The Realty Income Dividend Is Paid Every Month!

The Realty Income Stock Dividend satisfies my real estate investment needs.

Because I’m not a big fan of real estate investments. One single-family residence is enough physical ownership of real estate for me.

I can analyze stocks and form an opinion on their prospects. On the other

So today we are going to work through a Realty Income dividend stock analysis. I want to take a close look at the company, Realty Income stock,

Disclosure: At no cost to you, I may get commissions for purchases made through links in this post.

REAL ESTATE, REITs & REALTY INCOME’S DIVIDEND

First of all, I think it is important to have real estate represented in a diversified dividend stock portfolio. And Real Estate Investment Trusts (REITs) are a great way to do that.

Furthermore, by owning REITs, there is no need to get involved with individual properties. Finally, in my opinion, Realty Income is one of the best REIT stocks that pay regular dividends.

To get started, I’d like to address a couple of frequently asked questions.

IS REALTY INCOME A GOOD INVESTMENT?

I believe Realty Income is a good dividend stock and a good investment. Investing in Realty Income stock is an excellent way to passively participate in the positive economics of real estate.

And the stock is a solid holding when building a diversified dividend investment portfolio. Most importantly, the company is well managed and has a stellar track record of paying a rising dividend stream to shareholders.

IS REALTY INCOME A GOOD STOCK TO BUY NOW?

Quality rarely comes at a cheap price. Thus, whenever I review Realty Income stock it appears overvalued to me.

I base this partly on its relatively low dividend yield for a REIT. And slowing dividend growth prospects.

For me, I would prefer a larger dividend yield relative to its potential for dividend growth. To keep it simple, if and when the stock yields at least 5%. I like to consider adding to my shares.

Next, let’s learn a little about the company known as Realty Income. And dig into the details that support the questions I just answered.

HOW DOES REALTY INCOME MAKE MONEY TO FUND ITS DIVIDEND?

Realty Income makes money for growing dividend payments through ownership of thousands of commercial properties. These properties generate rental revenue from long-term net lease agreements from tenants.

Realty Income’s customer base is diversified with hundreds of commercial tenants. They operate in dozens of different industries.

And are located throughout the United States, Puerto Rico, and the United Kingdom. Their properties are generally freestanding buildings in prime locations with good access and visibility.

Source: Realty Income – About Us

MAJOR TENANTS

You have likely been in one of their properties. Since many of their tenants are recognizable names. Some of their largest tenants are listed below.

- Walgreens

- 7-Eleven

- Dollar General

- FedEx

- Dollar Tree & Family Dollar

- LA Fitness

- AMC Theatres

- Regal Cinemas

- Walmart & Sam’s Club

- Sainsbury’s

- Lifetime Fitness

- Circle K

- BJ’s Wholesale Clubs

- CVS Pharmacy

- Treasury Wine Estates

- Super America (Marathon)

- Life Time Fitness

- Kroger

- GPM Investments/FAS Mart

- TBC Corporation (Sumitomo)

- Home Depot

BUSINESS STRATEGY

The Realty Income dividends come from the growing cash flows generated by earnings. So how does Realty Income grow earnings and ultimately the dividend over time? Well, they do this in two primary ways.

First of all, they acquire more properties to increase the size of their real estate portfolio. By leasing the new properties to tenants for rental revenue that exceeds the cost of funds to acquire the properties, Realty Income makes more profits.

Realty Income also makes more money by regularly increasing the rent on existing leases. They do so by a small percentage increase each year.

BUSINESS RISKS

Bricks and mortar retail businesses are being challenged by e-commerce. But, take another look at Realty Income’s tenant list. Many do not compete directly with Amazon. That is definitely a plus.

Also, some tenants were negatively impacted by the global health crisis. Cinemas and fitness clubs suffered large losses while their facilities were closed. And some customers still aren’t comfortable going back.

These types of issues can place a strain on Realty Income’s ability to collect some rents as they come due.

REALTY INCOME STOCK (O STOCK)

Realty Income stock trades on the New York Stock Exchange. And their stock market ticker symbol is easy to remember.

