Our Best Vanguard Three-Fund Portfolio Paying Dividends!

A Vanguard 3 fund portfolio is a popular choice. Here is why I would like to talk about it…

Not long ago, I wrote an article reviewing the Vanguard High Dividend Yield ETF (VYM). Shortly thereafter, one of my readers posed an interesting question to me.

He did so on Twitter and asked…

“How about building a dividend-paying ETF portfolio?”

Disclosure: At no cost to you, I may get commissions for purchases made through links in this post.

And I responded…

“It certainly can be done. You could use VYM and its international counterpart, VYMI. Just to keep it simple”.

After pondering the reader’s question…

I thought it was an excellent topic to cover. To add to our library of investment articles.

Certainly, it deserved more attention than just a spur-of-the-moment Twitter tweet on my part.

So, let’s dive in…

How To Build A Vanguard 3 Fund Portfolio Paying Dividends In 4 Easy Steps

Here’s my suggestion for building the portfolio. Broken down into 4 simple steps:

- Select your three funds

- Choose your asset allocation

- Make your investments

- Rebalance on an annual basis

We will dive into each of these steps in a moment. But first, a little background information…

Dividend Stocks Vs Index Funds

First of all, let’s touch on the dividend stocks vs investing in funds debate.

Since individual dividend stock selection is not for everyone. To do it right, it takes clearly defined investment objectives, time, and research.

If you like those types of activities, that’s great. Then you should check out our model portfolio.

It is full of individual dividend stocks. And more, because each article is linked to a comprehensive dividend stock analysis.

But since individual stocks aren’t for everyone. We will dig into how to build a Vanguard three-fund portfolio paying dividends.

And the great thing is, you can get started without a lot of money.

What Is The Vanguard Three-Fund portfolio?

Bogleheads popularized the Vanguard three-fund portfolio. It is an interesting investment term.

So, let’s discuss it…

What Are Bogleheads?

Bogleheads are devoted followers of John Bogle. He was the founder of the investment firm, Vanguard.

They believe in…

- Investing at a young age

- Living below one’s means

- Regular saving

- Broad investment diversification

- Sticking to one’s investment plan.

Source: Bogleheads.org

What Three Vanguard Funds?

Then What three funds go into the portfolio?

For Bogleheads, the answer to the question “what mutual funds should be used in a three-fund portfolio,” is very broad.

They say, “low-cost funds that represent entire markets.”

But, if you ask different Bogleheads to choose funds. For a three-fund portfolio.

You will get different fund choices. On the other hand, they should have these main characteristics:

- Low cost

- Representation of entire markets

From Vanguard’s core funds, Bogleheads believe the best funds for a three-fund portfolio are:

- Vanguard Total Stock Market Index Fund (VTSAX)

- Vanguard Total International Stock Index Fund (VTIAX)

- Vanguard Total Bond Market Fund (VBTLX)

Source: Bogleheads.org – Three Fund Portfolio

The Vanguard 3 Fund Portfolio Paying Dividends

For building our 3 fund ETF portfolio paying dividends. We will have to deviate slightly from the Bogleheads classic definition.

Here’s why…

Not All Stocks Pay Dividends

Because we want to limit our stock selection. To only those companies that pay dividends for the portfolio income they provide.

So by definition, the funds I will choose will not represent entire markets.

Since many stocks in the stock market do not pay dividends. For example, a well-known company like Amazon comes to my mind immediately.

Exchange Traded Funds (ETFs)

Furthermore, we will build our portfolio with super low-cost ETFs per my reader’s suggestion. Rather than traditional open-end mutual funds.

The differences between the two types of funds are not significant for our purposes today. Thus, I will leave these differences for an article on another day.

Related: 60+ investment assets that appreciate in value

So we will bend the rules just a little to build our Vanguard three-fund portfolio paying dividends. I hope the Bogleheads will understand.

Okay. With that background information taken care of.

It’s now time to go through the 4 easy steps to build a Vanguard 3 fund portfolio…

Step 1: Select Your 3 Vanguard Funds

Let’s get started by choosing between the different fund types. All information for the funds is sourced from Vanguard’s website.

First Fund – US Stocks (VYM)

The first fund selection should come as no surprise. It is the Vanguard High Dividend Yield ETF (VYM).

VYM tracks the FTSE high dividend yield index. The index is comprised primarily of US-based stocks that are characterized by higher than average dividend yields.

Trailing dividend yield – 2.7%

Expense ratio – .06%

Related: Vanguard High Dividend Yield ETF review.

