McDonald’s Dividends March Higher

It’s time to work through a McDonald’s stock analysis. Plus, a review of McDonald’s dividend metrics.

But first, I sometimes wonder what has happened to my values. Since I invest in:

- Tobacco companies

- Defense contractors, and

- Fast food restaurants

Allow me to be honest. I’m not a socially conscious investor.

As long as those dollars are going to legal businesses. I just follow the dividends. And today we are reviewing McDonald’s dividends.

Disclosure: At no cost to you, I may get commissions for purchases made through links in this post.

Let’s start by answering some important questions. These are the key takeaways from the rest of the article.

Is McDonald’s A Good Dividend Stock?

Yes. As I assess my finances, McDonald’s is a good long-term dividend stock. The company’s dividend history and track record of dividend increases are impressive.

On the other hand, McDonald’s stock currently has a relatively low dividend yield. And modest projected annual dividend growth.

In other words, the stock does not have an attractive combination of income and income growth potential right now. At least not for me, as a dividend growth stock investor.

Is McDonald’s Stock A Good Buy?

For a long-term investor, yes. McDonald’s is a good stock to buy. But…

Right now the stock is a little overvalued, in my opinion. So, it does not appear to be a good stock to buy now.

Absent changes in the fundamentals. Only a correction in the stock price will make me interested in purchasing more McDonald’s shares.

Furthermore, McDonald’s has a mid-sized position in my dividend growth stock portfolio. But, as I said, I won’t be a buyer at these prices.

McDonald’s is a good stock for the long term. I consider buying it on any price weakness. The company is a good investment for that IRA account you have been planning to open.

With those key questions taken care of. Let’s dive into our McDonald’s stock and dividend review details.

McDonald’s Company Background

The Company franchises and operates McDonald’s restaurants in the food industry.

History

McDonald’s was founded in 1940 and has become one of the world’s largest restaurant chains based on revenues.

If you like nostalgia, check out the company’s history on its website. It is pretty interesting.

Kind of a slice of America. As McDonald’s came of age over the decades.

Business Model

The McDonald’s brand is truly global. The “golden arches” are recognized internationally.

However, most restaurants are owned and operated by thousands of small and mid-sized businessmen and women. These business owners are known as franchisees.

Many restaurants worldwide are locally-owned franchises. And the count is even higher in the United States.

Growth Strategy

I like it when I find dividend stocks with easy-to-understand strategies. So, the simplicity of McDonald’s growth plan works for me.

What is it?

Their goal is to:

- Serving more customers

- See those customers more often

- Provide customers with solid value

The company seeks to:

- Retain the customers they have

- Regain the customers they have lost

- Convert casual customers to more frequent diners

Furthermore, underlying these growth initiatives is a focus on:

- Digital interactions with their customer base

- Delivery of food and beverages to homes, offices, and other community locations

- Elevating the restaurant experience through people and technology

McDonald’s Stock Symbol

Finally, McDonald’s stock trades on the New York Stock Exchange. It operates under the stock symbol MCD (NYSE: MCD).

When it comes to trading stocks. I do my buying and selling for free.

I use the fast, powerful Webull app. It has excellent features. And stock research tools.

You can sign up for Webull here. And check it out for yourself.

Also, for a limited time, Webull is giving away free stock. For those who open and fund a new account.

We now have some background on McDonald’s business. So, let’s turn our attention to the main course. The McDonald’s dividend.

Does McDonald’s Pay A Dividend?

Yes. Of course. McDonald’s stock pays dividends. I would not own it otherwise.

So, let’s learn all there is to know about dividends McDonald’s pays investors.

McDonald’s Dividend Per Share

The company pays an annual forward dividend.

Simply put the annual forward dividend is the last dividend approved by the company. Multiplied by the number of times each year a dividend is paid.

Divide the annual forward dividend by the stock price to get the stock’s dividend yield.

McDonald’s Dividend Yield

McDonald’s yield is a little low for my liking. I normally invest in specific dividend stocks that yield between 3 and 5%.

