I Love Blue Chip Stocks!

One of the best things I did years ago was start building a portfolio of blue chip stocks. And not just any type of blue chip stocks. Most importantly, blue chip stocks that pay dividends.

I firmly believe buying and holding blue chip stocks that pay dividends is a cornerstone to building wealth. So today I’m going to discuss why I believe that and how to go about it with your own money.

WHY BLUE CHIP STOCKS?

According to Investopedia…

“Blue chip stocks are considered high-valued, supreme long-term investment vehicles.

Historically, they have shown to generate growth in long-term portfolios. Blue chip stocks are stocks of well-known and well-established companies. Many blue chip stocks, historically, pay out dividends to their shareholders”.

There are several advantages to investing in blue chip stocks that pay dividends.

Dividend payments are real cash. You can use that passive income for day to day living expenses. Or reinvest it to produce more dividends in the future. Therefore, you have less need to sell shares to get money.

The blue chip stocks I’m talking about usually increase their dividend payments every year. Sometimes they are referred to as dividend growth stocks. The growing dividend helps your income keep up with inflation.

You as the investor focus on a rising stream of dividend payments. Hence, you can be less concerned about day-to-day stock market volatility. You are getting a large piece of your investment returns in cash every quarter.

On the other hand, the stock price usually goes up as the company raises its dividend every year. So you benefit from asset growth and income too.

Recurring dividend payments that rise over time are a sign of financial strength. Further, they represent an optimistic view of the future by management.

Related: 60+ investment assets that appreciated in value

HOW TO BUILD A PORTFOLIO OF BLUE CHIP STOCKS

Our investing discussion today will follow this outline:

- Searching for blue chips stocks-go global

- Searching for blue chip stocks-know your sectors

- Selecting the right blue chip stocks-know your metrics

- Putting it all together-adequate diversification

Related: 1 option for diversified bond investing

SEARCHING FOR BLUE CHIP STOCKS-GO GLOBAL

Living in the United States, I will admit to having a home country bias. US based blue chip stocks that pay dividends are my favorites. The really great ones have a tradition of paying a consistent dividend amount per share each quarter. And they raise that quarterly amount each year.

I like this practice because it provides greater certainty about how much I will get paid and when. Furthermore, I am confident I will get paid more as each year passes. These traits are very helpful when you want to live off your passive portfolio income from dividends. Whether that is right now or sometime in the future.

In addition, many US based companies have significant amounts of business in foreign countries. This is another means of attaining global investment alternatives without having to put your money dollars in non US based concerns.

Many non US based companies pay dividends too. And, for diversification, we do not want to ignore them. However, international companies often pay dividends only twice per year. And those dividend payments often change each year based on actual company profits.

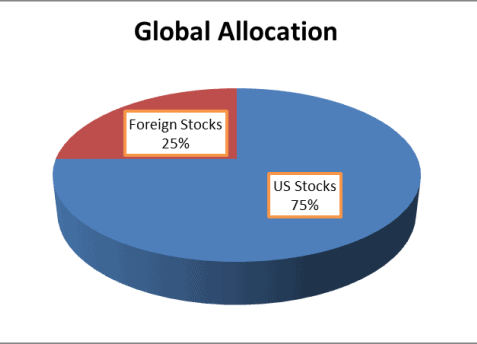

To sum up, we will look for our blue chip stocks globally. But our primary focus will be US based companies because of their consistent dividend paying practices. I like to shoot for 75% US and 25% foreign allocation in my personal portfolio.

NON US BLUE CHIP STOCKS

When it comes to the non US portion of a blue chip stock dividend paying portfolio, I like to stick with ETFs. I prefer individual stocks, but I want to be diversified.

Unfortunately, I can’t follow and analyze enough US and Foreign stocks to do this. Foreign stocks also follow different accounting and financial statement reporting rules. It’s just too much time and complexity for me. I will let the market do the work here with a broad-based index fund.

I prefer the Vanguard International High Dividend Yield ETF. This ETF trades under the ticker symbol (VYMI).

Read my VYMI review here

Here are the key attributes of the fund according to Vanguard:

Seeks to track the performance of the FTSE All-World ex US High Dividend Yield Index

Provides a convenient way to get exposure to international stocks that are forecasted to have above-average dividend yields

At a paltry .32% expense ratio, this ETF is a good low cost strategy to get non US based exposure to blue chip stocks that pay dividends.

Now, lets move on to the fun stuff: knowing what sectors hold blue chip stocks. And then picking stocks from those sectors.

