

- Current dividend income

- Future dividend growth

- Long-term share price appreciation

- Living off dividend income

Then, yes. Coca-Cola shares are a good investment.

Next up, let’s address a big issue that’s been on my mind as a dividend investor…

Analyzing Coke Stock Using A Long Term View

The global pandemic and changing consumer preferences have taken a toll on Coke’s business. Why?

Because many soft drinks are consumed away from home, also, people are seeking healthier beverage options.

Coca-Cola’s beverages are enjoyed in restaurants, theatres, and sports venues. Furthermore, many of these places were temporarily shut down. Finally, this led to a short-term negative impact on Coke’s performance that the company has worked hard to overcome.

However, changing consumer preferences may be here to stay and a tougher problem to solve.

Most importantly, I’ve been a long-time Coke shareholder. And I hope to continue holding forever.

So, I will take the long-term view while completing this Coca-Cola stock analysis.

Thinking long-term is 1 key to becoming a successful dividend investor.

So, with that long-term approach in mind, let’s dive into our Coca-Cola stock analysis and dividend review right now.

Company Background

Coke is a leading beverage company. They own some of the world’s most well-known and powerful brands.

Their namesake product, Coca-Cola, was created in 1886. It was invented by a doctor. And first sold in an Atlanta, Georgia pharmacy selling beverages and other convenience items.

Since then, the product and especially the company behind it have evolved. Currently, Coke has a large portfolio of beverage brands that include:

- Coca-Cola

- Diet Coke

- Minute Maid juices

- Honest Tea

- Dasani

- Glaceau water drinks

- Power Ade sports drinks

Source: Coca-Cola Company Brands

Coke’s Business Objectives

Coke is unlike Pepsi (NASDAQ: PEP), which has a large snack food component to its business.

Target Beverage Categories

In contrast, Coke’s vision is to build a total beverage company. They desire to be a dominant player in several beverage categories:

- Sparkling soft drinks

- Juice, dairy, and plant-based beverages

- Hydration products

- Tea and coffee

- Energy drinks

Coke’s Category Growth Tactics

The company seeks to grow in these categories through:

- Product and packaging innovation

- Deeply penetrating emerging international markets

- Making disciplined investments in both new and mature products

Long-Term Financial Targets

Coke’s management believes that by successfully achieving their business objectives they can deliver the following annual financial targets:

- 4-6% organic revenue growth

- 6-8% operating income growth

- 7-9% earnings per share growth

Source: Coca Cola financial strategy

Who Owns A Lot Of Shares In Coca-Cola?

We are going to dig into Coke’s dividend metrics in a moment. But first, a fun fact.

According to CNN Business, Berkshire Hathaway holds many shares of Coca-Cola stock. As an investor, it’s good to know you have Warren Buffett on your side.

Berkshire Hathaway, Mr. Buffett’s company, knows how to find and identify good dividend stocks. The company is a big investor in some of the other stocks I cover here at Dividends Diversify.

iPhone maker Apple comes to mind immediately. Other dividend stocks Berkshire owns or has owned include Kraft Heinz in the packaged food sector. And JPMorgan Chase & Co. in the banking area.

And for the record, the investment company Vanguard is another large shareholder in KO shares. Because Coca-Cola stock is held in many Vanguard exchange-traded funds and mutual funds.

Facts And Figures About The Coca-Cola Dividend

Next, let’s review everything we need to know about the Coke dividend. Because knowing how a stock dividend works matters! Especially for Coca-Cola.

Coca Cola Dividend Per Share

First of all, like all dividend stocks. Coke has an annual forward dividend.

Simply put, the forward dividend is the last dividend approved by the company’s board of directors. Multiplied by the number of times dividends are paid each year.

Take the forward dividend. And divide it by the stock price. Then you have dividend yield.

Coke Dividend Yield

On the surface, Coke’s dividend yield looks okay to me. Regular readers know I prefer buying stocks with 3-5% dividend yields.

Many times, the dividend yield is below this range. The fact is, rarely is it higher.

But, there is much more to dividend investing versus success with high dividend yields.

So, let’s keep digging into Coke’s dividend.

Does Coca-Cola Pay Monthly Dividends?

