Dividend Relevance Theory & 3 Top Dividend Stocks To Prove It

Today’s topic is bird in hand theory. Also known as bird in hand dividend theory. Or, dividend relevance theory.

Research shows that over the long run, dividends make up about 40% of total stock market returns. This makes a strong case regarding dividend relevance for investors.

And that is what bird in hand theory is all about: dividend relevance. Something every good dividend investor should know a little bit about.

So, let’s talk about it. And, before we are done I will share with you 3 stocks putting bird in hand theory to work.

Or, read this>>> How To Get Dividends Every Month. For a 7 step plan to make $5,000 a month in dividends.

What Is Bird In Hand Theory?

First of all, bird in hand is 1 of 3 dividend theories. It is based on the belief that investors place a high preference for the receipt of dividends. This is sometimes referred to as dividend relevance theory.

Furthermore, bird in hand is based on an old adage. It is “a bird in the hand is worth two in the bush”.

The saying means that it is better to hold onto something you have now, or can count on receiving soon. Versus the risk of losing whatever “it” is. By trying to get something bigger and better down the road.

How does this relate to dividends? Well, it is quite simple…

A dividend from a high-quality dividend stock is something you can count on. It is the bird in hand.

In contrast to the potential for large increases in the share price of a stock. That may or may not come in the future.

Share price increases are the 2 birds in the bush. Or, something potentially better than a dividend.

Disclosure: At no cost to you, I may get commissions for purchases made through links in this post.

Why Is Bird In Hand Theory Important?

Since you found your way to this article, I can guess about you. Specifically, you are a dividend investor. And own 1 or more dividend stocks.

Or, you are interested in getting started dividend investing. And are trying to understand dividends and dividend stock investing. And decide whether or not to move forward.

As a current or future dividend investor, whether you realize it or not, you are a believer and follower of bird in hand theory. It is part of your investment philosophy or will be.

That being the case, I suggest that bird in hand theory is important to you. So, why not fully understand it?

Next, let’s compare and contrast bird in hand with 2 other popular dividend theories.

Dividend Irrelevance Theory Versus Bird In Hand

Bird in hand is the counterargument to the Modigliani Miller dividend irrelevance theory. The dividend irrelevance theory merely states that investors do not care how they get their return on investment.

The total return is what is important. No matter if it comes through share price appreciation, receiving dividend payments, or both. Furthermore, a company’s dividend and its dividend policy have no impact on the value of the company and its stock price.

This dividend theory gets its name from its creators. Economists Franco Modigliani and Merton Miller. It is also known by the name of homemade dividend theory.

Tax Preference Theory Versus Bird In Hand

The third dividend theory is called tax preference theory. It is also known as the tax aversion theory.

Tax preference theory works off the assumption that investors care about taxes. And take them into account when making investment decisions.

As such, investors that follow this theory have a strong preference for share price appreciation. That creates capital gains. Furthermore, they would rather not receive dividends on a regular schedule.

Because historically, dividends were taxed at a higher rate than capital gains. And dividends are taxed when received. While capital gains are only taxed if and when an investor chooses to sell a stock.

Tax preference makes good sense. It’s almost always better to be taxed at a lower rate. Also, defer the payment of taxes for as long as possible.

But you can have the best of all worlds. Just put your dividend stocks in an IRA.

But, back to our topic. Let’s do a quick recap of what we have learned so far.

Bird In Hand Is 1 Of 3 Dividend Relevance Theories

Thus far we have discussed 3 dividend theories:

- Bird in hand

- Modigliani-Miller dividend irrelevance

- Tax preference

Each presents its reasons why the theory will lead to the best possible cash flow from dividend investing or the highest total investment gains.

Next, let’s dive deeper into bird in hand dividend theory.

Who Developed Bird In Hand Theory?

Bird in hand theory was developed by Myron Gordon and John Lintner. These gentlemen were big believers in dividend relevance theory.

According to Wikipedia, Mr. Gordon was an American economist. He was Professor Emeritus of Finance at the Rotman School of Management, University of Toronto.

Mr. Lintner was a professor at the Harvard Business School in the 1960s.

