Because Making Money With Dividends Is Fun!

Do you want to know how to make $200 a month in dividends? If the answer is yes, then you have come to the right place.

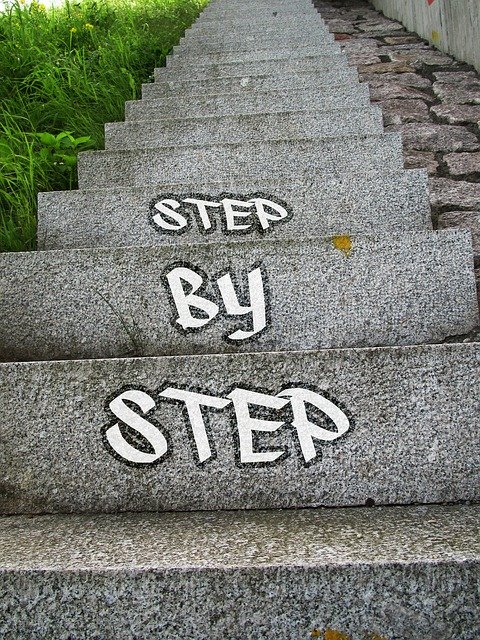

Because I’m going to lay out an easy 5 step plan. For making monthly dividend payments.

And the best thing? Once you know how to collect dividends. They can never be taken away.

But as you might expect, I have a couple of suggestions on the best ways to put them to use. After you get dividends rolling in.

More on that in a bit. Now, your 5 step plan for making $200 a month in dividends…

Disclosure: At no cost to you, I may get commissions for purchases made through links in this post.

How To Make $200 A Month In Dividends: An Easy 5-Step Plan

When I’m trying to make money with dividends, faster is better. And achieving any financial goal goes quicker with a plan.

So, here’s your 5-step investing for dividends plan:

- Choose a dividend yield goal

- Determine the amount of money required

- Find and select the best dividend stocks

- Invest new money & reinvest dividends regularly

- Construct a portfolio for monthly dividends

When we are done. You will know exactly how to make money with dividends. More specifically, how to make $200 a month in dividends.

And the best thing? These same investing steps apply no matter how much passive income you want to make each month.

So, let’s not delay. And dig into the 5 steps for monthly stock dividends right now.

Step 1: Choose A Goal For Dividend Yield

The first step in your journey is to choose a dividend yield target.

This leads me to the first question we must answer. What is dividend yield?

Dividend Yield For $200 A Month In Dividends

Well, a stock’s dividend yield is one of the most important things to know about dividend stocks.

Here is how dividend yield is calculated…

First, determine the amount of dividend per share a stock pays during the year. The annual dividend per share can be looked up online. At Yahoo Finance, for example.

While you are investigating, look up the price per share of the stock too. Then you have both pieces of information to calculate a stock’s dividend yield.

Just take the annual dividend per share and divide it by the stock’s price per share. And there you have it: dividend yield.

Dividend yields change daily. They move in the opposite direction of a stock’s price.

So, I want you to root for lower stock prices. Because lower stock prices mean higher dividend yields.

And higher dividend yields mean making money from dividends is easier. And, I like easy.

But. And I bet you knew there was but coming. Well, here it is…

But Watch Out For High Dividend Yields

Now, just a word of caution. Before you go tearing off looking for the highest dividend yields you can find.

Yes. Higher dividend yields can be good. Because it allows dividend investors to collect more dividends. For every dollar, invested.

But high dividend yields can get us into trouble. Why? Because they typically indicate greater investment risk.

What kind of investment risk? First of all, the risk of losing some or all of your investment.

Furthermore, the risk that a dividend may not be safe. Meaning company management may need to reduce or eliminate the dividend shortly.

These are bad things for dividend investors. Because nothing can blow up your plan of making money with dividends faster.

So, how do you get dividends? Rule #1: Avoid dividend reductions. This means being cautious of high dividend yield stocks.

Choose A Dividend Yield Target For $200 A Month In Dividends

So, you are finding some good dividend stocks. And I will have more on some ways to do that in a moment.

Also, you are calculating their dividend yields. But what are you seeing?

Let me guess. Some dividend yields are low. Maybe less than 1%. Apple stock comes to mind.