But the dividend yield can change quickly…

First, dividend yields move opposite to a stock’s price.

Furthermore, we all know how quickly stock prices can change.

So, check the MCD stock’s current dividend yield before investing money for dividends.

How Often Does McDonald’s Pay Dividends?

McDonald’s dividends are paid quarterly. Or 4 times per year.

The quarterly dividend is one-fourth of the annual dividend rate.

When Does McDonald’s Pay Dividends?

The company’s dividends are routinely paid in specific months. They are March, June, September, and December.

The timing and frequency of McDonald’s dividends are typical for many U.S.-based dividend stocks. Especially the ones I hold in my investment income portfolio.

McDonald’s Ex-Dividend Date

To receive the next McDonald’s stock dividend payout. You must complete your purchase BEFORE the ex-dividend date.

McDonald’s ex-dividend date usually falls on or around the last day of the month before the next dividend is paid.

Paying Attention To Dividend Dates

The ex-dividend date is slightly different each quarter. So, checking McDonald’s dividend information on its investor relations website is best.

You can get the exact McDonald’s ex-dividend date for each quarterly dividend. In addition to exactly when that dividend will be paid.

McDonald’s Dividend History

McDonald’s has raised its dividend each year since paying its first dividend in 1976.

Beginning in 1976 and through 2000, McDonald’s paid a quarterly dividend.

From 2001 to 2007 the Company transitioned to offering dividend payments just 1 time per year.

Then, starting again in 2008, dividends have been paid quarterly.

McDonald’s Is A Dividend Aristocrat

A Dividend Aristocrat is a company in the S&P 500 stock index that has paid and increased its dividend yearly for at least 25 consecutive years.

McDonald’s meets the criteria of a Dividend Aristocrat.

Because management has a long and impressive track record. Of increasing McDonald’s dividends each year.

Are you interested in trading Dividend Aristocrat stocks? If yes, here is a grouping of others that I cover at Dividends Diversify.

Abbott Laboratories (ABT)

Automatic Data Processing (ADP)

Health Care Stock, Becton Dickinson (BD)

Consumer goods company, Clorox (CLX)

Beverage giant, Coca Cola (KO)

Emerson Electric Co. (EMR)

Genuine Parts Company (GPC)

Hormel (HRL)

Health care stock: J&J (JNJ)

The maker of household goods, Kimberly Clark (KMB)

Medtronic PLC (MDT)

Snacks & beverage company, Pepsi (PEP)

The maker of Tide detergent, P&G (PG)

Real estate company, Realty Income (O)

Food distributor, Sysco (SYY)

Omnichannel retailer, Target (TGT)

Pharmacy operator, Walgreens (WBA)

Omnichannel retailer, Walmart (WMT)

On a side note. As I look at this list. It occurred to me that none of my utility sector dividend stock holdings have made it as Dividend Aristocrats.

But now, back to our McDonald’s stock analysis and dividend review.

So, we know McDonald’s has a long history of increasing dividends. But what does McDonald’s dividend growth look like? Let’s look at that now.

McDonald’s Dividend Growth Rate

McDonald’s dividend growth has been steady and consistent for several years.

Most Recent McDonald’s Dividend Increase

Furthermore, the 2018 McDonald’s dividend increase broke the trend to the upside at nearly 15%.

While the company’s dividend was increased by nearly 7%, closing out 2021 and heading into 2022, and was increased even more heading into 2023.

McDonald’s Dividend Policy

McDonald’s has a dividend policy based on the bird in hand theory. I can tell from their long record of such payments.

On the other hand, I have found no formal communications with investors about future dividend growth. Or future dividend payout targets.

This is not a red flag or unusual condition.

However, I appreciate it when a company provides specific future guidance about the dividend. However, it is not a concern when they choose not to do so.

Okay. For now, that concludes the dividend review. I will come back to dividend safety. And make a dividend growth forecast in a moment.

But next, let’s discuss some of the business fundamentals…

McDonald’s Revenue

Revenue has not grown rapidly.

2020 was especially tough due to temporary restaurant closures dictated by the global health crisis.