Bird In Hand Theory Assumptions

As you can see, bird in hand theory was developed in academia. By professors of economics.

Meaning no disrespect, the assumptions of bird in hand theory seem a little impractical to me. Regardless, I will highlight them for reference purposes.

The 6 assumptions for bird in hand theory relate to the company and the environment in which it operates. They are:

1. Only equity financing is used, no debt.

2. Retained earnings are the only source of that equity financing.

3. Earnings are retained in the business at a constant rate. The retention ratio is the opposite of the dividend payout ratio. Put another way, the dividend payout ratio is held constant.

4. There is a constant growth rate of earnings.

5. The company’s cost of capital is constant and greater than the growth rate.

6. There are no corporate income taxes

In direct contrast to the dividend irrelevance theory, bird in hand firmly believes that dividends impact the value of a company and its stock.

Furthermore, Mr. Gordon developed a model to prove this out. Let’s talk about that next.

Bird In Hand Theory Formula

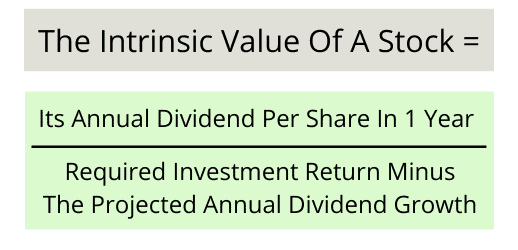

To prove dividends have a big and positive impact on a stock’s price, Gordon developed a formula to support that thinking. It is called the Gordon Growth Model.

The Gordon Growth Model is a tool to calculate the intrinsic value of a stock. And more specifically, the value of a dividend growth stock.

As a formula, the Gordon Growth Model is quite simple. First, I will describe it in words.

It is simply a company’s expected annual dividend payment 1 year from now. Divided by the difference between 2 numbers.

The first number is your desired annual return on investment. Then second, subtract from that number how much you think the dividend will grow each year in the future.

Now, taking those words here is the Gordon Growth Model formula.

So, what does this mean?

As per bird in hand theory, it means the higher a company’s dividend per share. And the faster the dividend is expected to grow in the future. Then, the higher the intrinsic value of the stock.

In short, dividends are VERY relevant. That’s why companies pay them.

But to be fair, let’s address some of the disadvantages of bird in hand theory.

Criticisms Of Bird In Hand Theory

First of all, one criticism of the bird in hand theory suggests that investors usually reinvest dividends.

They do so by purchasing stocks of the same or similar companies. So, companies receive back the biggest portion of dividend payouts anyway.

Second, tax minimization should not be ignored.

By paying taxes on dividends received today. An investor has reduced the amount of capital they can have invested at any point in time. Versus an investor who is solely focused on capital gains. Of course, an IRA account mitigates most of this problem.

Third, a company with profitable growth prospects should retain all of its earnings. Rather than paying them out as dividends.

This criticism assumes the company can reinvest those funds in its business at high rates of return. Let’s say at the very least a 15% return on investment.

Proponents of this criticism might argue this. Why invest in any company that does not have ample and profitable investment opportunities for growth?

Like any debate on a topic. There is some truth in each of these criticisms about the bird in hand theory.

Furthermore, they support the thinking that dividends aren’t free money.

Next, I want to make one more point about dividend theory. Then move onto some examples of bird in hand theory at work in businesses today.

Dividend RelevanceTheories Versus Dividend Policy

First of all, a dividend theory is a system of ideas to describe a situation about dividends. Also, a set of principles upon which the concept of dividends is based.

Furthermore, dividend theory provides the basis for a company’s dividend policy. Where dividend policy is the actual corporate behavior that results in dividends paid to you and me.

Finally, stemming from dividend policy are many decisions companies must make. Such as, how much dividend should be paid? When? How often? And at what rate should it be increased?

And this is what you and I, desiring profits from dividends, are most interested in. Finally, we will look at some examples of bird in hand in practice at real companies. Then, wrap this article up.

Bird In Hand Theory Examples

Here are several examples of dividend stocks that fit with a bird in hand theory-based investing strategy.

If you need more investment ideas, I use the Simply Investing Report for high-quality dividend stock recommendations. Check Simply Investing out here.