Coca-Cola does NOT pay a monthly dividend. Of course, there are ways to get dividends every month.

One such way is to invest in stocks that pay monthly dividends. Realty Income is my favorite company that does so. Known as the monthly dividend company.

And there is another way. You can construct your dividend income portfolio to achieve the goal of receiving consistent amounts of monthly dividends.

Monthly dividends are a great topic. But let’s get back to our next series of questions and answers about Coca-Cola dividends.

How Often Does Coca-Cola Pay Dividends?

Coke pays dividends 4 times per year. This frequency is typical for most US-based dividend stocks.

What Months Does Coca-Cola Pay Dividends?

On the other hand, the company’s dividends are not quarterly or every 3 months. Coca-Cola dividends are paid in April, then July, October, and December.

This is an unusual dividend payment pattern. Not one I’ve seen followed by other dividend stocks like Coca-Cola.

Coca Cola Ex Dividend Date

As an investor in Coke, you must complete your purchase by the ex-dividend date to receive the next stock dividend payout. Coca-Cola’s ex-dividend date falls in the month before it pays dividends.

During March, June, and September, Coke’s ex-dividend date is in the middle of the month. In November, it is near month end.

The ex-dividend date is slightly different each quarter. So, checking Coke’s dividend information on its investor relations website is best.

You can get the exact date for each dividend payment there.

Coke Dividend History

Coca-Cola has a very long and proud dividend history. It is one of those companies where good money can be made from dividends over the long run.

Thus, I want to cover a couple of important points on dividend history next.

When Did Coca-Cola Start Paying Dividends?

Coke’s initial public offering (IPO) was on September 5, 1919. The company started paying dividends in 1920. And has paid a dividend every quarter since then.

Most noteworthy, dividends are highly relevant to this company’s culture.

How Many Years Has Coke Increased Its Dividend?

Coke has been increasing dividends annually every year since 1963.

This may just be a coincidence. But another stock I own and cover at Dividends Diversify has a similar dividend increase streak.

Who is that? Johnson and Johnson (JNJ).

Furthermore, this streak of dividend increases qualifies Coca-Cola as a Dividend King. Dividend Kings are those rare and special companies who have increased their dividend payouts for at least 50 consecutive years.

Are you interested in Dividend Kings? They are a great resource if you are looking for investment ideas.

Then, here are a few others that I have reviewed. They typically include companies that provide essential goods and services that never go out of favor.

Dividend Kings: Consumer Goods Sector

- Altria Group, Inc.

- P&G

Kings Of Dividends: Industrial Sector

- Emerson Electric

- GPC

Dividend Kings: Food Sector

- Hormel Foods

- Sysco

Consistent performance is key to becoming a Dividend King. It is impossible to increase dividends for 50+ years without a stable and consistent business model.

Are you still looking for more investment ideas?

I use the Simply Investing Report. It is full of high-quality dividend stock recommendations. You can learn more about Simply Investing here.

Now, let’s get back to our Coca-Cola stock analysis and dividend review…

We know that Coke has a long and impressive dividend history. But what does the Coke dividend growth tell us Let’s talk about that…

Coca-Cola Dividend Growth Rate

Unfortunately, Coke’s dividend growth rate has been slowing. Recent dividend increase announcements confirmed this trend.

We will look at the business fundamentals in just a moment to see why. But first, a few words on Coke’s dividend policy.

Coca-Cola Dividend Policy

I like it when a company communicates its intention for future dividends. In the past, Coke has not disappointed me in this regard.

Because I found this comment buried in the company’s financial strategy. Stating management’s intention for the dividend.

“Continue to grow dividend with a target of 75% free cash flow payout over time.”

I like that Coke has included the word “grow” in its dividend policy statement. Dividend growth is important to me as a dividend investor.

This is a nice example of a communicated dividend policy. On the other hand, it is important to understand that companies are not required to pay dividends. And they can change the dividend policy at any time.

Okay. Now we know a lot about Coke’s dividends.

Let’s check on some important business fundamentals next. Maybe they will shed some light on Coca-Cola’s dividend growth rate.

Revenue Trend

Coke’s revenue has dropped significantly in recent years. Almost by one-third from top to bottom.