On the other hand, McDonald’s strength allowed for greater market penetration. Why?

Because other lesser established restaurants closed their doors for good. Reducing competition for consumer spending on meals prepared away from home.

Also, the company operates on a revenue base from which I believe it can grow.

Most importantly, next, I want to discuss the longer, bigger-picture trend related to McDonald’s revenue.

More Franchised Restaurants

Long-term revenue declines have primarily been due to the company’s re-franchising efforts.

Because over the past few years, McDonald’s has intentionally shifted to a greater percentage of franchisees. Rather than company-owned establishments.

This shift negatively impacts revenues as Company-operated restaurant sales are replaced by franchising revenues.

As a franchiser, McDonald’s receives rent and royalties. Rather than revenue from the sale of food and beverages.

The Advantages Of Franchised Restaurants

The advantage of franchising is higher profit margins. And less need for capital expenditures to build new and remodel old restaurants.

As a result, during this time, the company’s gross profit margin dollars have been stable despite declining revenue.

Furthermore, gross profit as a percentage of sales increases due to this shifting strategy. And that is a positive financial indicator.

Next, we will cover McDonald’s dividend payout ratios. Based on both accounting earnings and cash flow.

McDonald’s Dividend Payout Ratio Based On Earnings

Since I take a long-term view looking for consistent dividend stocks. I do not base analysis or long-term investment decisions on any year of financial performance.

Thus I study longer trends such as earnings growth from…

- Reductions in selling, general and administrative expenses

- Gains realized on the sale of company-owned restaurants and their real estate as part of the re-franchising effort

- Fewer shares of stock outstanding as a result of company share buybacks

As a result, the dividend payout ratio based on earnings runs reasonably in my mind.

Most importantly, a lower dividend payout ratio is generally better. It shows the company has ample room to raise dividends in the coming years. Or withstand an earnings drop without reducing the dividend.

Next, I want to check for dividend payments against free cash flow.

MCD Dividends And Cash Flow

The dividend consumes a large but reasonable amount of the company’s free cash flow.

Similar to the payout ratio versus earnings. This too is acceptable for a large mature company like McDonald’s.

However, I wouldn’t expect management to let the dividend payout ratio go much higher in the years to come. This may keep a damper on dividend growth.

Furthermore, the company has stated its priorities for cash:

- Reinvest in the business to grow and improve operations

- Support for the dividend

- Reduce debt

Finally, share repurchases get reduced whenever cash gets scarce. Thus, one can see where management’s priorities lie.

Dividends over and above share repurchases. I like the company’s approach in this regard.

Next up, I make a dividend growth forecast for all of my dividend stocks. Let’s talk about that now.

McDonald’s Dividend Growth Forecast

I expect long-term dividend income growth to be solid and steady.

So, I’m forecasting future dividend growth in the 5-7% range for the foreseeable future.

McDonald’s Financial Position

A company’s financial position is important to understand for dividend investors. Especially during a difficult business environment.

When I look at my total financial picture, I wouldn’t say I like taking extra risks when investing in dividend stocks. So, I prefer stocks with high credit ratings and modest debt levels.

Since reliable dividend income is significant to me.

So, let’s see how McDonald’s measures up in these areas now.

Credit Rating

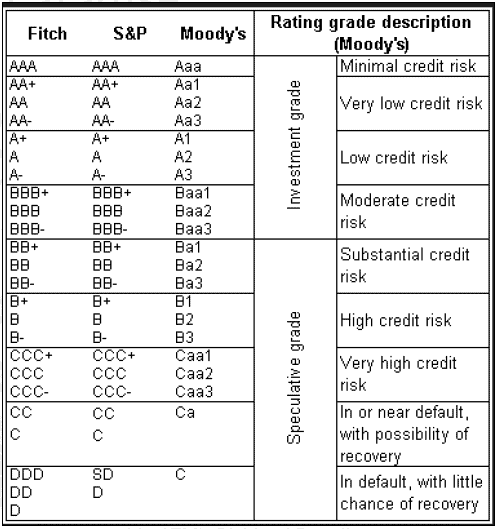

A company’s credit rating can make a big difference between companies that struggle. And those who thrive during difficult times.