Some dividend yields are high. Closer to 7%. Like AT&T stock. And maybe some dividend yields are even higher than that.

But now you know that high dividend yields can be risky. So, what is an eager dividend investor to do?

Well, the choice is completely up to you. You’re the boss. Because it’s your money.

But let me offer a little guidance. From my many years of investing in dividend stocks.

What To Look For In A Dividend Yield

Look for stocks with dividend yields of at least 2%. But not more than 6%.

Less than 2%? Then it is tough to make money from dividends.

More than 6%. The stock is probably too risky. Even though the dividend income is great.

As I said, the decision is yours. For use in this money-making article about dividends, I’m going to choose 4%.

Because it is right in the middle of the range. Some stocks you choose will have higher dividend yields. And stocks will be less.

But try and have them average out to a 4% dividend portfolio yield.

Still interested in how to make money on dividends? Then stick with me for step 2…

Step 2: Determine The Money Required to Make $200 In Monthly Dividends

This is the question that is on everyone’s mind. I know you want to ask. But, are probably too shy to raise your hand.

So, I will ask the question for you…

Specifically, how much do I need to invest to make $200 a month in dividends?

Allow me to put it in a larger print.

How Much Do I Need To Invest To Make $200 A Month?

To make $200 in monthly dividend income payments you will need to invest about $60,000.

It is calculated as $200 a month multiplied by 12 months in the year. Or $2,400 in annual dividend income.

Then take $2,400 and divide it by your dividend portfolio yield. Or, 4% in today’s example. Doing the math, I get $60,000.

Now, I suspect that may seem like a lot of money. Why do I think that?

Well, when it comes to the amount necessary for making money off dividends, people can get a little testy about dividend stocks.

I hear comments like “dividend investing is for rich people”.

Or, “So, all I need is to have $60,000 lying around.” Said with a sarcastic tone.

And I get it. $60,000 is a lot of money. $50,000 is a lot of money for a dividend portfolio too!

But here is my response to my critics: Dividend investing is a journey, not a destination. It is a process to build up to $60,000.

So, I’m not implying you have that money lying around. Just waiting to figure out what to do with it.

I will have more on this point a little later. Remember that dividend investing is a journey, not a destination.

What If Your Dividend Portfolio Yield Is Different?

Now, I worked this example off a hypothetical dividend portfolio yield of 4%. What if your monthly dividend income portfolio has a different yield?

Yes. That will change the result of the calculation I just showed you. So, you need to know how to calculate the dividend yield on your portfolio.

How To Calculate Portfolio Dividend Yield

This is how to calculate the average yield of your dividend portfolio:

First, get the total current market value of your dividend-paying stocks. Let’s say your brokerage account indicates they are worth $10,000.

Yes. I know that is a lot of money too. But it makes the math easy.

Second, look at the total dividends those stocks have paid over the past 12 months. If you have online access, this is easy. Just perform a search to look up the transactions.

The results of your research show your account has paid $375. That is dividends received during the past year.

Divide $375 by $10,000. The result is 3.75%. That is your portfolio’s average dividend yield.

If this were the case, you would need to invest $64,000 to make $200 a month in dividends.

For a refresher, the calculation is $200 a month multiplied by 12 months giving us $2,400 in annual dividend income.

$2,400 divided by 3.75% tells us $64,000 is required to earn $200 in monthly dividend payments.

Furthermore, if you can push your dividend yield up higher. Then the amount of money required for $200 a month in dividends becomes less.

Fire up your smartphone calculator. And play around with the calculation. You will see what I’m saying.

Okay. Still with me? Then let’s move onto step 3. In our quest of how to make money from dividends.

Step 3: Find, Select & Buy Stocks For $200 in Monthly Dividends

The next step is to find a selection of dividend stocks. Choose the ones you want to own. And buy them.

Finding Dividend Stocks For $200 A Month In Dividends

First of all, develop a watch list of 20-25 dividend stocks that you are interested in. Furthermore, you can find good stocks that pay dividends in many places. Several of which I explain next…

Stock lists like the Dividend Achievers, Dividend Aristocrats, and Dividend Kings are good places to look. The companies on these lists have paid and increased their dividends for many years in a row.

Next, think about the products and services you use every day. And see if the companies that produce them have a dividend stock.

For example, do you like iPhones? Then, consider Apple stock for dividends.