Refranchising The Bottling Operations

The revenue decrease is partly due to selling its company-owned bottling operations to independent businesses.

The return to local bottling ownership was known inside the company as “refranchising.” The local bottlers sell and distribute Coke drinks to stores in every community.

By now, Coke has completed the refranchising of the United States bottling system along with the bottling operations in China. And they helped create a new bottling partner to serve most of Japan.

Other Revenue Headwinds

In addition to declining revenues from refranchising, they often face revenue pressure from foreign currency translation. This occurs when the US dollar strengthens.

Furthermore, Coke has suffered declining sales volumes. Reduced demand is partly due to shifting consumer preferences away from carbonated beverages.

Fortunately, with the refranchising effort completed. Coke’s revenues have stabilized.

Finally, the pandemic put a dent in revenues as people consumed fewer beverages away from home. However, once again, that event has passed.

Looking long-term, management expects revenue to grow low to mid-single-digit percentages.

Coca-Cola Dividend Payout Ratio Based On Earnings

Coke’s accounting earnings are hard to interpret. They are full of one-time adjustments. Some of these adjustments are for tax law changes in addition to gains and losses from selling their bottling operations.

Until 2019, earnings had been declining. This was also mainly due to the sell-off of the bottling operations.

By selling the bottling operations, Coke has gone through a big transformation. They have become a smaller and less capital-intensive business.

On the other hand, profits as a percentage of sales have increased. However, profits on an absolute basis were negatively impacted.

Similar to revenues, earnings are expected to stabilize and grow now that some of the challenges I have discussed are behind them.

With all of that in mind, the Coca-Cola dividend payout ratio has been high. And higher dividend payout ratios compromise future dividend growth.

Okay. Since Coke’s accounting earnings have been so erratic, let’s discuss Coke’s dividends versus free cash flow and see what it tells us.

Since our dividends are paid in cash, this evaluation is critical.

Coca-Cola Dividend Payout Ratio Based On Cash Flow

The bottling transition resulted in profit and cash flow reductions. That created a very high dividend payout ratio for a couple of years.

Most noteworthy, dividends paid exceeded free cash flow for a short time. I believe this is the primary reason Coke’s dividend growth declined.

So, it has been a good sign to see Coke’s dividend payout ratio trending lower.

Coca-Cola Dividend Growth Rate Forecast

As I have mentioned, management has communicated a plan for future dividends.

They intend for their regular and recurring dividend payments to grow as a function of free cash flow. And target a 75% payout ratio based on the free cash flow over time.

So, what does all of this mean for future dividend growth?

It indicates that financial resources are in place to fund future dividend growth.

But still, I expect near-term dividend growth to be rather low. On the other hand, I expect long-term dividend growth to be much better.

So, I’m taking a long-term view. And will use a 5% long-term dividend growth rate for planning purposes.

My Coke dividend forecast mainly takes into account 2 things. First, Coke’s financial growth targets. Furthermore, the company’s stated dividend policy.

Coke Financial Position

Next, let’s take a look at the company’s financial position. Then I will have the last information required to judge Coke’s dividend safety.

Debt & Capital Structure

Coke carries a large amount of debt. Their debt-to-equity ratio checks in at a relatively high level.

However, as a comparison, Pepsi’s debt-to-equity ratio is also pretty high.

Credit Ratings

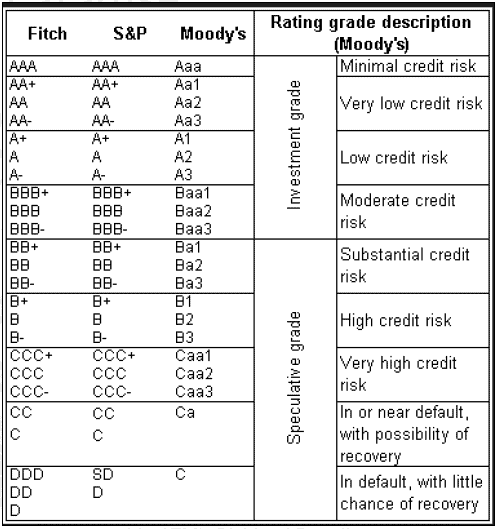

Coke has solid investment-grade credit ratings from Moody’s and S&P, respectively.