The stock symbol is the letter “O”. Sometimes Realty Income stock is referred to as O or O stock, for short (NYSE: O).

On a side note, I trade my dividend stocks for free. Using the fast and powerful Webull app. It has some very good research capabilities too.

You can check out the Webull app here. And for a limited time, Webull is offering free stock to new customers that open and fund their account.

REALTY INCOME PAYS MONTHLY DIVIDENDS

Realty Income is also known as The Monthly Dividend Company. Why? Because they choose to pay dividends to shareholders every month of the year. Monthly cash payments to shareholders are a part of their dividend policy.

In contrast, most

There are not many stocks that pay dividends monthly. And some of them are riskier than the typical stock I like to invest in.

On the other hand, I think Realty Income is one of the safest monthly dividend stocks. That an investor can find.

REALTY INCOME’S DIVIDENDS ARE NOT QUALIFIED DIVIDENDS

Realty Income is structured as a real estate investment trust (REIT). REIT tax status provides the company with tax treatment that requires minimum dividend distributions. That’s great for investors that place a high value on dividend payments from their investments.

On the other hand, Realty Income’s dividends are not considered qualified for tax purposes. So, as an investor, they are taxed as ordinary income. And, are not “qualified” for the lower dividend tax rate.

This is an important point about REITs. Since Realty Income is a REIT, let’s learn a little bit more about them before we go any further.

WHAT IS A REIT?

REITs are companies that own or finance income-producing real estate in a range of property sectors.

Most REITs operate a straightforward business model. They own space, lease it out to tenants, and collect rent. The income from this process is then paid out to shareholders in the form of dividends.

Furthermore, REITs allow anyone to invest in portfolios of real estate assets without the responsibilities of being a landlord.

Finally, when looking for dependable dividend stocks. Be sure to consider companies operating in this sector of the market.

REIT REQUIREMENTS

REITs have to meet a number of requirements to qualify. A REIT must:

- Invest at least 75 percent of its total assets in real estate

- Derive at least 75 percent of its gross income from rentals of real property, interest on mortgages, the financing of real property, or from the sales of real estate

- Pay at least 90 percent of taxable income to shareholders in the form of dividends each year

- Be structured as a taxable corporation

- Be managed by a board of directors or trustees

- Have a minimum of 100 shareholders

- And have no more than 50 percent of its shares held by five or fewer individuals

Source: REIT.com

REITs AND TAXES

As long as they qualify, REITs pay no federal income tax. This eliminates the “double taxation” of their income generated and the dividends passed along to shareholders.

Because of this, a REIT’s dividends received by an investor do not receive preferential tax treatment known as qualified dividend income. Therefore, dividends paid are taxed as ordinary income.

So, under current tax law, your tax rate on the dividends received from Realty Income stock will depend on your tax bracket.

HOLDING REITs IN AN IRA

Because of the tax treatment, it is usually best to hold REITs in tax-advantaged accounts, like Individual Retirement Accounts (IRAs).

If you have been meaning to open an IRA to save for retirement, it’s a smart idea, so get it done.

MAKING THE MOST OF ALL YOUR MONEY

My other “go to” online tool for managing money is Personal Capital. It pulls all of my investments AND expenses together in one place.

Best of all, Personal Capital is free to sign up and use. You can check Personal Capital out here.

Okay. That concludes our background lesson about REITs. But there is much more to come.

Next, it’s time for my favorite part of stock analysis. Talking about the monthly Realty Income dividend!

FACTS AND FIGURES ABOUT THE REALTY INCOME DIVIDEND

So, let’s dig into the Realty Income dividend metrics now. How do the dividends work for a company like this?

We will answer that important question. And many more…

REALTY INCOME DIVIDEND RATE PER SHARE

Realty Income has an annual forward dividend rate. Just like any other dividend stock.

What does the annual forward dividend mean? Simply put, the last dividend approved by the company. Multiplied by the number of times per year a dividend is paid. In this case, monthly dividends mean 12 times per year.

Then take the forward dividend. Divide it by the stock price. To get the dividend yield…

REALTY INCOME DIVIDEND YIELD

Realty Income’s dividend yield is a little low versus other REITs. But it has a high dividend yield compared to many other stocks.