SEARCHING FOR BLUE CHIP STOCKS-KEY SECTORS

Dividend paying blue chip stocks often cluster in certain stock market sectors. Let’s talk about these sectors. And provide some examples of companies that reside in each sector.

Utilities & Energy

The global economy runs on electricity, oil and natural gas. These products are about as essential as it gets.

Electric utility companies can be a cornerstone of a blue chip dividend stock portfolio. Here are some examples.

Dominion Energy is one of the largest producers and transporters of electricity and natural gas in the United States utility sector. They also operate one of the largest natural gas storage systems. At the current dividend yield, this company’s stock represents a good investment strategy for current income and growth of that income.

ExxonMobil is the largest publically traded international integrated oil and gas company. The company’s dividend payments to shareholders have grown at an average annual rate of 6.2% over the last 36 years.

Consumer Staples

Another sector that is essential to our lives is consumer staples. We all need food, beverages and household products to live out life on a daily basis.

Hormel Foods is a Fortune 500 company that manufactures and markets high-quality, brand-name food and meat products. They are known as a dividend King having increased their dividend annually for more than 50 years.

The Clorox Company is a leading manufacturer and marketer of consumer products. Clorox bleach, Pine Sol cleaners and Kingsford Charcoal are a few items in their high quality stable of brands. They have increased their dividend annually for more than 40 years.

I will even throw in a dreaded tobacco company here, Altria. Smoking is quickly going out of style, but this high dividend yield company is moving to diversify into noncombustible nicotine products and marijuana. Like me, you might not like smoking, but I wouldn’t bet against this company.

Technology & Telecommunications

For our next sector of blue chips stocks with rich dividends let’s talk about technology and telecommunications. If I was writing this article ten years ago, this sector would not even have deserved a mention. But now it has evolved and matured to be as essential as any other product or service in our daily lives.

Microsoft develops, licenses, and supports a wide range of software products, services and devices. This iconic tech company didn’t start paying a dividend until 2003. Since then they have increased that dividend payment every year.

And we have to mention Apple. Do you own an iPhone or iPad? Not much explanation is needed about this company’s products. Just about everybody has a smart phone these days. And most folks choose Apple. This blue chip stock only started to pay a dividend in 2012. And each year they increase it by a large amount. Usually, the dividend grows by 10% or more annually. That’s what I like to see.

And all of those smartphones would be useless without wireless connectivity. That’s where a company like AT&T comes in. AT&T is a world leader in communications, media and entertainment, and technology. They have been strategically acquiring companies to grow and position themselves in the future. Acquisitions like Time Warner and DirecTV. And AT&T pays a big fat dividend increasing it annually for more than 30 years!

Health Care

With the aging of populations in developed countries, health care spending keeps growing. Health care products and services are just as essential to our lives as energy, food and technology.

One of my longtime favorites in this sector is Johnson & Johnson. JNJ aspires to help billions of people live longer, healthier, happier lives through the development and sale of innovative health care products. They are very large and diverse operating in many areas of the health care sector. This company is another dividend King having increased its dividend annually for more than 50 years.

And if we want to get really focused on pharmaceuticals, lets mention Abbvie. AbbVie was founded in 2013. The company was formed through a spin off by Abbott Labs. They own the patent to the blockbuster drug Humira. This company has really grown their dividend fast. The dividend has grown more than 20% in their short operating history as a standalone company.

Services

The services sector is very broad and contains a wide variety of blue chip stocks. They operate both business to business like payroll processing firm ADP. And they can operate business to consumer. The iconic restaurant chain McDonalds comes to mind immediately.

Industrials

In the industrial space we see companies that are the back bone of industry. This sector can be a little tougher to find good blue chip companies with a long history of a growing dividend. Because these companies are more susceptible to the ups and downs of the business cycle and can be negatively impacted in a recession.

Emerson is another dividend King having increased their dividend annually for more than 60 years! They provide industrial automation solutions to help businesses and countries operate more efficiently. And products and solutions for the commercial and residential real estate markets.

Cummins is a global leader in the manufacture of engines, and their related products and services are essential to that activity. This company powers the trucks and equipment that move goods through the global economy.

And don’t forget UPS if you want to profit from e-commerce!

SEARCHING FOR BLUE CHIP STOCKS- THE ETF APPROACH FOR US STOCKS

You can always augment your individual stock selections with a fund. Because you might want additional diversification. Or you do not want to pick stocks. That’s okay. Vanguard has another great option for you here.

I prefer the Vanguard High Dividend Yield ETF. This ETF trades under the ticker symbol (VYM).