Source: FINRA Bond Center

The ratings indicated low credit risk as shown in the table above.

Financial Position Summary

In summary, Coke’s debt levels are slightly troublesome to me. Offsetting my concerns are the high credit evaluations. And the consistency of the free cash flow generation from Coke’s business.

Management has also stated in past investor materials their objective to reduce debt leverage in future years.

Coca-Cola Dividend Safety

Due to Coke’s overall financial strength and stability, its dividend appears safe from a reduction.

I support my view regarding high dividend safety because of the following factors:

- Coke will go to great lengths to protect its status as a Dividend King

- Strong credit ratings by the major rating agencies

- Consistency of cash flows

- The drag from transforming the business through refranchising is over

Coke Stock Valuation

Let’s judge value in several ways:

- Dividend Discount Model

- Dividend Yield

Coke Dividend Discount Model

The single-stage dividend discount model considers several factors I have discussed thus far.

- The current annual dividend payment

- Projected long-term dividend growth

- My desired annual return on investment

Using these assumptions, the dividend discount model example suggests Coke’s shares are overvalued.

Coke Dividend Yield As A Valuation Basis

I like dividend yields in the 3-5% range to build passive income from dividends.

Furthermore, with Coke’s low dividend growth. I want to be at the higher end of my desired dividend yield range to justify additional purchases.

So, I would only buy more Coke stock at a dividend yield of at least 4%.

Is Coke Stock Overvalued?

Looking at the valuation, I believe Coke stock is slightly overvalued. For me, a good value lies at a lower price than where KO is trading.

Also, take note that valuation metrics can change quickly. Either due to stock price volatility. Or changing business fundamentals.

Thus, I like and use the Simply Investing Report & Analysis Platform. To get a current and up-to-date call on stock valuation. Whenever I need it.

And last I checked, Simply Investing also had an overvalued call on KO stock.

Before I wrap up, I want to ensure I cover all of the questions I posed at the beginning of this article. Here is one question I frequently get from readers.

How Do I Buy Coca Cola Stock For Dividends?

Investors most commonly buy stock through brokers. I buy and sell stocks using the Webull app. It is a great tool and free to set up and use.

It takes just a few minutes to open your account. Then, link your bank account. And deposit some cash.

For a limited time, Webull is giving away free stock. So open and fund your Webull account today. Then you will be ready to buy Coke stock.

Don’t have a lot of money? That’s okay.

You can buy a fractional share of Coke for less than $100. Then, when Coke pays dividends, they will be deposited directly into your Webull account.

Next, as your finances grow, you may need a tool to see your entire financial picture. You may have investments in multiple accounts.

Plus, it would be best if you manage your spending. And assess your readiness to retire.

For this task, I use Personal Capital. Best of all, Personal Capital is completely free to sign up for and use.

Coca Cola Stock Analysis & Dividend Review: Final Thoughts

Coke has completed a major business transformation. The company is now smaller, more focused, less capital intensive, and generates higher profit margins.

Management has had to navigate reduced consumption away from home. Long-term, they need to leverage their product portfolio and brand power across multiple beverage categories and distribution channels to grow profits and cash flow to support a rising dividend.

Coke’s been one of my long-term “buy and hold” investments in my dividend growth stock portfolio. I intend to hold for the long term.

At the current stock price, the combination of “lowish” dividend yield and slow dividend growth is not compelling to me. I would consider add-on purchases only if the share price moved lower.

Further Reading About Dividend Investing And Dividend Stocks

- A good resource for utility stocks that pay dividends

- Book review: The Little Book of Big Dividends

- A review of the Simply Investing Report for dividend stocks

My Favorite Investing And Personal Finance Resources

- Webull for free online stock trading (and get free stock)

- Simply Investing for quality dividend stock recommendations

- Personal Capital to manage all of your finances for free

Author Bio: Tom Scott founded the consulting and coaching firm Dividends Diversify, LLC. He leverages his expertise and decades of experience in goal setting, relocation assistance, and investing for long-term wealth to help clients reach their full potential.