Second Fund – International Stocks (VYMI)

For our second fund, we will go with VYM’s “close cousin”. It is the Vanguard International High Dividend Yield ETF (VYMI).

VYMI seeks to track the performance of the FTSE All-World (excluding the US) High Dividend Yield Index.

The fund provides a convenient way to get exposure to international stocks that are forecasted to have above-average dividend yields.

Trailing dividend yield – 3.9%

Expense ratio – .28%

As is typical with many international stocks versus US stocks. The dividend yield of VYMI is higher than VYM’s.

But the fund also carries a slightly higher expense ratio.

Related: Vanguard International High Dividend ETF review

Third Fund – US Bonds (BND)

For our third fund, we will stay close to the standard Boglehead fund recommendation. That is the Vanguard Total Bond Market ETF (BND).

According to Vanguard, the fund:

- Provides broad exposure to US investment grade bonds

- Offers relatively high potential for investment income

- Tends to rise and fall modestly in value

- Is appropriate for a reliable income stream

- And is appropriate for diversifying the risks of an all-stock portfolio

Trailing income yield – 1.6%

Expense ratio – .035%

For clarification, BND is not a dividend stock fund. Since bonds and loans pay interest, not dividends.

If you want a pure dividend stock ETF portfolio. Then drop this one and invest only in the first two.

But for today’s purposes, we will stick with the Vanguard three-fund portfolio concept.

Related: Vanguard Total Bond Market Index Fund ETF review

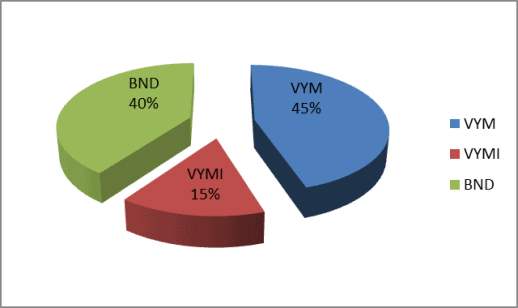

Step 2: Choose Your Asset Allocation

Now that we have our funds selected. We need to decide how much money to put in each one.

One investment strategy says choose your allocation of money to the three funds by your age.

First of all, the rule of thumb is to take your age and invest that percentage in bonds. Then take the rest and invest it in stocks.

Furthermore, split the stock percentage by 75% US and 25% International. This is a target asset allocation for example purposes.

Your allocation may be different. Depending on your age, risk tolerance, and investing philosophy.

For example, if you are 40 years old. You would allocate the amount of money you have to invest between the Vanguard three-fund portfolio like this:

Step 3: Make Your Investments

Next, make your investments.

Divide up whatever amount of money you have. Put it into shares of the 3 funds based on your asset allocation percentages.

Of course, to make your investments. You need a brokerage account.

I like Webull. First of all, it’s free and easy to set up.

Furthermore, there are no commissions.

Finally, the Webull app has some great capabilities. Ready to go as you progress along your investing journey.

Webull is an excellent choice.

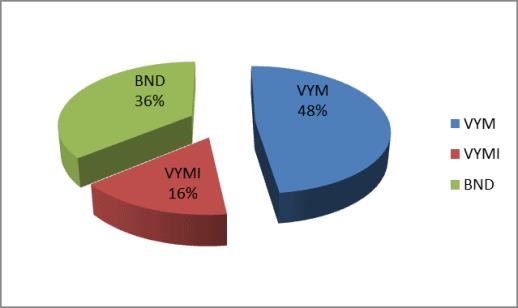

Step 4: Rebalance Your Three Fund Portfolio

Rebalancing is the act of bringing your investments back to the target asset allocation.

So, review your three-fund portfolio annually. Then rebalance it.

Once per year should be sufficient. Twice a year is okay too.

So, let’s say that at the end of the first year, the stock market did really well and the percentage of your holdings in each Vanguard fund looks like this:

Rebalancing says you should sell off a portion of VYM and VYMI. Then reinvest the proceeds into BND to get back to your target asset allocation.

This forces an investor to sell higher-performing investment assets. While buying lower-performing ones.

Buying low and selling high is usually a solid investing strategy!

Okay. We have reviewed the 4 steps. But, I have a little more before we wrap up.

So hang with me for another minute…

Performance And Advantages Of A Vanguard 3 Fund Portfolio

Because I would like to touch on two important points.

First, what kind of investment returns can you expect from a Vanguard 3 fund portfolio.

Second, what are the advantages of this approach to investing?