Enjoy snacking and refreshing beverages? Then how about PepsiCo stock.

Who do you pay your electricity bill to? Because utility stocks pay good dividends too.

Finally, identify mutual funds and exchange-traded funds. That focus on dividend stocks.

Then look up the specific stocks they hold. This method can be a gold mine for finding dividend stocks.

Analyzing And Choosing Dividend Stocks

You already know about 1 important thing to look for. That is a stock’s dividend yield.

But there are many other dividend stock measures and metrics you may want to consider. Such as a company’s:

- Dividend payout ratio

- Dividend payment history

- Stock valuation

- Timing of dividend payments

- Dividend growth rate

On the other hand, if you don’t feel up to identifying and selecting dividend stocks on your own. Here is a suggestion…

Try Simply Investing For Dividend Stock Recommendations

I have been using the Simply Investing report for years. Each month it delivers dividend stock recommendations right to my inbox.

Not only the dividend stocks that are good buys at the moment. But many others you may want to consider. When the price and timing are right.

Simply Investing takes all of the work out of it. And the time it takes for selecting the right dividend stocks.

You can learn more about Simply Investing here.

So, for making money off dividends don’t forget this rule. Investigate and research before buying a dividend stock.

Or, have a professional resource do it for you. Like Simply Investing.

And one more thing you must know about selecting your dividend stocks…

Know Dividend Payment Patterns For $200 A Month In Dividends

Many dividend investors wish to receive dividends every month. And some want about the same amount each month.

This is especially important when you want to collect dividends for a specific purpose. Such as, paying bills.

So, for making monthly stock dividends. Remember this: check the dividend stock’s dividend payment pattern.

You will find that most companies in the U.S. pay dividends four times per year. On the other hand, the months they pay dividends will differ.

You should know that there are 4 typical quarterly dividend payment patterns:

- January, April, July, December

- February, May, August, November

- March, June, September, December

But note, a few companies pay their dividend monthly. Realty Income is my favorite monthly dividend stock.

The company is also known as a REIT stock. That stands for a real estate investment trust.

To sum up this topic, here’s my point. Before you invest, check into stock’s dividend dates. To smooth out your dividend payment calendar.

When you do, you will see some new terms. That you may want to learn about. For example, record date, ex-dividend date, and payment date.

On the other hand, promise me one thing. Don’t buy a stock just based on when it pays dividends.

The timing of dividend payments is something to consider. But, has little to do with the quality of the stock. Or, the safety of its dividend.

Buying Dividend Stocks To Earn $200 A Month In Dividends

To recap, you have found some dividend-paying stocks. And, developed a watch list.

Furthermore, you have analyzed the stocks you identified. And have chosen 1 or more shares of stocks that pay dividends to buy.

So, it’s time to buy some stock. And, buying stocks is easy…

But, you need 2 things besides some money to invest. First, you need a brokerage account. Second, some basic knowledge on how to execute an online trade.

For a brokerage account, I use and recommend the Webull app.

First of all, the Webull app is fast and easy to use. And sign-up is a breeze.

Furthermore, it has excellent research capabilities. Making your dividend stock analysis easier.

Finally, Webull is completely free to start trading stocks online. Specifically, there are no costs to sign up. And all your dividend stock trades are completely free of charge.

You can learn more about Webull here.

Once you have your account set up. Webull has easy to access help features. If you are uncertain how to make a stock trade.

But just because you have a brokerage account now. Don’t leave me.

Because I’m ready for step #4 in our monthly dividend strategy…

Step 4: Invest Regularly And Reinvest All Dividends

Add new funds to your dividend portfolio regularly. And, reinvest all the dividends received. Right back into your dividend stocks.

Investing and reinvesting consistently are excellent practices for any investor. But especially for a dividend investor.

Dollar-Cost Average Into Your Dividend Portfolio

Choose an equal amount of money to set aside each month. Then allocate it to 1 or more of your dividend-paying stocks.

This practice is known as dollar-cost averaging (DCA). And allows you to benefit from price swings in the stock market.

Because without realizing it. You will buy more dividend shares when prices are lower. And fewer shares when prices are higher.

Reinvest All Dividends Received

Another good practice when learning how to make dividends is dividend reinvestment. This just means putting all the dividends you receive. Back into the dividend stocks you own. Or, new ones you want to buy.