Related: Vanguard High Dividend Yield ETF (VYM) review

Here are the key attributes of the fund according to Vanguard:

Seeks to track the performance of the FTSE High Dividend Yield Index, which measures the investment return of common stocks of companies characterized by high dividend yields

Provides a convenient way to track the performance of stocks that are forecasted to have above-average dividend yields

And of course with Vanguard you get a super low expense ratio of .08%.

SELECTING YOUR STOCKS

Let’s recap for a moment. We are going global with our blue chip dividend paying stock portfolio. And we achieved our global allocation with the Vanguard International High Dividend Yield ETF.

We have reviewed the sectors and some example companies where high-quality blue-chip dividend-paying stocks reside.

But how do we know a good blue-chip dividend-paying stock from other stocks? Here are the metrics I like to look at for selecting defensive stocks. That well for long-term investors.

Current Dividend yield

Divide the annual dividend payment per share by the stock’s price per share. This gives you the dividend yield. I prefer stocks that range from 2% to 6%.

If it is less that 2%, we are not going to get paid much cash in the form of dividends for committing our investment dollars. In contrast, a dividend yield greater that 6% could indicate too much risk.

What is the stock market telling me that I do not know? Can the company sustain a dividend yield greater than 6%? If the answer is no, we move on.

Personally, I really like dividend yields in the 3-4% range for portfolio income.

Historical dividend growth

I ask myself several questions here. How rapidly has the dividend grown in recent years? Does the company have a long track record of dividend increases? This shows a great commitment to sharing cash with stockholders. And an unwillingness to freeze or cut the dividend when the going gets tough.

Typically you will see that the higher the dividend yield the lower the dividend growth. And the opposite is also true.

My sweet spot for historical and projected dividend growth is 6-8%. That’s nice annual growth in my passive portfolio investment income and usually a sustainable level for blue chip stocks.

Profit trend and revenue trend

I like to see growing profits as indicated by earnings per share. Because dividends are paid from profits. And in order for the company to increase my dividend payments over the long term, profits must grow.

Also, what is the trend in revenue? Costs can only be cut so low and for so long. Expense management is critical to solid long term profitability, but ultimately revenue must grow for sustained long term success.

Dividend payout ratio

The dividend per share divided by the company’s earnings per share gives us the dividend payout ratio. Lower is usually better. But how low should it be? Well, it depends. For more economically sensitive companies like those in the industrial sector, I like to see less than 50%.

For companies in sectors with highly consistent demand for their products and services, like utilities and consumer staple companies, less than 80% is okay with me.

Credit rating

And finally a company’s credit is a signal of financial strength. Can they pay their financial obligations as they come due? It’s similar to your own personal credit score. The big rating firms like Moody’s and S&P do this work for us. I like to see a high rating. This is termed “investment grade”. Most blue chip stocks have an investment grade credit rating.

PUTTING IT ALL TOGETHER

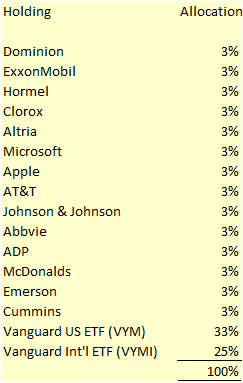

So we know where to find our blue chips stocks. We know how to select those stocks and ETF’s. So let’s put it together and see what it looks like in a model portfolio for income from dividends.

A portfolio such as the one above provides adequate diversification. And it can be fine-tuned to achieve nearly a 4% dividend yield and a projected 6% growth rate in the dividend payments each year.

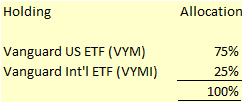

Not up for picking your own stocks then invest in ETFs. Here is what that would look like.

BLUE CHIP STOCKS WRAP UP

To build your investments of blue chip stocks that pay dividends:

- Go global

- Know your sectors

- Consider ETFs

- Pick the right stocks

- Diversify your investment holdings

Related Articles About Investing & Blue Chip Stocks

Funding your retirement income needs with dividends

Simply Investing: For identifying the best dividend stocks to by now

Disclosure

I own all the stocks and funds mentioned in this article. It is not intended to be investment advice specific to your personal situation. Invest at your own risk. You are responsible for any investment gains or losses. See this site’s disclaimer policy under the Disclaimer and Privacy tab.

Hi Tom, great post. You summarized very well what should be considered when picking the blue chip stocks that pay dividends.

In terms of global allocation, 10+ years ago, I used to invest more than 50% to international funds (developed countries). Since then, I dialed more back to US funds, as the international ones were not performing that well since 2007.