My target dividend yield range when I make a stock purchase is between 3-5%. And this stock will typically have a yield in or above this range.

Rarely, if ever, will the stock’s yield fall below 3%. Only an insane run-up in the stock price. Or a dividend reduction would cause the yield to drop this low.

Note that dividend yields for all stocks move in the opposite direction of the stock price.

WHEN IS THE REALTY INCOME DIVIDEND PAID?

We already know the Realty Income dividend is paid every month. Monthly dividends are very helpful if you use dividends to pay living expenses.

To receive Realty Income’s next monthly dividend payment, you must complete a purchase of Realty Income stock before the ex-dividend date.

Furthermore, the ex-dividend date is typically the last business day of each month. Then, as a shareholder, your Realty Income dividend is paid out on or around the 15th day of each month.

What happens if the 15th falls on a weekend or holiday? Then, the Realty Income dividend is paid on the last business day prior to the 15th.

Thus, there is no need to worry. This company pays recurring dividends like “clockwork”.

REALTY INCOME DIVIDEND HISTORY

Realty Income has paid dividends every month of the year since it became a public company in 1994. Also, the dividend has been increased annually by management since its inception.

TOUTING THE REALTY INCOME STOCK DIVIDEND

This company is really proud of its strong dividend-paying heritage. First of all, going by the nickname “The Monthly Dividend Company” tells us just how serious they are.

Furthermore, they also boast about their impressive dividend achievements on their website…

REALTY INCOME STOCK DIVIDEND AMOUNT & TRACK RECORD

They highlight:

- The number of consecutive monthly dividend payments for investors

- Their number of dividend increases

- Consecutive quarterly dividend increases

- Dividend growth statistics

- Compound average annual dividend growth rate

So, they brag it up about their dividend-paying accomplishments. And that’s okay with me.

Source: Realty Income Monthly Dividend Commitment

REALTY INCOME IS A DIVIDEND ARISTOCRAT

Having paid and increased dividends since 1994, qualifies Realty Income as a Dividend Aristocrat.

Dividend Aristocrats are those rare companies that have increased their dividends annually for at least 25 consecutive years.

So, we now know Realty Income increases its dividend every year. But what does the dividend growth rate look like?

REALTY INCOME DIVIDEND GROWTH RATE HISTORY

The Realty Income dividend growth rate has been declining. Furthermore, this is especially true when I look back beyond 10 years .

Using history as a guide. I expect this year’s dividend appreciation to come in at a lower rate too.

What I see is the company becoming larger and more mature. It’s looking more like steady, reliable, but slower-growing utility stocks.

Because, in my opinion, there are fewer properties that meet its investment profile to support higher dividend growth rates.

On the other hand, I think the monthly dividend payments and annual dividend growth have been and will continue to be a nice combination for a dividend stock investor.

REALTY INCOME DIVIDEND INCREASE PROCESS AND TIMING

Realty Income has a unique track record for increasing dividend payments to shareholders.

They typically increase their dividend by a small amount 4 times per year. Then in January of each year, they have announced a larger dividend increase.

So, Realty income pays a monthly dividend. That is increased quarterly.

There are very few other types of dividends paid by companies that can beat their formula for steady reliable dividends.

REALTY INCOME DIVIDEND GROWTH RATE FORECAST

In the last couple of years, I have noticed that the January dividend increase has become smaller. This is what has mainly caused a decline in the historical dividend growth rate.

Looking forward, I believe the trend will continue. So, I project an annual dividend growth rate for Realty Income stock of 2-4%.

BUSINESS FUNDAMENTALS UNDERLYING THE REALTY INCOME DIVIDEND

Now we know a lot about the Realty Income dividend! So, let’s move on to business fundamentals. And the underlying trends that support those ongoing dividend payments.

REVENUE TREND

We know how Realty Income grows. Remember?

They acquire and rent out new properties and increase rents on existing properties.

Additionally, on occasion, they will acquire other businesses operating in the same industry. And combine them into their operations.