You can do dividend reinvestment automatically. By just telling your broker (Webull) to put all dividends paid right back into the stock that paid them.

Or, you can let your dividends accumulate in cash and invest it in a lump sum. Do this once a month. Or, once a quarter.

Whatever timing you decide. Then choose the stocks you want to buy and reinvest the cash lump sum.

Either method is fine. But, if you are a beginner, I suggest automatic reinvestment.

By adding new money regularly. Also, doing automatic reinvestment.

You will do exactly what I did. To build my dividend portfolio during the first 10 years.

Finally, we are ready for the last step in your making money with a dividends plan. Step 5…

Step 5: Construct A Portfolio of Stocks For Monthly Dividends

As soon as you have bought at least 2 dividend stocks. Whether you know it or not, you have a dividend stock portfolio. And now, you are going to build brick by brick.

That’s right. You can throw that fact around at your next cocktail party. Do people still have cocktail parties?

Sorry. Off-topic! Let’s get back to work. Optimizing your dividend portfolio…

How Many Stocks Should You Hold In Your Dividend Portfolio?

Research suggests you should have 20-25 dividend-paying stocks in a portfolio.

Why? Because that number of dividend payers provides an adequate level of diversification. And, diversification reduces investment risk.

You know the old saying. Don’t put all of your eggs in one basket.

Now that may seem like a lot of stocks. And it may seem to take a lot of money to have that many stocks.

How To Build A Dividend Stock Portfolio

But here’s a process you may want to consider. So you can get on with how to make dividends right away…

To get started, buy a different stock each month. Just 1 share.

And, let’s say that the average price of a share of stock is $100. So each month you will add another stock. And a little more diversification to your portfolio.

Tell your broker to automatically reinvest the dividends back into the stock that paid them. And you are on your way.

In 20 months, you will have a nicely diversified dividend stock portfolio. Just be sure not to buy stocks that are all from the same industry.

In other words choose a technology stock, a consumer goods stock, a pharmaceutical stock, a utility stock that pays dividends, and so on.

So, invest in stocks from different industries. It is another best practice as it relates to dividend investment portfolio diversification.

Okay. Another thing I want to say. For how to make dividends from your dividend portfolio…

Review & Rebalance Your Dividend Stock Portfolio

At least once a year. Sit down and take a look at all of your dividend stock holdings.

And make sure no 1 dividend stock has become too large. Where it makes up a high percentage of your portfolio.

Try to keep your holdings balanced. For example, if you hold 10 dividend stocks. Try to keep each at around 10% of the total dividend portfolio value.

But realize, your portfolio will never be perfectly balanced. Because stock prices change every business day.

Furthermore, some of your stocks will perform great and become big holdings. Generating large capital gains. On the other hand, some stocks will lag.

Buy And Sell To Rebalance Your Dividend Portfolio

So, sell off some of your big winners. And put that money into the stocks that have not performed as well.

Also, add new money to the stocks that are lagging. Or, do a combination of both of these activities.

Doing so will keep your portfolio balanced. And help you achieve adequate diversification.

And, another thing. Hopefully, I don’t sound like your mother preaching to you here.

It’s just my passion for doing dividend investing coming out. And, doing it right.

Income Taxes On Your Dividend Portfolio

Yes. Income taxes may be due on the dividends you receive.

But, everyone’s tax situation is different. So, I can’t tell you exactly how taxes will impact your dividend income.

Just be aware that some of that $200 a month in dividends you are collecting will have to be shared with the taxman. Or, tax women. As the case may be.

Buy And Hold Dividend Stocks In An IRA Account

Here is one suggestion to save on taxes. And even eliminate them…

Buy and hold your dividend-paying stocks in an Individual Retirement Account (IRA).

Depending on the type of IRA you choose, either no taxes will ever be due. Or, they won’t be due until you make withdrawals in your retirement years.

Have you been meaning to open an IRA? And start investing for a secure retirement? If yes, get it done!

Next, before I wrap up. I want to circle back. To a very important point, I made earlier.

Dividend Investing Is A Journey Not A Destination

So you know, it takes about $60,000 to make $200 a month in dividends. Assuming a 4% dividend portfolio yield.