Coca-Cola

Let’s start with the Coca-Cola Company (NYSE: KO). Or, Coke for short

Coke’s initial public offering (IPO) of stock was on September 5, 1919. The company started paying dividends in 1920. And, Coca-Cola has paid a dividend every quarter since then.

Furthermore, Coke has been increasing dividends annually every year since 1963. This streak of dividend increases qualifies Coca-Cola as a Dividend King.

Dividend Kings are those rare and special companies who have increased their dividend payouts for at least 50 consecutive years. It is a major dividend growth achievement for a company and its stock.

McDonald’s

McDonald’s (NYSE: MCD) started paying dividends in 1976. And has raised its dividend each year since then.

From 1976 and through 2000, McDonald’s paid a quarterly dividend. From 2001 to 2007 the Company transitioned to offering annual dividends. Starting again in 2008 until now, dividends are paid quarterly.

McDonald’s has earned Dividend Aristocrat status. An Aristocrat is a company in the S&P 500 stock index. That has paid and increased dividends every year for at least 25 consecutive years.

For my last example, I want to dig even deeper. And show how dividend growth stocks pull from the best aspects from each of the 3 dividend theories.

PepsiCo

Let’s say you bought 1 share of snack food and beverage giant, PepsiCo (NYSE: PEP) on December 31, 2010. And held that share for 10 years.

Here’s what would have happened:

First of all, you bought this stock commission-free. Never pay commissions.

If you need a zero-commission online account to buy dividend stocks. You should try Webull. I like the Webull app because it is fast, free, and easy to use.

Now the details on your investment results:

- The price paid per share on 12/31/2010: $65.83

- The per-share price on 12/31/2020: $148.30

- Cash dividends received over 10 years: $29.22

- Annual dividend per share when purchased: $1.92

- Annual dividend per share after 10 years: $4.09

- 10-year compound annual dividend growth rate: 7.8%

- Compound annual return in share price: 8.5%

- Percentage of total return from dividends: 26%

Here is why I say dividend growth stocks like Pepsi pull from the best aspects from each of the 3 dividend theories.

Best Of Bird In Hand Theory

You received over $29 in cash from dividends. Nearly half of your original investment.

And the regular dividend payments grew over time. It was more than 2 times greater than when you purchased the stock.

Best Of Dividend Irrelevance Theory

Your total return came from both dividends and share price appreciation.

Do you care? Only if you needed the cash from the dividend. But I would also argue the rising dividend increased the value of the stock.

See how the dividend growth rate of 7.8% is very similar to the average annual increase in the stock’s price of 8.5%.

This is a very common thing you find good quality dividend stocks. Share prices will often follow dividend increases higher. At a similar rate.

Best of Tax Preference Theory

74% of your total return came from tax-deferred share price appreciation. As long as you hold the stock, taxes are not due on the bulk of your investment return.

Can you see how this will create a snowball effect in your investment portfolio? So here’s what I’m trying to say.

No matter how you feel about the 3 dividend theories. Investing in dividend growth stocks is an excellent investing strategy. For long-term total returns from the stock market.

That concludes 3 examples of bird in hand theory working in practice. It would be hard to go wrong by adding these stocks as part of a dividend portfolio.

Finally, let’s wrap this up with a quick summary.

Bird In Hand Theory: Summary And Wrap Up

First of all, bird in hand theory is 1 of 3 prominent dividend theories. It is based on the belief that investors place a high preference for receiving dividends.

Furthermore, dividend theories provide the principles on which individual company dividend policies are established. Those policies put cash dividends in the pockets of dividend investors like you and me.

Finally, in my opinion, dividend growth stocks benefit from some of the best aspects of all 3 dividend theories.

More Reading About Dividends And Dividend Stocks

- Our complete content library of dividend investing articles

- The 5 kinds of dividends fully explained

- Analyzing dividend stocks after you find them

My Favorite Dividend Investing & Financial Resources

- Trade stocks for free with the Webull app

- Get dividend stock recommendations from Simply Investing

- Get top stock picks from Motley Fool

- Manage all of your finances with Personal Capital