Vanguard Three Fund Portfolio Performance

Now you might ask what kind of investment returns can be expected from this Vanguard three-fund portfolio.

Let’s look at the performance of these three funds since their date of inception. Of course, past performance is never a guarantee of future results. But, it is a reasonable indicator.

The table below presents the average annual fund return since inception.

| Fund | Inception | Annual Return |

| VYM | 11/2006 | 8.6% |

| VYMI | 2/2016 | 9.5% |

| BND | 4/2007 | 4.1% |

First of all, I would expect that a large portion of the annual return will come in the form of dividends.

Furthermore, you can instruct your broker to reinvest the dividends automatically.

Or let the cash build up and use it to rebalance your portfolio at the end of each year.

Advantages Of A Vanguard Three Fund Portfolio Paying Dividends

Here are some of the advantages of this investment strategy…

Investment returns: Research indicates dividend-paying stocks outperform the broader stock market.

Simplicity: There are only 3 investments to manage. Set it up and forget it.

Except for once a year when it is time to rebalance.

Defensive: By increasing the bond allocation. These 3 funds can make for a defensive investment portfolio.

Such investments typically hold up well during difficult economic times.

Costs: Vanguard ETFs have some of the lowest expense ratios available.

Buy them in your brokerage account. And make your trades for free with Webull.

Little money is needed: You can get started with just a few dollars.

Then add more money over time as you have it.

Save time: You should be able to set up and manage this portfolio in an hour or two per year.

Diversification: Get hundreds of stocks and bonds. Representing many different companies.

Vanguard Three Fund Portfolio Summary

As I said in the beginning, there is more than one way to invest for portfolio income and get paid dividends. And I’m sure the Bogleheads would agree.

Most noteworthy, it doesn’t have to be expensive. Or, time-consuming.

To summarize…

Vanguard Three-Fund Portfolio In 4 Easy Steps:

- Select your three funds

- Choose your asset allocation

- Make your investments

- Rebalance on an annual basis

This is a passive investment approach to do-it-yourself dividend and income investing.

Advantages Of A Vanguard 3 Fund Portfolio

The method has a number of advantages for the investor:

- Solid investment returns

- Simplicity

- Low costs

- Time savings

- Diversification

Related Articles About Investing In Vanguard & Other Assets

Author Bio: Tom Scott founded the consulting and coaching firm Dividends Diversify, LLC. He leverages his expertise and decades of experience in goal setting, relocation assistance, and investing for long-term wealth to help clients reach their full potential.

There is also VIG and VIGI. The typical 3-fund portfolio I would build is with VOO, VXUS and BND. Some people tend to add BNDX as well. Also, the dividend ETFs do not have exposure to REITs. So, adding in a small % of VNQ will help diversify and boost the dividends.

I own VIG, VYM, VOO and BND.

Thanks for your thoughts DG. I like your suggestion of adding the REIT component. Tom

I used a mix of about 6 Vanguard ETFs from 2011 – 2016, international, domestic, bonds, equities, and REIT. It did really well. I’ll likely build a new mix soon and will consider these ETFs. Thanks!

Hi Matt, A good mix of Vanguard funds is a great investing strategy. Glad yours has done well for you. Tom

I like the 3-fund idea Tom. It’s simple. Right now, the only fund I have in my Roth IRA is the total stock market index fund from Vanguard. I’ve been meaning to diversify, and will eventually add more to the mix. Thanks for the suggestion, and Happy 4th!

Hey DP. Happy 4th to you too. You can’t go wrong with the total US stock market ETF. Maybe add a non-US ETF when you get a chance to do so. Tom

Hi Tom,

Great portfolio. Something I’ve never been certain of is whether the dividends from the US fund will be taxed at the qualified dividend rate of 15% and the international ones at higher rates.

Also, I agree with you on using M1. They’re my main broker and really make it easy!

Cheers,

Miguel

Hi Miguel, I find that most international dividends are taxed at the qualified rate. Not quite 100%, but a high percentage. Tom

This is similar to the ‘couch potato portfolio’ (not sure if they call it that in the US), but it’s a great way to start off a clean portfolio covering a lot of the market. If I were to turn back time I would definitely have my ETFs mmuch more streamlined.

Hi GYM. Agree on turning back the clock. I would do the same and keep it super simple in my younger days too. No regrets though. Tom

A simple and effective approach to hands-off investing indeed! Apart from VYM, I also own some VNQ for real-estate exposure.

Hi SMM. I think VNQ is a good addition to the 3 ETFs discussed in the article. Tom