But understand, $60,000 is the destination. On the other hand, I want you to start your journey with 100 bucks or so each month. More if you can swing it.

Allow me to provide an analogy to hammer this point home…

A Hiking Journey

Let’s say you like to hike. And you are planning a 10-mile hike in your favorite park this Saturday.

Now, you wouldn’t expect to wake up Saturday morning and have the hike completed. Would you?

No. You probably have a plan. Such as get a good night’s rest. Have a good breakfast. Pack some water, lunch, and some snacks.

And make sure your hiking boots and other gear are in good order. Those are your tools for your hiking journey.

Then you take a drive and show up at the trailhead. And spend most of the day hiking until you reach your destination.

Your day and your hike were a process. Whether it’s hiking or whatever meaningful activity you enjoy it’s the same. A process.

Your Dividend Journey

Just like you did not start your day at the end of the hike. You don’t start your dividend journey with $60,000.

$60,000 is the destination. It is the end of the hike. And you can make it. I know you can.

First, you need a plan. And I have provided you with a 5-step dividend investing plan today.

Next, you need some money. Just like the gear you need for a hike.

You need some gear when investing to make dividends. That gear is money!

Tools For Your Dividend Investing Journey

In today’s article, I suggested starting with $100 per month. Hopefully, you can come up with more. Because it will speed up your journey to $200 a month in dividends.

Here are some tools I want you to consider. To have more money for your dividend investing plan.

Because earning dividends is just 1 part of a good personal finance program…

Make More Money

Try to make more money. In any way that you can.

Get a higher-paying job. Or earn a promotion from your current employer. Either way, you need a top-notch resume.

Here’s a tool to make the most out of your resume. And impress the heck out of the boss. Or, that prospective employer.

Check out MyPerfectResume here.

How about doing a little side hustle for some extra cash? You can take online consumer surveys. And get paid to do it.

Promise me this. Whatever you make from this little side hustle. Funnel it into your dividend stocks.

You can take surveys for cash using Survey Junkie.

Save More Money

Next, I want you to consider how to save some extra money. So, sharpen your pencil and take a hard look at your budget.

Because every dollar you save. Can go to paying off credit cards. Or, even better. More shares of stocks that pay dividends.

First, try Rakuten. It is an online cash rebate system.

Where you receive cash rebates on all your daily essentials that you buy online, plus, for a limited time, Rakuten is offering $10 cash just for signing up and making your first purchase.

Next, save money on all of your grocery purchases by shopping for the best deals and sale-priced items.

Are you getting the idea? Because your dividend investing journey is all about making more money. Saving more money. And investing the difference into dividend stocks.

By doing so, you will create a dividend snowball. And before you know it, a $60,000 dividend portfolio will be yours.

Plus, the $200 a month in dividends it pays you. And that is the end of today’s journey. So, let’s wrap it up.

How To Make $200 A Month In Dividends: Summary

To review, here’s your 5-step investing for dividends plan:

- Choose a dividend yield goal

- Determine the amount of money required

- Find and select the best dividend stocks

- Invest new money & reinvest dividends regularly

- Construct a portfolio for monthly dividends

And now that you have a plan. Make your journey to $200 a month in dividends as fast as possible. By doing the following:

- Making more money

- Saving more money

- Investing the difference into dividend stocks

Now you know how to make $200 a month in dividends. Over time, your passive income from dividends will grow, grow, grow!

More Reading About How To Make Money With Dividends

- Some of the best DIY dividend articles on the web

- Learn dividend investing from this little book

- Best stocks that pay dividends monthly

My Favorite Dividend Investing And Finance Tools

Throughout the article, I mentioned the most helpful tools for your dividend investing journey. So, gear up and do your financial planning in style.

Best of all most of them are free to sign up and use. Or, offered at a very affordable price. I have summarized them here for your convenience.

- Trade stocks for free with the Webull app

- Get dividend stock recommendations from Simply Investing

- Get top stock picks from Motley Fool

- Manage all of your finances with Personal Capital

- Get cash back on your online purchases with Rakuten

- Improve your resume using MyPerfectResume

Author Bio: Tom Scott founded the consulting and coaching firm Dividends Diversify, LLC. He leverages his expertise and decades of experience in goal setting, relocation assistance, and investing for long-term wealth to help clients reach their full potential.