For the most part, the strategy has worked well. Generating a growing revenue line on the income statement.

REALTY INCOME DIVIDEND AND FFO PER SHARE

Realty Income also has stable and consistent Funds from Operations (FFO) from which its dividends are paid.

Bringing up this next question…

WHAT IS FFO?

I mainly cover traditional dividend-paying corporations here at Dividends Diversify. Therefore, I evaluate dividends against earnings per share and free cash flow.

Realty Income is the only REIT represented in the Dividends Deluxe model portfolio.

Because of that, FFO is not frequently discussed. So let’s take the opportunity to improve our knowledge about FFO next.

FFO DEFINED

For REITs, FFO is a better measure of dividend payment capacity and income than traditional earnings per share. Investopedia explains FFO this way

FFO is calculated by adding depreciation and amortization to earnings and then subtracting any gains on sales of property. It is sometimes quoted on a per-share basis. The FFO-per-share ratio should be used in lieu of earnings per share when evaluating REITs and other similar investment trusts.

The formula for FFO is: FFO = Net Income + Depreciation + Amortization – Gains on Sales of Property

REALTY INCOME DIVIDEND PAYOUT RATIO

Realty Income dividends as a percent of FFO typically runs between 80-90% each year. This is known as the dividend payout ratio.

The ratio is high. But not uncommon for a REIT.

Supporting this high payout ratio, many of Realty Income’s tenants have investment-grade credit ratings. And pay their rent on a timely basis.

Furthermore, the breadth and diversity of Realty Income’s tenant base are substantial. And a big benefit providing stability to incoming cash flows.

Next, to endure difficult economic times. Companies need a strong financial position. Let’s see how Realty Income stacks up in this area.

FINANCIAL POSITION: CREDIT RATING AND BALANCE SHEET

Realty Income states that they seek to maintain a conservative capital structure. Not allowing the debt ratio to become too high.

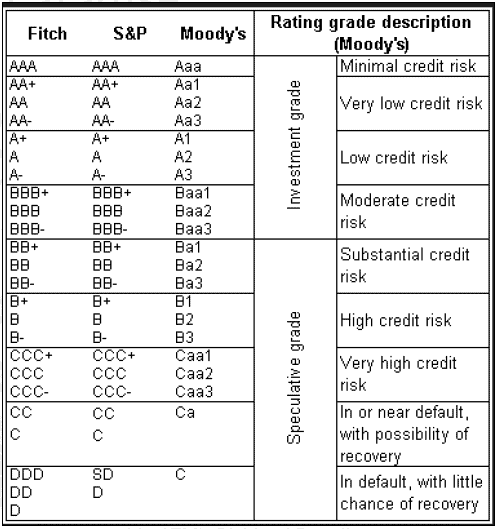

And Moody’s and S&P give Realty typically provide investment-grade credit ratings for the company.

High credit ratings are typical of quality dividend-paying companies.

TABLE 2: CREDIT RATING EVALUATION GRID

Based on my review, Realty Income appears to have a strong balance sheet. They maintain excellent credit ratings as a good dividend growth stock normally does.

On a side note. Do you need to check your personal credit score?

If yes, Credit Karma is an excellent and free resource to do so.

REALTY INCOME DIVIDEND SAFETY

Having successfully navigated the real estate collapse, financial crisis, bear market of 2007-2009, and the global pandemic. I have little doubt that Realty Income will make it through the toughest of economic challenges.

Also, based on its business fundamentals, financial position, and dividend metrics. I judge Realty Income’s dividend safe from a reduction in the foreseeable future.

And to me, dividend safety is critical. For making a consistent income from dividend stocks.

Finally, let’s check into Realty Income’s stock valuation. Then, I will wrap up.

REALTY INCOME STOCK VALUATION

Let’s judge value using a dividend discount model and dividend yield approach.

REALTY INCOME DIVIDEND DISCOUNT MODEL

The single-stage dividend discount model considers some of the factors I have discussed thus far

- Current dividend payment

- Projected dividend growth

Also, my desired annual return on investment.

Using these assumptions, the dividend growth model suggests the stock is overvalued at this time.