I understand your experience with international stocks Helen. They have generally under performed US stocks for me too. I know they will have their day in the sun again, that’s why I do not want to turn my back completely on the international markets. Tom

Tom, I think you outlined a solid blue chip allocation strategy. Have you tried playing around with different payout ratios to see how it affects returns?

Check out https://www.smarterdividends.com for a free tool with a “time machine” feature that lets you test out different selection strategies – such as the affect of payout ratio on returns.

I have not Mike, but it is an interesting concept to me. Thanks for leaving the info. Tom

Tom, great article. I use a blue chip stock selection strategy very similar to this in my conservative portfolio. Have you done any backtesting around how your selection criteria impacts your returns?

It’s a great way to look at it, but I primarily focus on current dividend yield, dividend growth, dividend safety and valuation. Then sit back and let the companies and the market do the work. There are probably better ways of going about it including the analytics you mention, but this has worked for me over the long run. At this point, I’m more into income, income growth and protecting my downside than maximizing my upside. Thank you for your thoughts and input. Tom

Very comprehensive and easy to follow DD, thanks!

I use to pick more stocks when I was single because I had more time. Now I have gravitated more to ETFs and index funds due to less time with marriage and kids. I suspect when I retire, It’ll be a combination of both individual stocks and funds. Selecting stocks is kind of like rooting for a football team; you’re interested in its players coaches, records, injuries, etc. For a while I didn’t have one and didn’t care, but now I do and I do….care. 🙂

I use the combination approach that you mention SMM. And thank you for the kind words! Tom

I love blue chip dividend stocks too! Thanks for the breakdown, Tom! I am working towards building a large blue chip stock portfolio. Your point on finding non US dividend stocks is helpful! I think ETF’s is the way to go for that as well. Thanks for sharing!

You are welcome Graham. I appreciate your thoughts. Tom

Hi Tom,

Awesome post; I’m bookmarking it for future reference. This looks like it could be the core of a great portfolio. And if I’m not mistaken, US stock dividends are only taxed at 15%?

Cheers,

Miguel

Thanks Miguel. And yes, the preferential tax treatment on dividends is an added bonus. Tom

Great post and diagram/pictures of your thought process in terms of asset allocation and having blue chip stocks in your portfolio. Also great summary of all the dividend stocks that you have mentioned!

Appreciate the kind words GYM. Especially with all the knowledge you have from the many investing books you have read! Tom

What is the dividend yield for the Vanguard International High Dividend Yield ETF? It doesn’t seem to show it on the Vanguard website.

Hi Ashok, Based on the trailing 12 months dividends, VYM yields 3.1%. The yield is down a little with the recent market rally. But it is a quality ETF and I have owned it for a number of years. Thanks for your comment and being such a loyal reader! Hope you are doing well! Tom

Seems like a solid playbook for current and future investors. I can see the teacher in you Tom!

Thanks Mr. R. Tom

Very well laid out strategy Tom, and closely aligned with how I have tried to construct my dividend portfolio–with quite a few of the companies that you’ve mentioned being represented. For international exposure, I too have opted for an index fund rather than trying to select individual companies.

Agree DD. I’m just not comfortable trying to fill out a portfolio of international dividend stocks. And when it comes to dividend payers, I have a home country bias. tom

Thanks for your recommendation DD, it’s a very well written and clear article.

I’m diving into dividend investing to gain more passive income, to accelerate the road to financial independence. Let’s do this!

Good luck. Set a plan, be consistent and stick with it and you will do great. Tom

I appreciate the article and have a few thoughts to offer. There are companies that offer both price appreciation and dividends. For energy stock selections, I’d suggest adding NextEra Energy (NEE). NEE is investing in renewable energy infrastructure, experiencing double digits dividend growth, has great management, and good price appreciation. For the technology selection, ATT (T) is listed. Maybe not a growth stock, but I would submit that Verizon (VZ) is a better choice in this space. ATT’s debt load after the DirectTV acquisition has left it with some “challenges”. Thanks -BillR.

Hi William. Thank you for your thoughtful comments! And, I totally agree. I personally own and cover both NEE and VZ here at Dividends Diversify (they just didn’t make it into this specific article). NEE is one of my favorite holdings for exactly what you suggest: income, income growth and capital appreciation. I can tell we think alike. Tom

You did a good job! I do not have much experience in investing and managing finances. I try to learn from the experience of others. Thanks for the info help.

You are welcome, Daniel. I am glad you found the article helpful. Blue-chips stocks for dividends can be a productive part of any investment portfolio. Tom