A corporation’s credit rating is similar to how your personal credit score works.

Specifically, higher ratings mean lower risk to those who lend the company money. Also, higher ratings mean lenders will likely get their money paid back when it is due.

Most importantly, McDonald’s has investment-grade evaluations.

These ratings are provided by two big rating agencies: Moody’s and S&P.

They are adequate. But at the lower end of the investment-grade spectrum.

Most companies with high-quality dividend stocks have an investment-grade credit rating. And McDonald’s is no exception.

Debt Levels Have Been On The Rise

Credit ratings for McDonald’s are likely influenced by debt levels carried on the balance sheet.

Because McDonald’s has taken on debt. To fund the combination of large dividend payments for investors. And share repurchases in the stock market.

Returning large amounts of cash to shareholders in the form of dividends and share repurchases is a great practice by management. On the other hand, borrowing money to do so can be risky.

The debt levels and credit ratings should be watched closely moving forward. And they are a reason, in my opinion, that dividend growth might be constrained in future years.

McDonald’s Dividend Safety

Because of its dividend history, I believe management will go to great lengths to protect investors’ money from dividends.

Financial leverage and debt do concern me and need to be monitored. But the dividend is well covered by earnings and cash flow.

Putting these facts together, I consider McDonald’s dividend safe from a reduction for the foreseeable future.

Last but not least is stock valuation. Then I will wrap up.

McDonald’s Stock Valuation

McDonald’s stock price has risen dramatically over the past decade.

So, I’m guessing McDonald’s stock is overvalued, but let’s prove that.

I will use the following valuation measures:

- Single-stage dividend discount model

- Dividend yield

McDonald’s Dividend Discount Model

The single-stage dividend discount model considers several factors I have discussed thus far:

- The current annual dividend payment

- Projected dividend growth

- My desired annual return on investment

Based on these assumptions, the dividend discount model suggests the shares are overvalued.

McDonald’s Dividend Yield

As regular readers know, I prefer to buy dividend stocks with higher yields in the 3-5% range. And McDonald’s dividend yield currently falls below that range.

I prefer to buy more McDonald’s stock at a minimum 3% dividend yield. Thus, this metric also indicates that the stock is overvalued for my purposes.

McDonald’s Stock Valuation Summary

We have looked at several valuation methods. And they suggest McDonald’s stock is fully valued. Perhaps slightly overvalued.

Note that valuation measures can change quickly from stock price movements and shifts in business fundamentals.

For the latest measures on valuation and dividend metrics, I use the Simply Investing Report & Analysis Platform.

It’s an excellent interactive database for building and maintaining a dividend stock portfolio.

McDonald’s Dividend Stock Analysis Wrap-Up…

Let’s recap our dividend stock analysis because we have covered a lot of ground regarding the McDonald’s business, McDonald’s dividend, and McDonald’s stock.

McDonald’s Business

The company has migrated to more franchised-owned stores. And this business model has reduced the need for capital expenditures. Also, it has increased profit margins.

I believe that McDonald’s brand and financial strength will allow for increasing market share in the future.

McDonald’s Dividend

The company’s dividend appears safe. And looks poised to grow modestly in the years to come.

McDonald’s Stock

But, the stock looks a little expensive to me. So, I’m not a buyer at recent price levels.

On the other hand, I am happy to hold my McDonald’s stocks. As a part of my long-term dividend growth investment portfolio.

More Reading About Dividend Investing And Dividend Stocks

More Resources To Improve Your Dividend Investing Game

Here are some of my favorite finance and investing tools that I use and recommend:

- Trade stocks for free with the Webull app

- Get dividend stock recommendations from Simply Investing

- Get top stock picks from Motley Fool

- Manage all of your finances with Personal Capital

Author Bio: Tom Scott founded the consulting and coaching firm Dividends Diversify, LLC. He leverages his expertise and decades of experience in goal setting, relocation assistance, and investing for long-term wealth to help clients reach their full potential.