Dividend metrics and valuation measures can change quickly. That’s why I like to stay up to date with my dividend stocks.

To do so, I prefer the Simply Investing Report & Analysis Platform. The interactive database is an excellent resource and tool. For finding the best dividend stocks. And buying them at the right time.

REALTY INCOME DIVIDEND YIELD AS A BASIS FOR STOCK VALUATION

Although not a typical valuation measure. I sometimes like to use dividend yields to set my buy prices.

With future dividend growth likely to be in the 3% range, I would like to see a higher dividend yield, closer to 5%.

So, anytime the yield rises to 5% or more. I will look to add to my shares in small increments.

Okay. Allow me to wrap up with a few parting thoughts…

REALTY INCOME STOCK AND DIVIDEND ANALYSIS – WRAP UP

Realty Income is a high-quality dividend-paying company. It holds a large position in my dividend growth stock portfolio.

I established my position in 2008 and have added to it over the years. At its most recent highs, the stock price had generated some great capital gains for me. Plus collecting dividends along the way.

I hold Realty Income stock in my IRA. Because of this, I trade O stock a little bit more than dividend stocks in my taxable accounts.

When the valuation gets stretched, I sell off some of my position. And then reinvest when the stock price declines.

I usually do not trade like this. Because I prefer to buy and hold forever.

Finally, when I’m investing, I do not specifically target monthly dividend stocks. But I know many investors who do so.

So, if I were to build a portfolio of monthly dividend stocks. Realty Income would be the first stock I would consider.

FURTHER READING ABOUT DIVIDEND INVESTING AND DIVIDEND STOCKS

- Dividend stock recommendations from Simply Investing

- Vanguard High Yield Dividend ETF

- 5 steps to a steady monthly dividend income

- Dividend-paying stocks making payments in May

My Favorite Dividend Investing & Finance Resources

- Free online stock trading with Webull

- Dividend stock recommendations from Simply Investing

- Excellent investment research from Morningstar

- Manage all your finances for free with Personal Capital

- Check your credit score for free with Credit Karma

Author Bio: Tom Scott founded the consulting and coaching firm Dividends Diversify, LLC. He leverages his expertise and decades of experience in goal setting, relocation assistance, and investing for long-term wealth to help clients reach their full potential.

Hi Tom,

Realty Income gives me pause. One the one hand, I like that its tenants seem somewhat insulated from e-commerce competition. On the other, I tend to favor service-oriented companies and I didn’t know that the dividends were nonqualified.

I’ll keep it on my watchlist.

Cheers,

Miguel

Miguel, It’s usually best to invest only in companies you feel good about. Tom

$O is the gift that keeps on giving. Another dividend raise this month.. I don’t know why but a monthly dividend always seems better than a quarterly dividend

Hi Derek. Well said. And as I reviewed first-quarter results for O, they came out better than expected given the circumstances. Let’s hope we continue to receive the gift of those monthly and growing dividends for many years to come. Tom

How will you use the distributions as income if they are in your IRA?

That’s a good point. Thank you for bringing it up. For me, I don’t need the dividend from Realty Income right now. Anyone that needs the monthly dividend from O to cover expenses should hold it in a taxable account understanding the dividends are taxed as ordinary income.

Great post Tom. I have been keeping my eye on $O but haven’t pulled the trigger. I have a little bit of VNQ instead and mainly Canadian REITs.

What percentage of your portfolio is REITs? I have under 5% right now.

Hi GYM. O is the only individual REIT that I own. So, like you, REITs are under 5% weight for me too. Tom

Realty Income s dividend history is second-to-none in the world of REITs. Its dividend has been increased a total of 105 times since it came public in 1994, and it has been increased for 89 consecutive quarters as of today. Most dividend stocks strive to increase their payouts annually; such a long streak of increases each quarter is much rarer.

Thanks for chiming in with those stats Stephanie. It is an impressive dividend history for sure. Tom

Hi Tom

So I want to buy shares from O because I’m obsessed with property and O’s rates are good. How much should I invest or rather how much is a share?

Hi. Realty Income shares have been trading in the high 50’s recently. Tom